Identity-related fraud is putting personal lines insurers to the test.

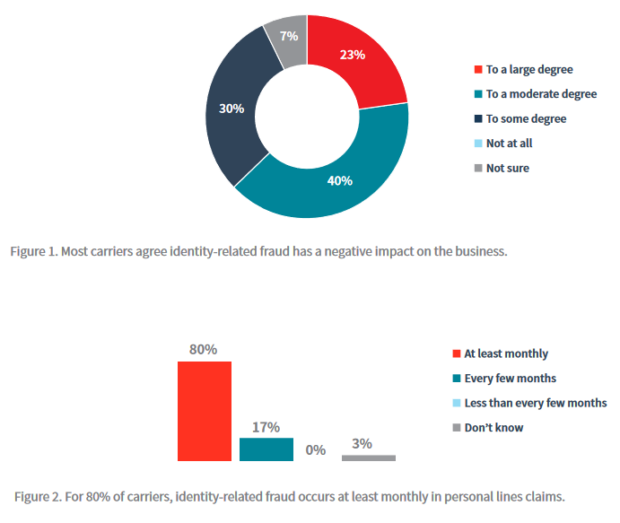

Nearly all offering digital claims portals reported, in a newly released survey, that identity fraud has a negative impact on their business, with 80 percent of respondents reporting that it is occurring monthly.

The complexity and sophistication of the crime makes it difficult to understand how it happens, the report found. In fact, 73 percent of respondents report that it is hard to know how identity-related fraud occurs, and 47 percent indicated it is very difficult to detect.

The new report, “Detecting the Undetectable: What Personal Lines Carriers Are Doing to Tackle Digital Identity Fraud in Claims,” by LexisNexis Risk Solutions, focuses on what senior managers, directors, executives and C-suite leaders within the top 50 U.S. insurers are dealing with when it comes to digital identify fraud in personal lines claims.

While the use of self-service digital claims portals, on the rise since the pandemic, has led to a more streamlined and efficient claims process, insurers are at greater risk of falling for synthetic identities. According to the report, synthetic identities are a combination of fabricated credentials combined with real personal information that has been stolen.

Currently, 52 percent of claims submissions are submitted via online and mobile channels as 67 percent of insurers provide digital self-service options — and the rest plan to do so in the next 24 months.

A majority of respondents (87 percent) are concerned about the security surrounding mobile web browsers and online channels, while 76 percent are concerned about mobile apps, compared with 57 percent for the contact/call center.

The survey found insurers are applying a greater number, and more advanced, identity authentication tools for online and mobile channels than for contact centers.

“Insurers have entered a world where they have to bridge physical, digital and behavioral dimensions to authenticate identities,” said Tanner Sheehan, vice president and general manager, U.S. Claims, LexisNexis Risk Solutions.

Insurers looking to grow their self-service options must invest in digital identity fraud mitigation tools, he added.

Insurers with a multi-layered approach to mitigating digital identity fraud reduce their fraud costs by 25 percent compared to those who do not, according to the study.

Just 33 percent of respondents agree they have an effective way to detect and mitigate identity-related fraud, while 30 percent of all top 50 carriers said they could be doing more.

Interestingly, the majority of the top 10 carriers (60 percent) say they have an effective approach to detecting and mitigating identity-related fraud and could be doing even more. An indication of their awareness of the increasing problem than their peers in the top 11-50 range, the study found.

A significant majority of personal lines insurers (83 percent) are going beyond the basics in claims, incorporating tools like multi-factor authentication, risk scoring or continuous monitoring. Not surprisingly, the top 10 carriers lead the pack, with 80 percent reporting using tools on the more sophisticated end of the spectrum.

The survey found that all respondents verify personally identifiable information (PII) and use one-time passwords. Almost all carriers reported using (93 percent) use multi-factor authentication.

Insurers with more robust security capabilities identify fraud earlier in the claims process. For example, survey responses indicated the top 20 carriers uncover identity-related fraud at First Notice of Loss (FNOL), whereas top 21–50 carriers find it at investigation.

Of the top 10 insurers, 40 percent report finding identity-related fraud similarly across FNOL, investigation and claims payment, which may be indicative of finding more fraud in general, and according to the data analytics provider, is indicative of another benefit of adopting a proactive, rather than reactive, approach.

The results of the study indicate there are “leaders” versus “laggards” when it comes to personal lines insurers addressing the potential for digital identity fraud.

According to the report, “Leaders are adopting a proactive, multi-layered approach that can include verifying PII, such as name, address and date of birth; using multi-factor or knowledge-based authentication methods, such as one-time passwords, multi-factor authentication or quizzes; using real-time digital risk signals, such as device and email intelligence, behavioral biometrics, link analysis or risk scoring; and using native device biometrics, consortium-based fraud scores or continuous monitoring.”

“Conversely, laggards are relying on basic, single-point solutions to authenticate consumer identities, which can result in finding fraud later and less success in balancing customer experience with fraud mitigation.”

The survey highlights the concern over digital identity fraud is prevalent among the top 50 personal lines carriers and that they would be wise to invest in a multi-prong approach to mitigating identity fraud occuring through digital channels.

“With digital channels here to stay, the carriers who emphasize digital identity fraud mitigation by capturing disparate digital, physical and behavioral data points for a dynamic view of the customer are better positioned to weather potential profitability, brand reputation, and customer retention and acquisition concerns at the point of claim,” said Souvik Kumar, director, U.S. Claims, LexisNexis Risk Solutions.

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next