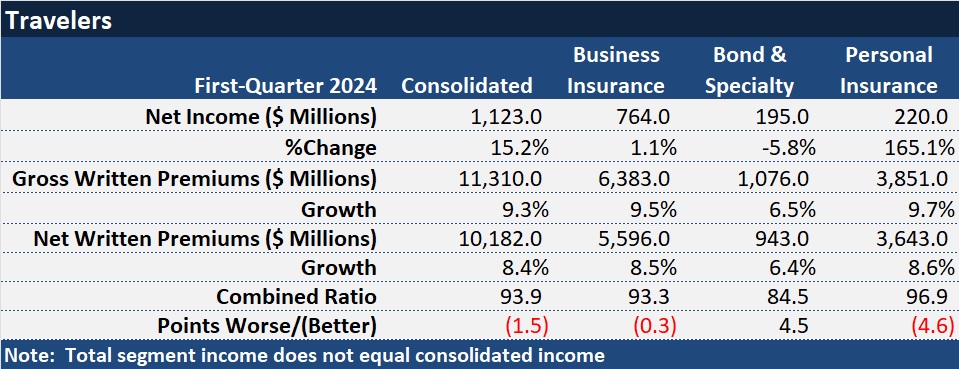

With its personal lines business benefiting from the impact of rate increases earning into the book, and the commercial lines insurance premium changes staying in double-digits, Travelers reported $1.1 billion in net income for the first quarter.

Still, it was a blank line on the financial report for the quarter that captured the attention of some investment analysts during an earnings conference call—indicating neither an overall boost or takedown to loss reserves for prior years in Travelers largest business segment, Business Insurance.

While earned pricing in the second largest segment—Personal Lines—and higher investment income overall were key drivers of jumps in income and return on equity, analysts focused more questions on possible obstacles to continued success in Business Insurance. They worried not just about the need for higher loss reserves but also about the possibility of aggressive competitor pricing behavior.

“What we would speculate is that everybody’s reacting to the same things that we’re reacting to,” Travelers Chair and Chief Executive Officer Alan Schnitzer told an analyst who reacted to the news that Business Insurance has recorded renewal rate changes of 7 percent for four straight quarters, and renewal premium changes above 10 percent with a question: Why haven’t competitors become more aggressive on price?

“Returns are in a much better place after years of pricing and improvements in terms and conditions. But there are some headwinds and some uncertainty out there,” said Schnitzer. “It’s all the things we’ve talked about [before]. There’s social inflation, economic inflation, a tight labor market, weather. Geopolitics, I think, puts a certain lens over the way we all see the world. And so I suspect what you have is a marketplace that’s reacting to an overall level of risk and uncertainty,” he said.

As for loss reserves, Chief Financial Officer Dan Frey reported there was no net prior-year reserve change in Business Insurance because favorable development in the workers compensation line of nearly $100 million “was largely offset by modest increases for liability coverages in recent accident years along with modest charges in our runoff book.”

Which accident years?

Analysts delivered that question and worried aloud that the troubles prompting industrywide boosts in liability loss reserves for accident years 2015-2019 late last year are bleeding into more recent prior years. “Everyone had thought these were better priced years relative to 19 and prior,” one analyst said, asking why there is now adverse development on other years at Travelers.

Related articles: Time-Tested Loss Reserving Methods Challenged: AM Best ; Worst Is Over: Most of Casualty Reserve Hole May Be Filled, Analyst Says; What Industry Executives Are Saying About Loss Reserves, Social Inflation

“I’ll avoid the temptation of splitting what is a small number to begin with into its individual accident years. We’re not going to do that,” Frey said.

“We’re talking about some pretty small movements here….What we’re doing here is trying to be reactive to all the information we’re seeing. Those recent accident years in the liability line which tend to take longer to develop and tend to be on the books for a while are more leveraged to IBNR. We’re just trying to get some more IBNR into those lines to recognize that uncertainty.

Schnitzer added that there’s no new news to report. “There’s not any significant new developments here. These are generally the same trends we have been talking about for a long time—a little more of the same,” he said, reiterating Frey’s comments that the adjustments are very small.

Overall Results

Overall, the after-tax net income figure of $1.1 billion that Travelers reported was roughly 15 percent higher than last year’s first-quarter result of $975, but Schnitzer also highlighted a 45 percent jump in pretax core income, noting that prior-year financial results contained a one-time tax benefit of $211 million. (Editor’s Note: Core income also excludes realized gains—$27 million after tax in 2024 and $5 million in 2023)

“Strong core income was driven by record net earned premiums of 10.1 billion, up 14 percent compared to the prior-year period and an excellent combined ratio of 93.9,” Schnitzer said.

Contributing to the bottom-line income figure, pretax underwriting income jumped 57 percent to $577 million and net investment income grew 28 percent to $846 million.

Even though nearly $0.5 billion of catastrophe losses impacted the Personal Lines segment, adding 12.4 points to the segment combined ratio of 96.9, Personal Lines had the biggest improvement in underwriting income of the three reporting segments for Travelers. The $176 million difference between the first-quarter 2024 $99 million underwriting gain and to a $77 million underwriting loss recorded in first-quarter 2023 for Personal Lines, represented more than 80 percent of the pretax underwriting income improvement (of $210 million) for the company overall.

“The earned effect of pricing is far and away the biggest driver of the improvement in the quarter and there’s more of that to come going forward,” said Personal Lines President Michael Klein, during the Q&A section of the earnings conference call. Klein was clarifying an insight he offered during prepared remarks, noting that the first quarter is historically the quarter with the lowest underlying (ex-cat, ex-prior-year development) combined ratio quarter for personal lines.

With respect to personal lines, executives also noted these impacts on results:

- Renewal premium (rate and exposure) changes in the quarter averaged 16.6 percent for personal auto and 13.4 percent for homeowners

- There were 19 PCS designated events for the industry, more than 50 percent above the long-term average.

- Vehicle severity trends moderated in the quarter.

“The underlying combined ratio of 86.1 reflects a 6.8 point improvement compared to the prior year quarter, driven by higher earned pricing in both automobile and homeowners,” Klein reported, referring to the combined ratio excluding catastrophe loss and prior-year reserve development impacts. The reported combined ratio, including those impacts, improved 4.6 points to 96.9, down from 101.5 in first-quarter 2023.

Both the Personal Lines and Bond & Specialty segments of Travelers reported favorable prior-year loss reserve development—shaving 1.6 points off the Personal Lines combined ratio, and 2.5 points off the Bond & Specialty.

Travelers smallest segment, Bond & Specialty, was the only one to report lower segment income and a higher combined ratio for first-quarter 2024 compared to the same period in 2023. Executives attributed this to a lower amount of favorable prior-year reserve development (2.5 point of the combined ratio this year vs. 6.7 point in 2023). Executives also talked about the expense ratio impact of the acquisition of cyber MGU Corvus, which closed in early January, noting that this resulted in a full quarter of expenses on Travelers books but little earned premiums.

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec