Several new driving trends have been recorded since the onset of the pandemic, according to a new report released by TransUnion.

While traffic violations have declined nationally by 13 percent, the death rate for motorists has increased 22 percent.

The findings of the TransUnion report, “Life on the Road: How Better Data Helps Carriers Respond to an Altered Driving and Law Enforcement Landscape,” were detailed during its annual insurance summit.

Three disturbing patterns were found to factor into the rise in fatalities.

Since 2019, the report noted a 21 percent increase in the number of fatal crashes involving unrestrained occupants, an 18 percent increase in alcohol-impaired fatal crashes, and a 17 percent increase in fatal crashes involving speeding.

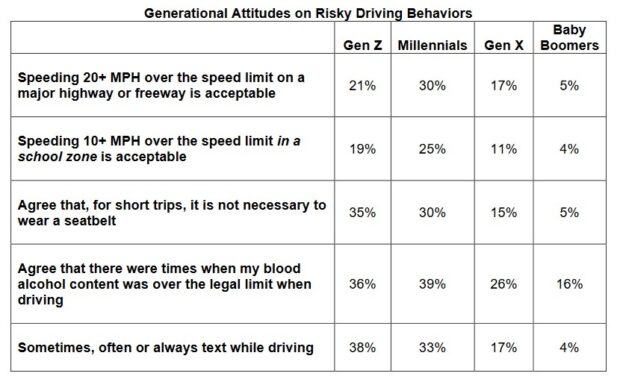

A related survey, conducted by TransUnion this year, found that Gen Z and millennial drivers tend to engage in risky driving behaviors more than Gen X and baby boomer drivers.

“Younger drivers are often more prone to risky behaviors, but it is especially concerning to see millennials—who are predominantly in their 30s and 40s—express such a lax attitude toward safety,” said said Mark McElroy, executive vice president and head of TransUnion’s insurance business. “It’s important they understand that this behavior is contributing to 50,000 preventable deaths every year.”

A correlation exists between prior violations and the likelihood of future auto insurance losses, the report found.

In 2019, 42 percent of accidents involved drivers who had been cited with traffic violations within the prior three years. That figure jumped to 51 percent in 2022.

The potential impact to insurance premiums and losses when considering both factors—the number of drivers with traffic violations has increased as traffic enforcement has decreased—is substantial, according to the report findings.

Auto insurers are capturing fewer dollars in surcharge premiums, contributing to negative premium trends, TransUnion found.

The decline in traffic violations beginning in 2020 cost the auto insurance industry an estimated $200 million per year in lower premium capture, the research estimated.

Adding to the potential missed premium is the rise in severe accidents resulting in fatalities, increasing insurance payouts for medical bills, legal fees, vehicle repairs and replacements.

Insurers are wise to evaluate driving behavior during the underwriting process.

“Ultimately, without traffic violation data, insurers aren’t able to accurately assess and underwrite a driver’s risk,” said McElroy. “With the compounding cost from accidents, carriers are now increasing rates for everyone, meaning we are all paying for this problem.”

Another concern is the increased turnover seen in the commercial driving sector.

The link between employment trends since the onset of the pandemic and commercial driver risks was examined in a separate study, and the findings indicate newly hired drivers were, on average, seven years younger and had 11 percent higher traffic violation rates compared to all commercial drivers (37 percent vs. 26 percent, respectively).

The report found that “companies with high employee turnover and those experiencing growth were both more likely to have outsized risk, compared to their existing premiums.”

Insurers can offer commercial driving entities telematics programs to monitor driving behavior and promote safe practices, the report suggested.

“Whether through growth or turnover, insurers need to pay attention to new hires,” said Patrick Foy, senior director of commercial insurance for TransUnion’s insurance business. “By leveraging the right data, insurers can reassess their customers and set premiums at an appropriate level.”

“Among many important takeaways from this research is the plain fact that traffic enforcement plays a role in maintaining safety on the road,” said McElroy. “That said, insurers can play a vital role in reversing this trend by educating their customers and promoting safe driving practices.”

The research utilized TransUnion’s traffic court record data to measure driving violation cases from January 2019 through January 2023. The data was then compared against death rates calculated by the U.S. Department of Transportation and the National Highway Traffic Safety Administration.

How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs