Damaged infrastructure created new obstacles for claims adjusters responding to Hurricane Ian, along with widespread flooding, damaged cellphone towers and even an occasional alligator.

Sedgwick Executive Vice President Danny Miller said his company is using boats to send claims adjusters to barrier islands off Florida’s Gulf Coast, where they make inspections with a police escort. He said local officials are also limiting the use of drones for the time being, delaying damage assessments.

“After the storm cleared, flooding is still limiting some exits off the major interstate system, so there could be unidentified damages still to come,” Miller said. “We have seen that the access to potable water, electricity, cellular service, Internet are all items affecting customers and business reaching out to file their claims.”

Alligators presented another problem. Miller said a Sedgwick team inspecting a “local government structure” encountered two alligators amid the wreckage. Sedgwick spokeswoman Judy Molnar, responding to a followup question, said the inspectors were able to “navigate” and safely complete their work without removing the animals.

Miller said Hurricane Ian will be a “long-tail” claims event because of the widespread destruction across Florida and in the Carolinas. “This causes downstream issues with transportation, rental cars, rental homes and hotels, supply chains, and logistics throughout the regions the hurricane hit,” he said.

Miller said Sedgwick has dispatched engineers, building consultants, forensic accountants and a contents team in addition to claims adjusters to respond to clients.

Numerous vehicles and boats were destroyed, in addition to buildings.

“The marine losses are massive from small personal watercraft to yachts,” Miller said. “Our yacht/pleasure craft team is surveying damages related to marinas and boat sales operations. In one instance, we had an inventory of 27 high-dollar watercraft. We located 12 at the facility and will spend a few days tracking down the 15 missing watercraft over the next few days,” he said.

Miller said the destruction to personal residences may come as a shock. He said Florida home prices almost doubled from 2004 to 2022, which could cause some properties to be underinsured.

Mike Beach, senior vice president and national property director for McLarens, said in an email Thursday that helicopters and boats are the only available means of access to some areas along the coast of southwest Florida, such as Sanibel Island near Fort Myers. Other areas — including Fort Meyers Beach, Bonita Springs and Sanibel — were closed to everyone except residents.

“This has impeded our ability to conduct timely inspections in some circumstances,” he said.

Another obstacle: “There is a state issued-ID card that adjusters must have in their vehicle to access certain areas, and there are curfews in place,” Beach said.

On the other hand, technological innovations are creating opportunities to resolve claims faster than ever before. State Farm, for instance, reported that its remote claims teams are using virtual inspections with claimants.

“The use of aerial imagery during the first stage of the response helped us determine the areas of severe impact,” said brand promotion specialist Heather Paul. “This helped State Farm identify the hardest hit areas and customers, and assess where we needed to initially respond and send our first wave of resources to start handling claims for those hardest hit.”

Catastrophe modelers have projected that Hurricane Ian’s path of destruction across the Florida peninsula will create historic losses. CoreLogic updated a wind and flood loss estimate on Thursday, saying insured damages will range from $41 to $70 billion. Uninsured losses will range from $10 billion to $17 billion, CoreLogic said.

The most serious access issues were in Charlotte, Lee and Collier counties on Florida’s Gulf Coast, where Ian came ashore on Sept. 29. The storm washed out a causeway that connects Sanibel Island to the mainland and a bridge that connects Pine Island.

Gov. Ron DeSantis said construction on a temporary Pine Island bridge was completed on Thursday and repairs to the Sanibel causeway are expected to be completed by the end of the month.

Claims administrator’s mobilized examiners from across the nation.

State Farm said its response began Sept. 26, when it sent a fleet of catastrophe response vehicles from its headquarters in Bloomington, Ill., to Birmingham, Ala. The company said it set up an orientation center to support incoming personnel, who arrived at a rate of 100 claims handlers per hour. Each received fully equipped laptops, printers and technical equipment to take to the field, the company said.

McLarens Director of Operations Cory Barnett said the company has dispatched about 80 adjusters to damaged areas, with 30 already “on the ground” as of Thursday. Teams were dispatched to Florida, North Carolina, South Carolina, Georgia and Virginia.

He said McLaren’s has experienced a 1,110 percent increase in the number of claims notifications from Florida when compared to the same 10-day period last year.

“The severity and complexity of losses is wide ranging, from habitational to condo associations, municipalities, builders risk projects, hospitality clients and more,” Barnett said.

McLaren’s Beach said his company expects the usual wind vs. flood causation disputes that have spurred litigation after past catastrophes in Florida. Catastrophe modeler Karen Clark & Co. warned of similar costs because of “excess litigation.”

“This was a large wind and surge event,” Beach said. “Such disputes can often be an issue in such circumstances, so we would expect to see a similar pattern, though to what extent remains unknown at this time.”

Like State Farm, McLarens is using policyholders’ smartphones to jumpstart the claims process. Beach said the McLarens app allows customers to “stream real-time, geo-tagged and tamper-resistant image evidence.”

“That ability to assess and manage claims remotely when needed is a significant asset in such circumstances,” he said.

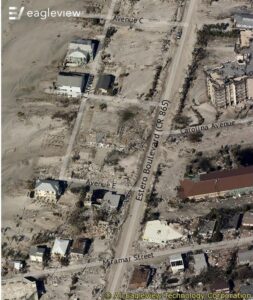

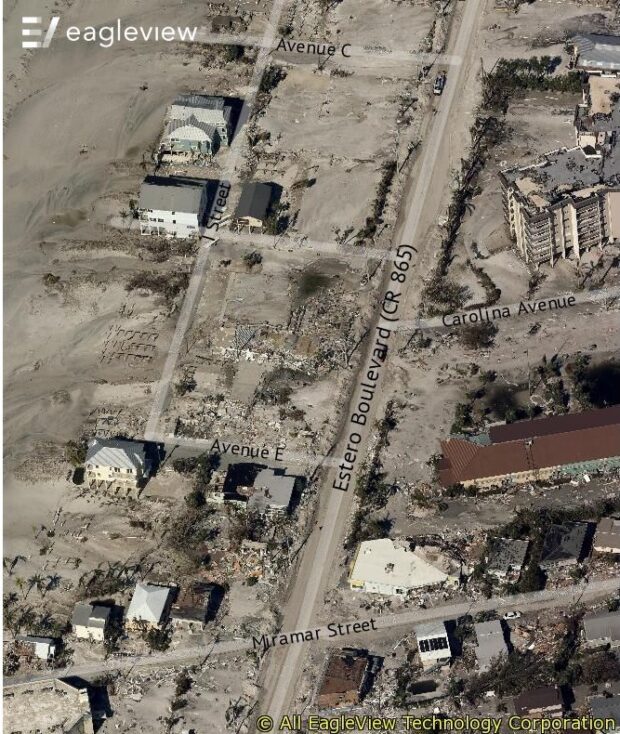

Quick availability of aerial images of damaged areas also helped insurers respond quickly.

EagleView said in a blog post that it staged a fleet of fixed-wing aircraft in counties along the west coast of Florida before Ian made landfall. After the hurricane passed, it sent those planes over areas that were within the storm’s path to capture high-resolution imagery. Images are being made available to customers in local government, insurance and construction as soon as it becomes available.

EagleView said in a blog post that it staged a fleet of fixed-wing aircraft in counties along the west coast of Florida before Ian made landfall. After the hurricane passed, it sent those planes over areas that were within the storm’s path to capture high-resolution imagery. Images are being made available to customers in local government, insurance and construction as soon as it becomes available.

The Geospatial Insurance Consortium also provides aerial images to member insurers via post-storm flyovers in a partnership with Vexcel Data Program.

Technology has also created a new peril, one that Florida Chief Financial Officer Jimmy Patronis experienced personally while touring hurricane damage in Collier County on Thursday.

Technology has also created a new peril, one that Florida Chief Financial Officer Jimmy Patronis experienced personally while touring hurricane damage in Collier County on Thursday.

While he was there, an electric vehicle combusted on US Highway 41 in North Naples. Patronis tweeted a video of North Collier Fire Rescue firefighters dousing the blaze with fire hoses.

“There are many EVs in Southwest Florida, and unlike a normal gas engine, saltwater corrodes those lithium batteries causing fires,” Patronis said in a press release later. “While EVs are nothing new, there hasn’t been a lot of experience throughout the nation related to EVs catching fire as a result of salty storm-surge water.”

*This article was originally published by Claims Journal, CM’s sister publication. Reporter Jim Sams is the Editor of Claims Journal

Before and after photos of hurricane damage in Lee County, Fla. were provided by EagleView Technologies, a geospatial technology company with a geospatial data and imagery library encompassing 94 percent of the U.S. population. EagleView shared more photos with Carrier Management, which are captured in the accompanying video presentation on Insurance Journal TV.

What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Preparing for an AI Native Future

Preparing for an AI Native Future  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages