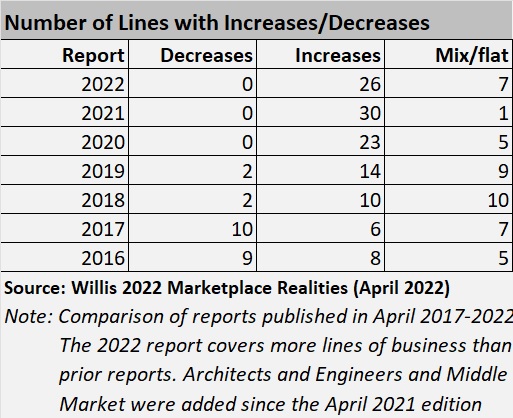

There still are no price decreases showing up on WTW’s regular update of rate changes for more than 30 commercial insurance lines, but many buyers are now seeing last year’s double-digit jumps falling to single-digits.

While “we are nowhere near a soft market,” 70 percent of WTW’s commercial lines business leaders report that rate increases “are slowing significantly,” WTW reported in a media statement about the publication of its 2022 Marketplace Realities Report, Spring Update.

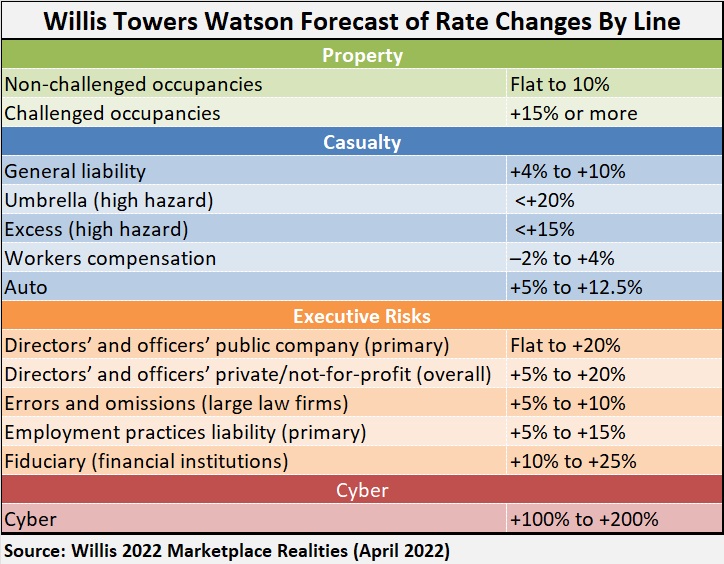

The news delivered in the latest market report, however, isn’t all positive for insurance buyers. A section of the report details inflationary economic trends that could soon drive prices higher. And buyers of cyber insurance are already seeing hikes, with rate increases as high as 100-200 percent becoming common, WTW said.

A Break in the Clouds

First, the good news from a buyer’s perspective.

Jon Drummond, senior editor, Insurance Marketplace Realities and head of Broking North America, said, “While we continue to see rate increases across most lines of business, the silver lining is that the increases are decelerating and beginning to stabilize.”

Even though the current edition of the Marketplace Realities is the fifth straight report in which the number of lines with predicted rate decreases is zero, for 13 of the 26 lines where buyers are facing increases, the magnitude of the increases is smaller than recent prior reports. In addition, a flat renewal is the bottom end of the range for a handful of lines.

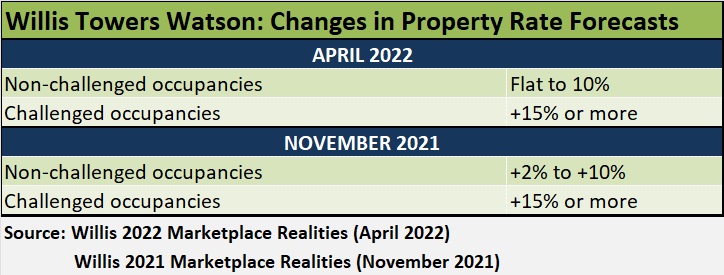

Property is one of the lines where the bottom end of the rate prediction is flat—down from a price hike range of 2-10 percent for better risks. Less attractive risks can still expect to see 15 increases.

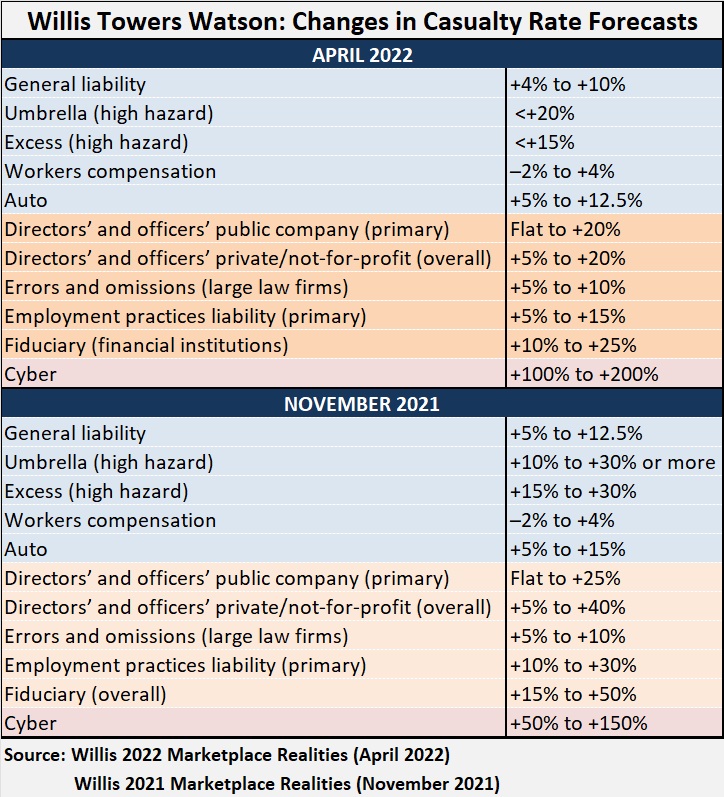

General liability increases are now expected to fall in the 5-12.5 percent range, down from 4-10 percent in WTW’s November 2021 Marketplace realities report. In addition, the umbrella and excess liability market has dramatically improved, the April 2022 report says, noting that recent renewals are yielding the lowest quarterly rate increases since the onset of the hard market.

For commercial auto, although WTW is reporting that the high end of rate hikes has come down, the April report offered some advice to insured businesses where modified duties of employees has impacted auto risks. An example would be a situation where in-house restaurant servers have been delivering take-out orders using their own vehicles, raising the non-owned and hired exposure to both restaurant owners and their insurance carriers. “Insureds should look at the employees’ personal auto policies to ensure that coverage under those policies would not be void in such circumstances,” the report says.

Relief from high double-digit rate increases is also coming in management liability lines like D&O and EPL. In fact, D&O is forecast to see some rate decreases in some best-case situations.

D&O insurance buyers, however, are facing increased underwriter scrutiny into ESG practices from operational and investment perspectives, including analysis of board diversity, corporate diversity and inclusion protocols, and the adequacy of ESG disclosures.

Cyber Insights

As for cyber, insurance isn’t just getting much more expensive. “Renewals are taking longer to complete because carriers do not want to quote early for fear of an incident occurring between quoting and binding,” the report notes.

Other problems facing cyber insurance buyers:

- Excess carriers are increasingly not aligned with primary coverages and are seeking to benefit from exclusions placed on excess policies below them in a tower.

- More carriers are requiring supplemental applications for ransomware, and cyber markets are commonly sublimiting ransomware coverage (or deploying coinsurance), increasing retentions and developing language to further limit their exposure.

- Some markets have added broad SolarWinds and Log4j exclusions to their policies.

- Some carriers are asking additional underwriting questions about whether insureds, their subsidiaries or their critical vendors have exposure in Russia, Ukraine or other potentially impacted countries and are considering adding territorial restriction endorsements onto their policies.

Generally Lower Insurance Pricing Expected…Unless

In addition to cyber, the report also flags two other notable exceptions to the general trend of lower insurance pricing across commercial lines. Against the backdrop of the Russia-Ukraine conflict, WTW notes that rate changes for terrorism and trade credit insurance are moving in the other direction. In these two lines, recent past predictions of small decreases for some have given way to predictions for flat renewals at best for trade credit and increases in double-digits for many buyers of terrorism and political violence cover.

Beyond those exceptions, improvement is expected to continue through 2022—”unless inflation or the crisis in Ukraine end up turning the direction of the marketplace,” the April Marketplace Realities report says.

The executive summary of the April edition of WTW’s Marketplace Realities series includes a statement about property/casualty insurance losses from the Russia-Ukraine crisis, which WTW estimates at roughly $15 billion. “That’s a big number, but to put it in perspective, 2021 brought over $130 billion in insured catastrophic losses,” the report says.

While WTW currently estimates the direct insurance impact of the reality of war below natural catastrophes, questions around the potential impact of inflation and investment volatility add uncertainty to insurance pricing forecasts.

“We now seem to be on the cusp of a new era of higher interest rates and, for a time, higher inflation. A key question is for how long?” Drummond and Ashwin Belur, director of WTW’s insurance investment team, ask in a special section of the report dedicated to the upward pressure on inflation and investment returns on insurance rates.

The two authors state that a medium-term (two-year) rocky period of elevated inflation is more likely than a transitory spike or a sustained period of high inflation.

Medium-term higher inflation, they note, will likely have a significant impact on expected claims in commercial lines including aerospace, commercial auto, construction, energy and marine, related to increases in material replacement and repair costs, as well as labor costs.

The Federal Reserve has started raising interest rates in response to inflation, something that many professionals working in the insurance industry have never experienced. Explaining the repercussions, the WTW report notes that while increased interest rates improve reinvestment yields for new premiums, they also reduce the value of insurers’ existing bond portfolios. “Additionally, the specter of higher inflation could lead to lower than expected or negative equity returns.”

Insurers facing claims inflation and depressed investment returns will likely consider higher and differentiated renewal prices, the report says.

Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk