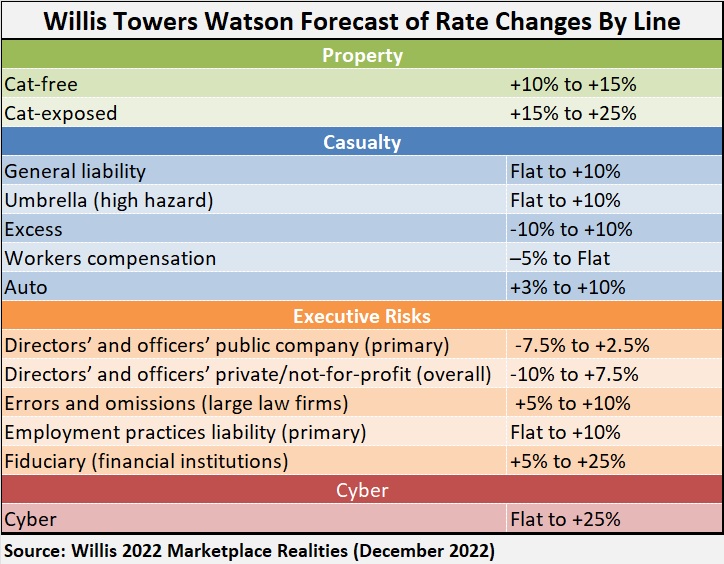

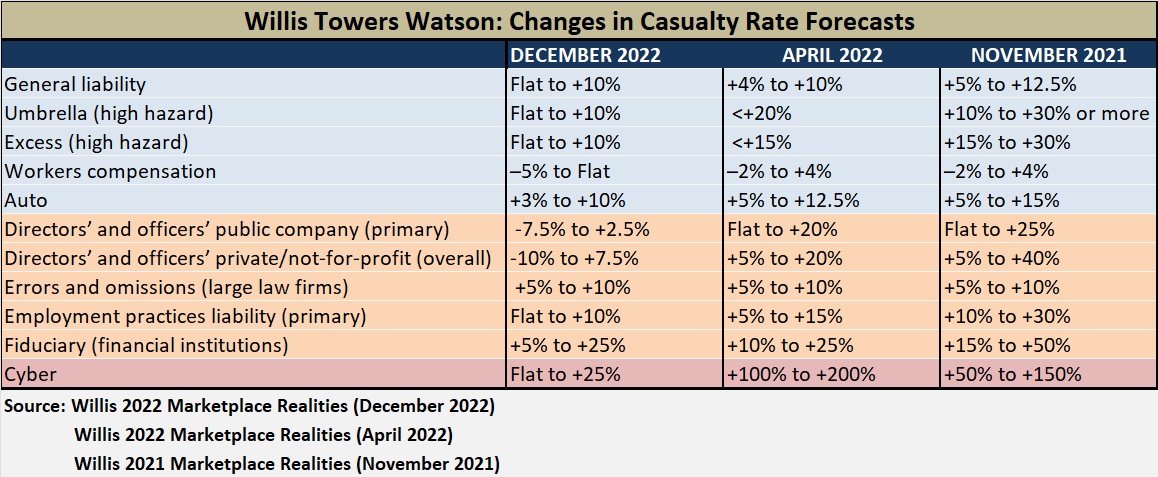

With last year’s 25 percent rate hikes for public directors and officers liability insurance dropping to 2.5 percent, and 150 percent hikes for cyber cover sinking to 25 percent, significant softening is forecast for some casualty lines in 2023.

Those reduced price hikes are the high-end rate changes included in the latest Insurance Marketplace Realities Report published by global broker and advisory firm WTW in early December. On the low end, public D&O insurance buyers could see rates actually drop as much as 7.5 percent, and cyber insurance buyers might experience flat renewals, the report says.

WTW experts said it’s not time to start celebrating a soft market, but they are predicting lower percentage increases across most lines of commercial insurance after several years of steady price jumps.

Related article: Insurance Pricing: True D&O Buyer’s Market; Stabilized Commercial Auto (USI’s Market Report)

“We are finally seeing rates that are more closely aligned with clients’ specific risk profiles, a promising trend for buyers as we head into 2023,” said Jon Drummond, WTW Head of Broking, North America, in a media statement about the report.

“The long curve—the larger trend—has begun to bend in a positive way for commercial insurance buyers,” the statement said, noting, however, that macroeconomic factors—inflation, the Russia/Ukraine conflict, persisting supply chain challenges, and a volatile interest-rate environment as factors—will continue exerting upward pressure on commercial insurance rates into 2023.

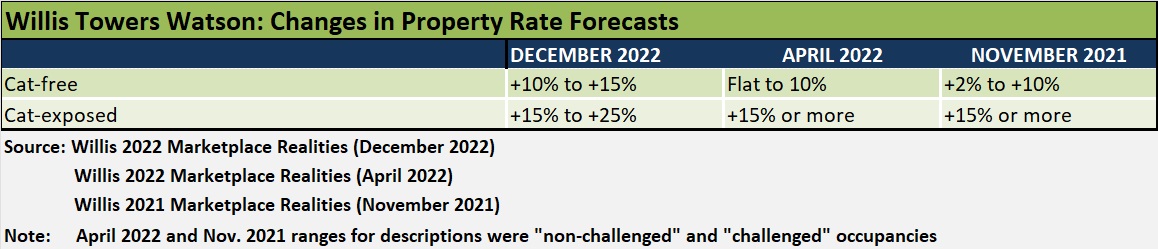

Notably, WTW is forecasting that property insurance buyers with catastrophe-free loss experience, who might have seen rate hikes in the low single-digits—or even flat renewals—in early 2022, are going to see double-digit price jumps in 2023.

“Property insurers have rekindled their tenacity to drive rate. This retrenchment is not solely driven by inflation but also by the continuing procession of loss events pushed by the extremes of weather,” the report says, highlighting the impacts of Hurricane Ian. Although losses from Ian were heavier on the personal lines side of the P/C insurance business, “the commercial response has been swift and dramatic,” WTW reports.

“With retail insurers making immediate adjustments to catastrophe capacity and rate, reinsurers are telegraphing grim renewal conditions for 2023, which would compound the rate and structural pressures we experience today,” the report says, also highlighting wildfire as a growing concern for insurers and reinsurers.

“While the grip of the hard market is loosening, buyers are not yet free from it,” the report notes.

Some key takeaways from the report by line are set forth below.

D&O.

- Increased capacity from newer market entrants and an improved securities litigation environment are combining to drive more competitive market dynamics.

- Newer markets initially provided rate relief isolated to the excess layers; several carriers are providing alternative primary competition now as they seek growth.

Cyber.

- An increased level of competition from cyber underwriters has meant small rate increases for buyers that can demonstrate good cyber security controls year over year.

- Although many carriers are starting to communicate that they are open to putting up more capacity for certain risks, WTW brokers say they are still waiting for this to become a reality.

- Still, there are “real signs of strong competition among markets,” with brokers reportedly receiving two to three quotes for certain risks.

- “Incumbents are eager to retain business.”

Property Insurance.

- Premium increases for most insureds will be driven by inflationary construction costs, heightened reinsurance pressures and possible catastrophe capacity constriction.

- In addition, valuation of assets will be the key topic of conversation in 2023, with insurers becoming very focused on ensuring that valuations are correct.

- “For those buyers perceived by the market as presenting inaccurate or out-of-date values, insurers are pushing intently for the inclusion of potentially claim limiting language, such an occurrence limit of liability clause or a margin clause…. Complicating matters for buyers, the language in these clauses varies across the industry, leading to the potential for misunderstandings and conflicting interpretations.”

Casualty Insurance.

- Workers compensation continues to provide underwriting profit to carriers.

- Forever chemicals, PFAS/PFOA and others, are driving underwriting concerns—and questions from underwriters, as well as potential limitations of coverage across a wide array of businesses.

- Auto liability continues to be a driving force behind the unprofitability of casualty insurers.

Property Reinsurance.

WTW offers these estimates of reinsurance rate changes

- Property fac: +5% to +15%

- Property cat (occurrence): +5% to +20% (loss free), +20% to +40% (loss impacted)

- Property cat (aggregate): +10% to +20% (loss free), +20% to +40% or more (loss impacted)

- Property risk: +5% to +10% (loss free), +10 to +25% (loss impacted).

The report includes rate forecasts and market takeaways for more than 30 commercial insurance lines.

There is also a section devoted to middle market risks. While that middle market section has separate rate forecasts for favorable and challenging middle market risks, the combined ranges are similar to the ranges forecast in the charts accompanying this article. One exception is excess and umbrella, where WTW experts foresee rates coming in flat to up 5 percent for favorable risks, but up by double digits—10-20 percent—for challenging risks.

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec