S&P News

NAIC Weighs Overriding Credit-Rating Companies

The National Association of Insurance Commissioners is gearing up to challenge credit graders by overruling ratings on certain assets bought by insurance ...

P/C Market Won’t See Underwriting Profit Until ’24; Outsized Growth Expected

After four years of unparalleled underwriting profitability ending in 2021, the P/C market is headed for a second straight year of underwriting losses, according to the newly released S&P Global ...

Will S&P Change ‘Negative’ Reinsurance Outlook to ‘Stable’ in ’23?

While no one directly asked the question of this article's headline at the S&P Global Ratings June annual insurance conference, the prospect that an outlook change is near came into view during ...

Regulatory Weaknesses, Politics Driving California Exits, Industry CEOs Say

A trio of property/casualty carrier executives voluntarily offered their views on a growing insurance availability crisis in the state of California at an industry conference in late June, pointing ...

Consumers Choose Automated Safety Over Self-Driving Technology

Car buyers seek advanced driver assistance systems (ADAS) to enhance driver safety when purchasing new cars, with the expectation the system will be standard in new luxury and mainstream vehicles. ...

U.S. P/C Industry Posts Record Q1 Underwriting Loss: S&P

An analysis from S&P Global Market Intelligence found that the finger can be pointed at personal lines carriers for most of the property/casualty industry ...

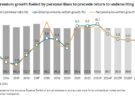

Auto Insurance Results ‘Historically Bad’ in 2022: S&P

In 2022, the U.S. private auto insurance industry reported its worst underwriting results in over two decades, according to a S&P Global Market Intelligence ...

Wait ‘Til Next Year: Auto Profit Unlikely to Return in ’23, S&P Says

In spite of continued actions to raise prices of coverage, auto loss costs continue to climb and profits will continue to elude personal auto insurers—probably until 2024, analysts at Standard ...