After four years of unparalleled underwriting profitability ending in 2021, the P/C market is headed for a second straight year of underwriting losses, according to the newly released S&P Global Market Intelligence “2023 U.S. P&C Insurance Market Report.”

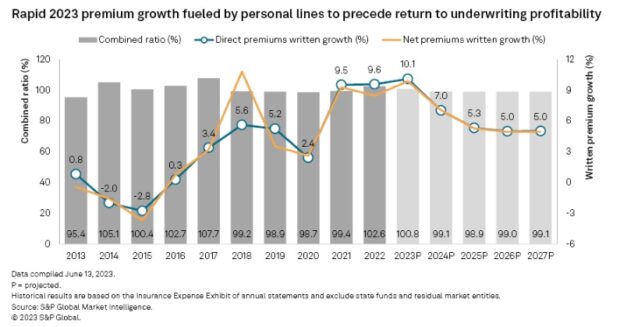

The report estimates a combined ratio of 100.8 percent for this year. Though an improvement from the calendar-year 2022 result of 102.6 percent, it’s still above the 100 percent threshold, the report said.

“Dismal first-quarter 2023 direct incurred loss ratios in the homeowners and private auto business suggests a repeat of 2022, when highly favorable underwriting results in the commercial lines were more than offset by the personal lines losses,” explained Tim Zawacki, principal research analyst, S&P Global Market Intelligence (S&P GMI).

“We project a narrower, but still significant, gap between personal and commercial lines results will remain in 2023 as we anticipate that benefits from multiple rounds of private auto rate increases will lead to improvement in loss ratios for that embattled business line,” he said.

S&P GMI projects “outsized growth” in personal lines direct premiums written of 12.7 percent and 8.5 percent in both 2023 and 2024, with personal lines combined ratios improving to 105.3 in 2023 and 101.4 in 2024, both down from 109.9 in 2022. The 2023 personal lines growth figure encompasses what S&P GMI believes will be the highest annual jump in private auto direct premiums in at least 25 years—and potentially back to the late 1970s or early 80s, the report noted.

The growth is due to several factors including aggressive carrier pricing actions across the nation, as well as the large rate catch-up occurring in California recently (the state is considered the largest U.S. private auto market).

“Corrective actions employed by carriers in the private auto, as well as the residential and commercial property insurance businesses will translate into robust premium growth in 2023 even against a lackluster macroeconomic backdrop,” Zawacki added.

“We project double-digit growth in direct premiums written across the P/C business in 2023 in what would mark the first time in 21 years for such a level of expansion. The industry’s 2002 premium growth of 14.6 percent, not coincidentally, came as leading private auto insurers aggressively responded to poor underwriting results in 2000 and 2001.”

As a result, underwriting results will continue to improve in the second half of 2023. By 2024, S&P projects the industry returning to a combined ratio below 100, signaling a return to underwriting profitability. A graph in the reports, reproduced above, reveals a projected combined ratio of 99.1 for 2024.

Property and auto insurers have continued their aggressive tactics by reducing market penetration in certain parts of the country known for catastrophic weather losses.

Workers compensation continues to perform above expectations, the report said. A workers comp combined ratio of 83.9 percent represents a decline of nearly 3.3 percentage points from 2021’s result.

S&P GMI’s commercial lines market projections, the report indicated, point to “narrowing but still positive underwriting margins over the course of our five-year outlook,” due to continued underwriting scrutiny and aggressive pricing in commercial auto, benefits from significant rate increases in commercial property and reversion to longer-term means in casualty businesses.

The outlook for all years is subject to various risks and uncertainties associated with the frequency and severity of natural catastrophes, the report noted.

From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance