Unemployment levels increased across the insurance industry in the first half of 2021, with property/casualty insurance carrier employment figures revealing a drop of 14,000 jobs.

Greg Jacobson, chief executive officer of The Jacobson Group, and Jeff Rieder, head of Ward Group, a unit of Aon, reviewed numbers from the U.S. Bureau of Labor Statistics, along with survey results from the Semi-Annual U.S. Insurance Labor Study conducted by their two companies during a webinar last month.

While the insurance industry unemployment rate of 4.2 percent is still below the overall 5.4 percent unemployment rate for the U.S. economy, the insurance industry figure has risen from just 2.2 percent at year-end 2020, according to the BLS figures.

Jacobson said his professional recruiting firm for the insurance industry is seeing some conflicting results, such as a jump in unemployment rates at the same time as it logs increases in the number of jobs available.

In the fourth-quarter of 2020, The Jacobson Group opened 570 new jobs, and in the first quarter of 2021, Jacobson opened 880 new jobs, followed by 1,050 just in second-quarter 2021. A lot of larger companies, however, have been reducing size, he reported. “It hasn’t been in the news because a lot it has been as a result of just early retirements that are given. It hasn’t been layoffs. But this is having an impact on the industry,” he said.

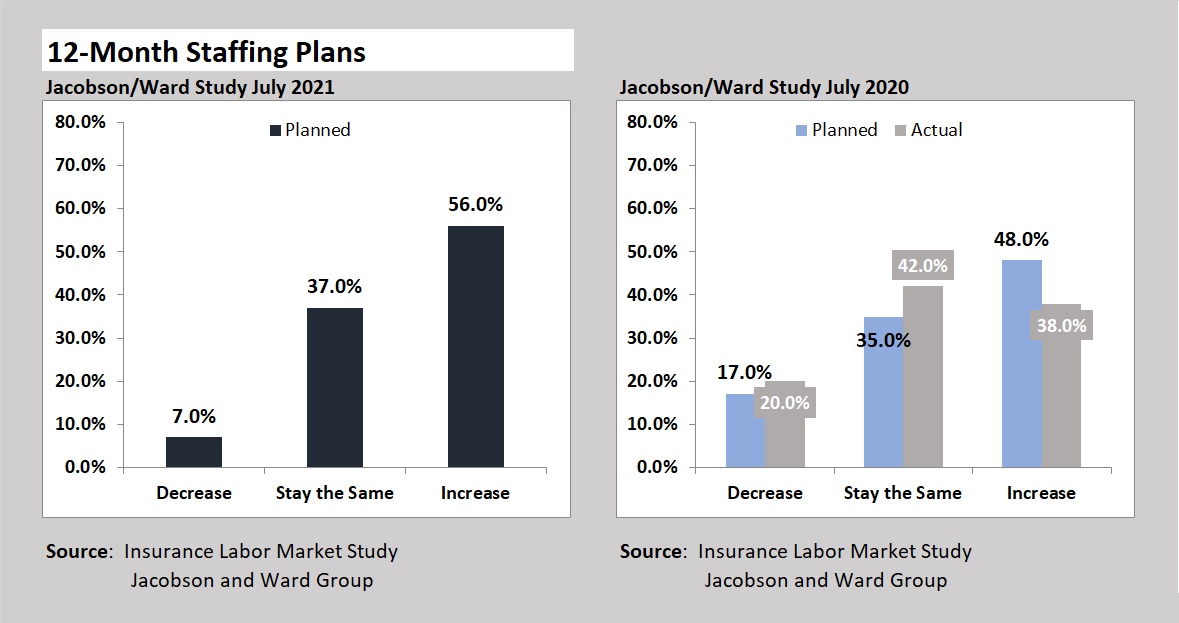

Referring to results of the Jacobson-Ward survey results, Rieder noted that 78 percent of P/C and life-health insurers surveyed in July expect revenue growth over the next 12 months. Although that’s up sharply from just 67 percent who said they were anticipating revenue growth in a similar survey conducted in January, only 56 percent of the insurance company respondents to the July 2021 survey said they anticipate growing staff, which is the same percent who said they would rev up hiring back in January. The divergence between the revenue and hiring expectations this time around—78 percent vs. 56 percent—is unusual, Rieder said, noting that trends in expected revenue and staff growth have typically been highly correlated over the years of the survey.

Carriers that had anticipated revenue declines in early 2020 didn’t make deliberate reductions in force. But things are starting to change, Rieder said. “We have seen many companies begin offering early retirement programs in fourth-quarter 2020 and the early part of this year,” he said. In addition, he noted that some carriers have seen productivity gains in spite of the fact that sales and territory managers were operating in work-from-home and hybrid working environments without putting in “windshield time driving to meet producers,” and many are also having success with virtual loss control and premium audit processes.

“A lot of companies are taking this opportunity to allow for the normal attrition that would have occurred….So, what we’re expecting to see is companies, as they’re growing, perhaps maintaining or fewer will be increasing staff—or increasing staff at a lower rate as they start to recognize productivity gains in the new working model.”

Overall, the Jacobson-Ward survey captures responses from carriers employing roughly 115,000 workers. In addition to asking how much hiring they expect to do, the survey delves into what positions they’re most interested in filling and what levels of experience they are seeking, among other things. Jacobson and Rieder noted that P/C responses are overweighted in the overall survey figures because 77 percent of the responses are from P/C insurers. Also, there were slightly more regional than national or multinational respondents, with regionals making up 57 percent of the respondent universe. The survey results represent roughly a 50-50 split evenly between carriers with less than 300 employees and those with more than 300.

Jacobson said that the average number of employees per carrier—1,640 for this study—is lower than in past, pointing to the increasing influence that a lot of startups are having on insurance employment market as a likely reason.

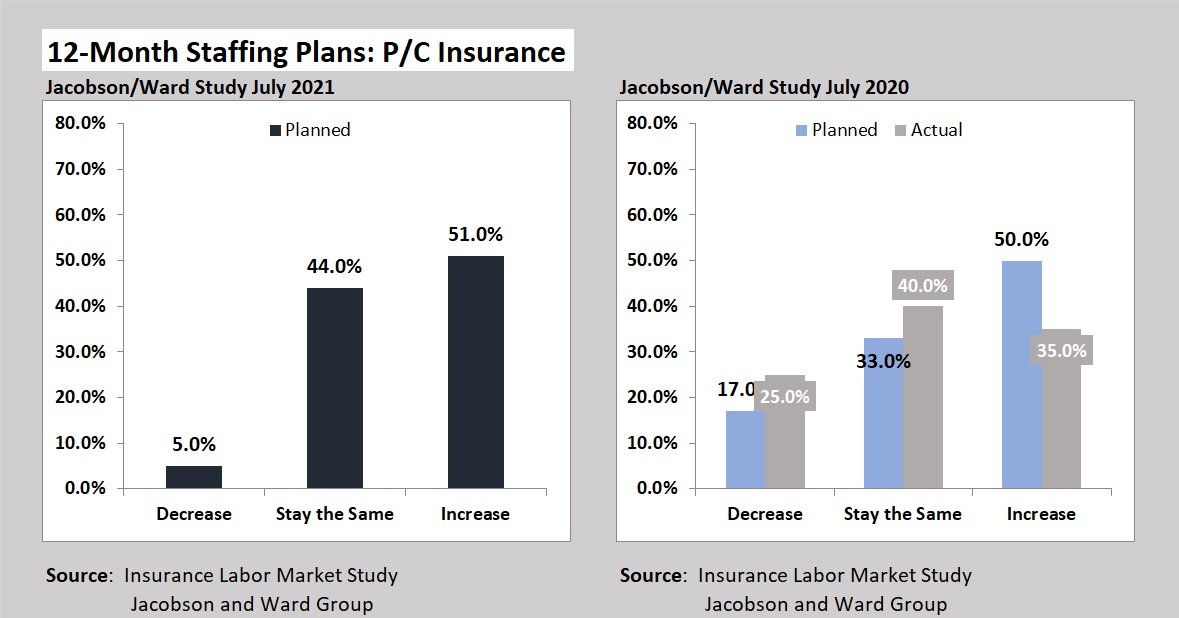

The charts below compare the expected staffing changes for the P/C segment from the July 2021 and July 2021 surveys, along with actual staffing changes experienced since the July 2020 survey.

While planned staffing increases for P/C carriers are about the same as last year—with 51 percent saying they plan to hire vs. 50 percent in July 2020—only 35 percent of P/C respondents actually increased staff last year, while 25 percent actually reported decreased staffing.

“Again, it’s not through direct reductions in force,” Rieder said, commenting on the P/C carrier staff declines. “A lot of that was allowing the attrition to happen and not replacing those positions in the uncertain economy. But certain areas are going to require additional staffing now because of the declines,” he added.

“Last year, insurance companies had made a commitment not to lay people off,” Jacobson said, referring to both P/C and L/H carriers. “They didn’t have to,” Jacobson said, noting that balance sheets were strong.

The majority of reductions in staff have been at the larger company level, Jacobson said, revealing that 34.5 percent of large carriers reported reduced staff over the last year. These were not large reductions, however, he said. “It hasn’t been picked up by the media because a lot of it has been more set up through early retirements than through layoffs,” he repeated.

In contrast, only 12.2 percent of small companies reduced staff in the past year. More small companies are adding to staff, Jacobson said.

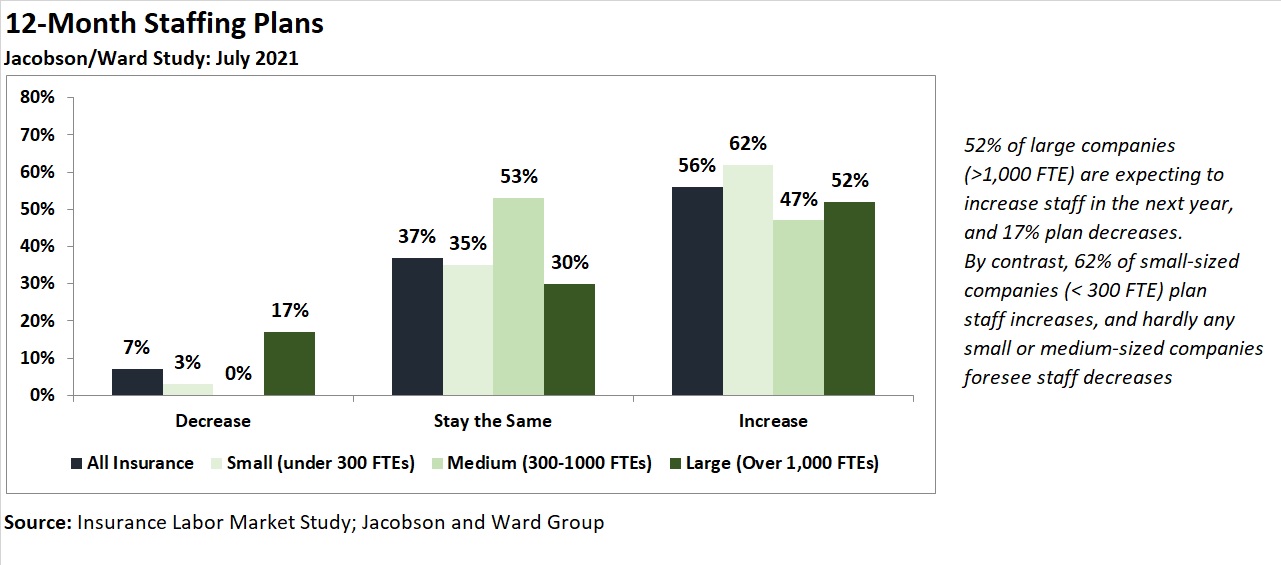

Looking ahead, Rieder presented planned staffing changes by size of company, summarized on the chart below.

Commenting on the 17 percent of large companies that said they expect staffing decreases over the next 12 months, Rieder noted that the figure is among that highest numbers ever reported in over a decade of surveys.

Commenting on the 17 percent of large companies that said they expect staffing decreases over the next 12 months, Rieder noted that the figure is among that highest numbers ever reported in over a decade of surveys.

Breaking down anticipated staff increases for P/C insurers by segment, Rieder said 54 percent of commercial lines P/C companies are expecting to increase staff during next 12 months, while only 40 percent of personal lines carriers said staffing increases are on the 12-month horizon.

Earlier in the webinar, flagging others types of companies that are stepping up hiring, Jacobson noted that there’s been a model change among InsurTechs. “They are looking for more insurance people than they were before,” he said.

Fast Food or Insurance?

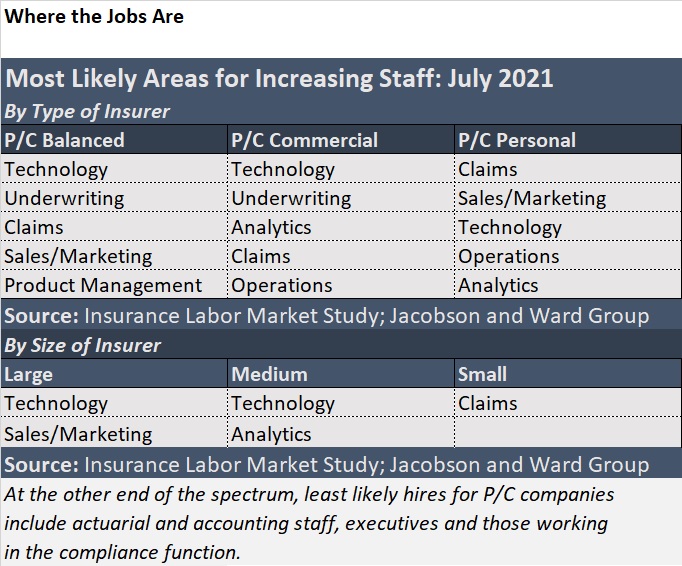

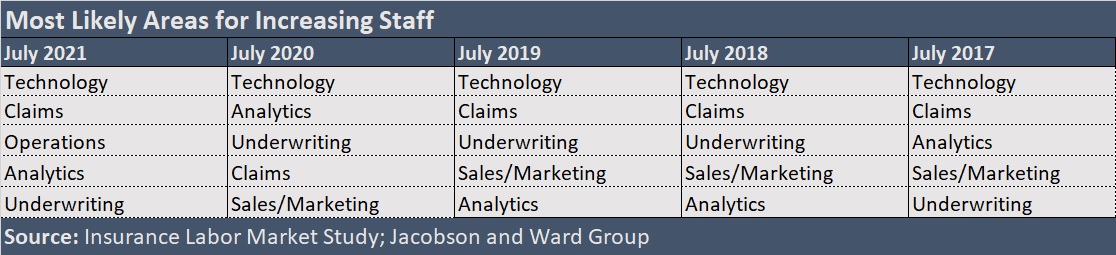

The Jacobson-Ward survey also reported the functional areas that P/C carriers plan to beef up. The top five by type of insurer and top two by size are summarized below.

Across all segments of the industry, Rieder noted that technology professionals continued to see the greatest demand, followed by claims and then operations roles for processing and support staff. “The operations roles “tend to be the lower paid roles within most organizations,” Rieder said. As a result, “we’re also finding now that [insurance] companies are competing for that talent with other service industries—food and beverage, hotel, etc.”

Rieder added that fast food restaurants that recently experienced hiring difficulties are now paying $15-$20 per hour, “which is now making it difficult for insurance companies to compete” to fill operations roles, going on to predict an emerging insurance industry trend of “greater increases on merit for those lower paid jobs.”

Considering all P/C and L/H sectors in the aggregate, Rieder said that virtually every activity showing growth in the likelihood of increased hires, one notable exception is actuarial staffing. Respondents indicated a decreased likelihood for adding to actuarial staff than in the past, he revealed.

Still, actuarial remains one of the five most difficult positions for insurers to fill. And Jacobson noted that for the first time in the 12-year history of the survey, every one of 11 different positions was judged difficult to fill by survey respondents. “Given that we’re seeing unemployment go up over the last six months you would think recruiting difficulty would go down but it really hasn’t,” he said. “There has been some letting up in some areas—analytics, actuarial and executive hires have become a little bit easier. But most of the rest have become harder including technology, right at the top,” Jacobson said.

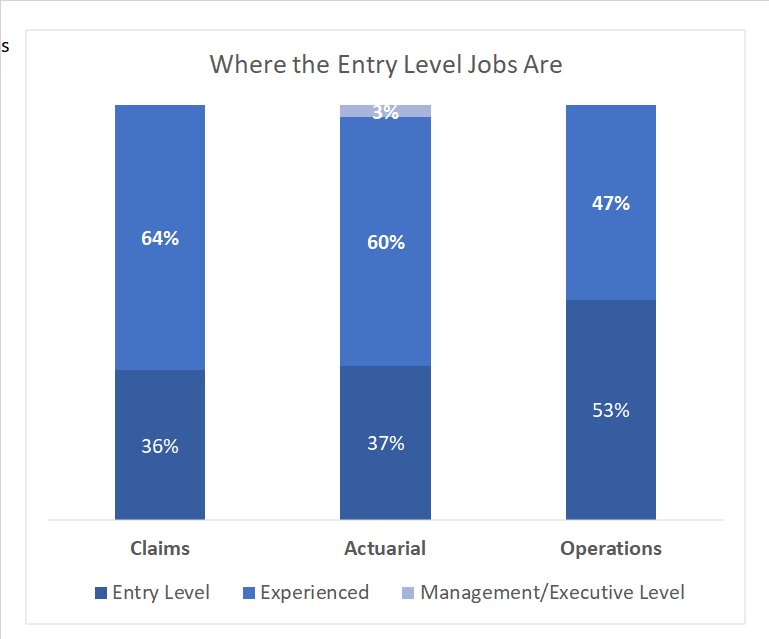

As part of the July 2021 survey, Jacobson Group and Ward also asked carriers what levels of experience they were seeking for various insurance roles, giving non-experienced job seekers a sense of where the entry level positions can be found. Across the insurance industry, on average, 24 percent of available positions are expected to be entry level positions. The three occupations with the highest percentages of entry level positions available going forward are operations, claims and actuarial work.

Back to the Office?

At an earlier point in the webinar, Rieder responded to an audience question about whether there is evidence of a trend of employees leaving positions for higher paying jobs noting that while that happens on and off in any environment, what he has seen is short-term movement when companies announce post-COVID work arrangements.

“We have had several clients that once they announced their return-to-work programs, if they were returning to work, they saw typically a spike in turnover within the first two weeks of making the announcement if they went back to the office….Those organizations that did have that spike were short-lived. Now, they’re seeing that their attrition rate is about the same. So, people are always leaving for better pay, but I don’t think that is necessarily indicative of the new environment yet.”

Jacobson said that despite Rieder’s anecdotal evidence that companies aren’t seeing a long-term impact from their return-to-work announcements so far, Jacobson believes the jury is still out on whether that continues to be the case. “I think it’s too early to determine whether we’re going to see a significant reshuffling related to changes in work environment because there have been so many delays in this,” he said, referring to the fact the impact of the COVID Delta variant on carrier work arrangements.

Jacobson also noted that his firm does a lot of placement work for positions that require relocation. “Far less people are willing to relocate than were willing to relocate two years ago,” he said, supporting the view with that fact that Jacobson professionals have to call twice as many people as they did two years ago when the job requires relocation. “People don’t’ think they should have to relocate. They have proven they can work remotely,” he said.

Based on the July 2021 Jacobson-Ward survey figures, Rieder reported that 71 percent of responding insurers expect of offer occasional work-from-home options, while 49 percent will offer full-time remote options and 49 percent will also offer flexible hours. “For companies that aren’t offering these options, it is limiting their pool of candidates. So, it could become a greater retention and recruitment tool to offer more flexible work options,” Rieder said.

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next