The trend of “uberization”—industry disruption caused by an unlikely outside competitor—has become a key concern of executives in and outside the insurance industry, according to a new IBM study published early this month.

In addition, while executives across all industries view technology as one of the driving forces allowing new competition to muscle in, insurance executives interviewed by IBM were much more likely to pick “cognitive computing” tools as new weapons to add to their competitive arsenals to keep pace with Uber-like challengers than other executives were, survey results available online revealed.

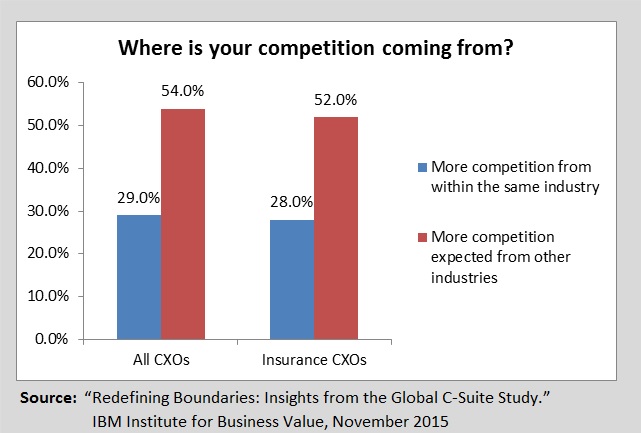

In a media statement, IBM reported that in just two years, the percentage of C-suite leaders across all 21 industries who expect to contend with competition from outside their own industry increased to more than half—54 percent today compared to 43 percent in 2013, according to the study, “Redefining Boundaries: Insights from the Global C-Suite Study.”

These findings come from responses of more than 5,200 C-suite leaders—CXOs—in more than 70 countries, IBM said, noting that most participated in face-to-face interviews. IBM said one-third of the respondents were chief information officers, and another 40 percent hold one of the top three C-suite titles: chief executive officer, chief financial officer or chief operating officer.

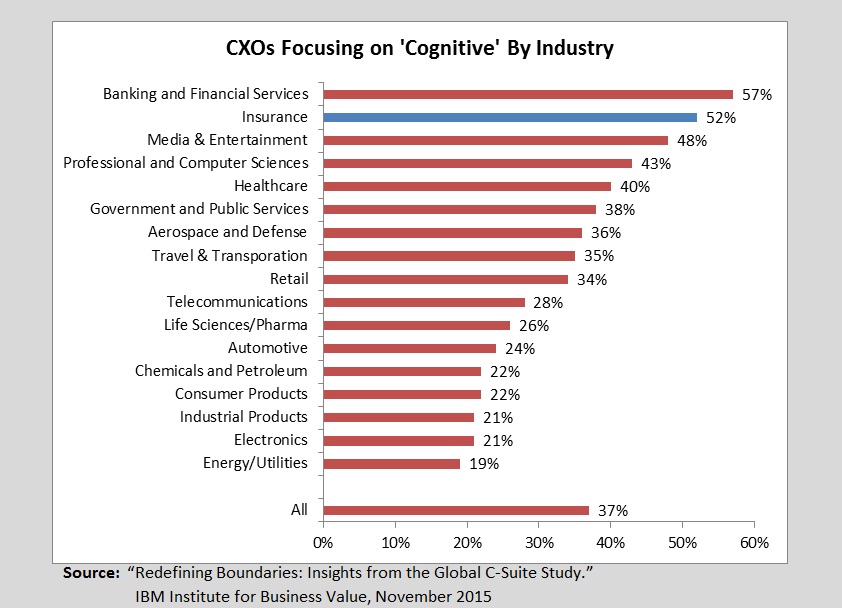

An interactive online presentation of key study results by industry shows that CXOs from the insurance industry are in sync with those in other industries in worrying about disrupters, with 52 percent wary of outsiders competing with them.

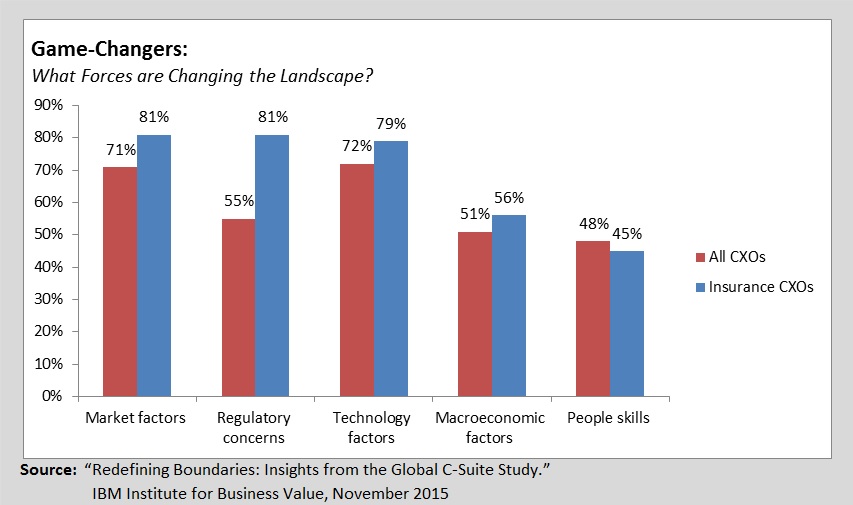

And like their peers in other industries, most insurance industry CXOs identified technology as a key factor changing the competitive landscape—79 percent of insurance industry CXOs and 72 percent of CXOs from all industries. (Notably, insurers rank market factors and regulatory factors slightly ahead of technology, unlike their counterparts in other industries.)

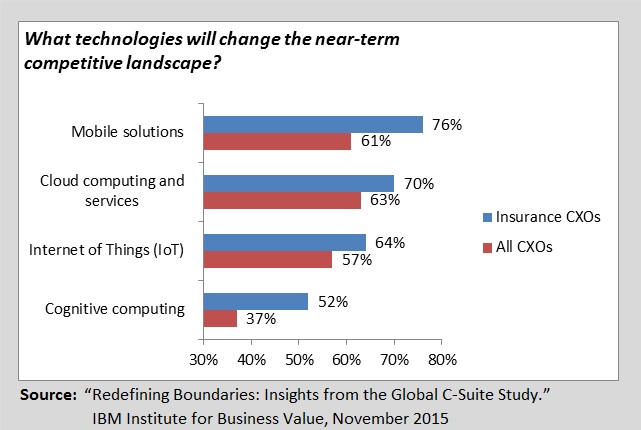

Regardless of role or industry, most CXOs also believe that three technologies—cloud computing, mobile solutions and the Internet of Things—will be the predominant forces to shake up the competitive landscape in the coming three to five years. Insurers, however, rank mobile technology above their peers. And they break from the pack again on the fourth area of game-changing technology: cognitive computing.

Fifty-two percent of insurer CXOs and 57 percent of bank CXOs see cognitive computing on the near-term horizon. In other industries, such as professional and computing services, which like insurance are heavily staffed by knowledge workers, just 43 percent selected “cognitive,” and only 37 percent of the CXOs see cognitive as a near-term force across all industries.

What Is Cognitive Computing?

With IBM’s Watson perhaps the most recognized player in the cognitive computing world, it is no surprise that the IBM report highlights the importance of cognitive technology, even though CXOs outside insurance aren’t ready to embrace it.

Different types of cognitive computing solutions offer various capabilities, including:

- Learning and building knowledge from various structured and unstructured sources of information.

- Understanding natural language and interacting more naturally with humans.

- Capturing the expertise of top performers and accelerating the development of expertise in others.

- Enhancing the cognitive processes of professionals to help improve decision-making.

- Elevating the quality and consistency of decision-making across an organization.

Source: “Understanding customers and risk: Your cognitive future in the insurance industry,” published by IBM, October 2015.

Defining cognitive technologies as “systems that understand natural language and are not programmed but learn,” the report asserted that these technologies “lie next on the horizon, as the bridge to new levels of personalization and insight from exploding volumes of data.”

In a media statement and a video released in conjunction with the Global C-Suite Study, IBM also touted cognitive technology as a way to keep tabs on emerging disrupters lurking in hidden corners.

“When it comes to the competition, C-suite leaders clearly have a new threat to consider—one that is often invisible until it is too late,” said Bridget van Kralingen, senior vice president, IBM Global Business Services, in the media statement. “At the same time, the highest performers see advances in areas like cognitive computing and systems that can sense and learn as the key to dealing with disruptive events, showing a path forward for all executives.”

Focusing on executives of leading companies (those with the highest revenues and profits), she said that they are the most likely to “expect that their agendas will be shaped by cognitive computing“—24 percent more likely, according to the media statement.

“With cognitive, they will finally have access to the world’s unstructured data, images and sound, chemicals and formulae, geospatial data, and just about everything streaming through social channels. That’s 80 percent of data out of reach of traditional computing systems today,” she said.

Can Watson Help With That?

IBM’s Watson is a cognitive-era system that learns and understands natural language just like human beings. There is no need to program every output with complex programming logic. It is a new species that is taught by design, learns by experience, learns from interactions, gets smarter over time and makes better judgments over time.

Watson enables humans to chat with it in natural language through a feature called “Watson Personal Advisor.” The Watson Personal Advisor capability was tested for the first time during an American quiz show, “Jeopardy.”

Source: Shaping the future of insurance with IBM Watson, December 2014

The published report on the Global C-Suite Study does not discuss the industry-by-industry results nor give any suggestions about how Watson—or cognitive computing generally—can specifically help insurers.

But a separate report published in October, titled “Understanding customers and risk: Your cognitive future in the insurance industry,” reveals just how quickly insurers expect to get on board with cognitive systems.

This earlier report, summarizing the responses of 86 insurance executives (included in a survey of 800 global executives from various industries conducted by the Economist Intelligence Unit) stated that 96 percent of insurance executives familiar with cognitive computing said they plan to invest in it.

Ninety-eight percent of these same insurance executives said they believe that it will play a disruptive role in the industry; 85 percent said it will have a critical impact on the future of their business.

As for the 96 percent that are going to invest in it, here’s the timetable the set:

- Within 1-2 years 13%

- Within 3-4 years 28%

- In five years or more 55%

“Already, cognitive systems are driving customer engagement through virtual digital agents and improving decisions for underwriters,” the report said. Setting forth recommendations for the future, the report suggested that insurers focus on improving their capabilities to “engage, discover and decide.”

• Describing how cognitive can be used to engage with customers, the report noted that cognitive systems act as “tireless agent[s] providing expert assistance to human users.”

Without naming the insurer, the report noted that the cognitive systems of a provider of consumer insurance use Watson’s natural language capabilities to answer questions and provide coverage counseling. “The solution can understand context based on information provided during the shopping experience and can tailor its answers accordingly. Over time, the solution will incorporate customer analytics derived from big data to create a more personalized experience for each customer.”

• As for discovery, the report highlighted the ability of cognitive systems to find insights and connections from vast amounts of information, beyond the capabilities of even the most brilliant humans.

• Decision-making in cognitive systems is based on evidence-based options, an approach that reduces human bias and “evolves continually toward more accuracy based on new information, results and actions.”

The systems also provide an audit trail of why a particular decision is made.

Here, the report gave the example of a Peruvian insurer—RIMAC Seguros—which plans to use Watson Content Analytics for health insurance claims processing. “When a claim is made, Watson will scan thousands of policy documents and almost instantaneously pull out the paragraphs relevant to the decision at hand,” the report said, noting that in early tests, this cut the time to process a claim by more than 90 percent.

RIMAC also expects Watson to provide insights into claims trends it might otherwise miss—hospital charges that are too expensive for certain procedure, or a particular region bringing a high frequency of claims related to a certain illness, for example.

A few days after IBM published the report outlining the cognitive future for the insurance industry, IBM and Swiss Re jointly announced that they are developing a range of underwriting solutions that rely on IBM Watson’s cognitive computing technologies. One of the first applications will be in Swiss Re’s life and health reinsurance business unit, the announcement said.

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard