“We are very bullish on AI, and we’re leaning into it.”

That’s how Alan Schnitzer, chief executive officer of Travelers, responded to a recent question from an investment analyst who wanted specifics on how AI investments would impact the carrier’s expense ratio and workforce headcount over the next three years.

Executive Summary

Sixty-seven percent of CEOs, including insurance industry CEOs, expect returns from AI investments in one to three years, according to new KPMG survey. Just a year ago, only 20 percent had the same prediction.Here, CM summarizes some key takeaways from the KPMG 2025 Global CEO Outlook related to AI, talent and leadership topics. The outlook also reports on concerns about business challenges, including cybersecurity risk, economic uncertainty and tariff impacts.

“We’re spending more than $1.5 billion a year on technology. A lot of that is focused on AI. We expect significant benefits from it,” said Schnitzer during a third-quarter earnings conference call earlier this month, declining to disclose expense ratio guidance but stressing instead that AI will create operating leverage that gives Travelers flexibility to deploy its efficiency and productivity gains however it chooses.

“We are very bullish about the opportunity for the investments that we have underway. We’re very bullish about the data we have to fuel the AI and think that it will make a big difference in the years to come,” he stated.

Schnitzer isn’t alone in his thinking. Nearly three-quarters of 110 insurance CEOs around the globe surveyed by professional services firm KPMG in August and September agreed that despite ongoing economic uncertainty, AI is a top investment priority for their organization.

The 110 insurance industry CEOs are a subset of 1,350 CEOs surveyed by KPMG across 11 key markets (Australia, Canada, China, France, Germany, India, Italy, Japan, Spain, UK and U.S.) and 12 industry sectors (asset management, automotive, banking, consumer and retail, energy, healthcare, industrial manufacturing, infrastructure, insurance, life sciences, technology, and telecommunications) for the KPMG 2025 Global CEO Outlook report. The report provides an in-depth three-year outlook from global executives on enterprise and economic growth, focusing on topics ranging from AI and talent as well as overall risks and leadership pressures.

(Editor’s Note: Carrier Management did not query KPMG about whether Schnitzer was one of the CEOs surveyed. All the respondents to the KPMG CEO survey lead companies that have annual revenues over $500 million, and more than one-third have more than $10 billion in annual revenue. The insurance industry respondents span subsectors including in P/C, life and health insurance, reinsurance, and brokers.)

Like the 73 percent of insurance industry CEOs that are prioritizing AI investments, 71 percent of CEOs across industries also flagged AI investments as a top priority, according to KPMG. Two-thirds of insurance CEOs (67 percent), and 69 percent of all CEOs around the world said they anticipate spending 10-20 percent of their budgets on AI in the next 12 months.

“CEOs are investing in AI with greater confidence—not just because of its promise, but because of the measurable value they are seeing and the rapid emergence of agents, making expected returns more accessible and scalable,” said Steve Chase, Global Head of AI and Digital Innovation, KPMG International, in an online statement about the report findings.

As respects measurable value, KPMG reports that both CEOs in and outside the insurance sector are increasingly confident about the short amount of time it will take to realize returns from AI investments, with 67 percent of both groups anticipating return on investment in one-to-three years. In contrast, just one year ago, only 20 percent of all CEOs expected to achieve ROI in the one-to-three year time frame, and the majority (63 percent) did not expect to achieve ROI until three-to-five years out.

Within the insurance industry, “transformation has gone from aspiration to expectation,” said Sean Vicente, KPMG U.S. Insurance Sector Leader, in a media statement. “The conversation is moving beyond new platforms to reimagining ways of working and the use of emerging technologies. As data security and regulatory questions continue to shape its adoption, AI is no longer a competitive nice-to-have but a strategic imperative.”

Since 2016, Travelers has invested $13 billion in technology, CEO Alan Schnitzer reported on a third-quarter 2025 earnings conference call.

“Scale matters—increasingly so,” he said. “We have the scale to win in an environment where technology and AI will continue to segment the marketplace. We have a track record of identifying the right strategic priorities and driving value from them. You can see that in the 300-basis point reduction we’ve achieved in our expense ratio since 2016, even while we were significantly increasing our overall technology spend.”

“Importantly, our size gives us the data to power AI, creating a virtuous cycle: Better insights, better decisions, better outcomes, more resources to invest,” Schnitzer stated, reporting that a long-time Travelers focus on “organizing and curating data” has given the carrier access “to more than 65 billion clean data points from decades of history across multiple business lines.”

“We leverage that to sharpen our underwriting and shape our claims strategies,” he said.

According to the survey results, insurance CEOs are more likely to see benefits of AI investments impacted by regulatory lags than by internal readiness. In fact, 77 percent of insurance CEOs said they are confident (65 percent) or very confident (12 percent) that their organization can keep pace with the rapid development of AI and its effects on workflow (operations) and workforces.

“Leading organizations are integrating AI into the core of their business strategies and investing in what’s needed for success: quality data, workforce readiness, and responsible AI governance built both for trust and agility,” Chase said.

Looking externally, the same percentage of insurance CEOs—77 percent—agreed that the pace of progress on AI regulations will be a barrier to their organization’s success. Across industries, the percentage of CEOs viewing the inability of regulation to keep up with the pace of technology as a barrier to their organization’s success was lower, coming in at 69 percent.

AI Disrupters and the Shape of the Workforce

As part of the survey, U.S. CEOs, including 41 U.S. CEOs from the insurance industry, were asked about a different external factor—disrupters to their industry from the technology sector. In and outside the insurance space, most U.S. CEOs predicted that at least one native AI organization would become a leader in their industry, displacing an existing incumbent within three years. Insurance CEOs, however, were a little less likely to foresee this possibility—78 percent of U.S. insurance CEOs vs. 84 percent of all U.S. CEOs.

Bigger differences emerged between insurance industry CEOs and their peers in other industries on questions about agentic AI, AI’s impact on company culture and workforce strategies.

The majority of all 1,350 CEOs surveyed across industries and across regions—57 percent—expect agentic AI to have a significant impact on their organization alongside generative AI. But less than half of insurance industry CEOs around the world—44 percent—said agentic AI will have significant impact, driving major improvements in efficiency or growth.

Still, a higher percentage of insurance industry CEOs said they were concerned about the impact of generative AI and AI agents on their company culture—72 percent of global insurance industry CEOs vs. 63 percent of all CEOs surveyed.

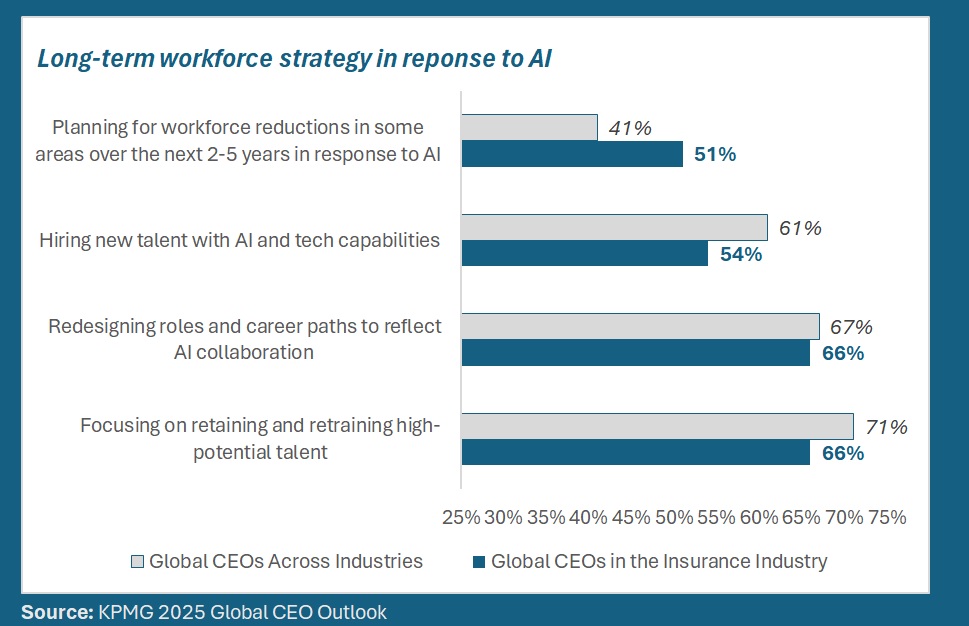

Also in contrast to the other CEOs surveyed, more than half of insurance industry CEOs said they are planning for workforce reductions in some areas over the next two-to-five years in response to AI (51 percent vs. 41 percent of all CEOs). The insurance industry CEOs are also less inclined to hire new talent with AI and tech capabilities (54 percent vs. 61 percent of all CEOs).

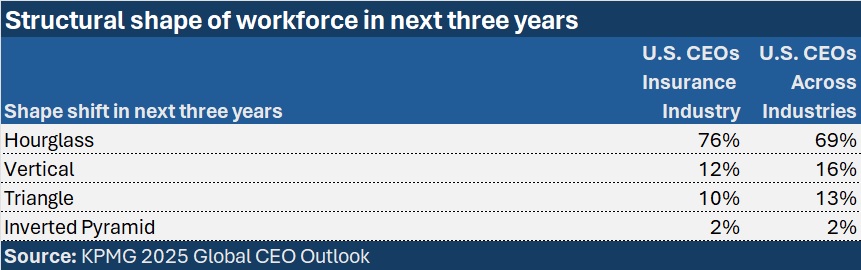

Beyond these talent management strategies, KPMG asked U.S. CEOs how the shapes of their organizations will shift as AI agents impact their workforces. More than three-quarters of U.S. insurance industry CEOs see an hourglass representation playing out—heaviest in senior management and front-line employee layers and slimmest for middle management positions.

Other noteworthy data points from the talent section of the survey revealed that 51 percent of insurance industry CEOs globally believe managers in their businesses will be primarily responsible for managing the performance of AI agents—not HR or IT departments—and 85 percent said that managers in their organizations (who are not technology developers) will be expected to manage multiple AI agents as part of their roles within the next year.

In their own roles, insurance CEOs are feeling more pressure, with 75 percent saying that “what’s expected of them has evolved significantly—with new expectations and greater complexity.”

***

What Else Did Insurance CEOs Say?

Beyond AI and talent, KPMG asked CEOs about M&A appetites, business risks and operational priorities. Among the insurance CEOs surveyed around the globe:

- 50% said they are likely to undertake acquisition which will have a significant impact to their overall organization. Only one-third of all CEOs said they had such a high appetite for enterprise-changing M&A.

- Over one-third (36%) listed cybersecurity as the pressure or challenge driving their short-term decisions, ahead of regulatory pressures (29%) and macroeconomic uncertainty (27%).

- More than half (53%) identified cybersecurity and digital risk resilience as areas where their organization have increased investment to mitigate pressing business risks over the next three years.

- 83% agreed that cybercrime and cyber insecurity will impact their organization’s prosperity over the next three years.

- Nearly a quarter (24%) said advancing digitization and connectivity across the business was their top operational priority aimed at achieving growth objectives over the next three years.

- More than half (52%) said improving customer experience through enhanced digital platforms and multi-channel communication were two top priorities to enhance customer satisfaction and risk assessment over the next two years

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits