Eighty-one percent of insurance executives surveyed for a new report from KPMG International said they expect to seek at least one and as many as three acquisition targets or partnership opportunities over the next three years.

And they’re not just looking for any deals. Most are looking for “transformational” deals, according to the report, “Accelerated evolution: M&A, transformation and innovation in the insurance industry.”

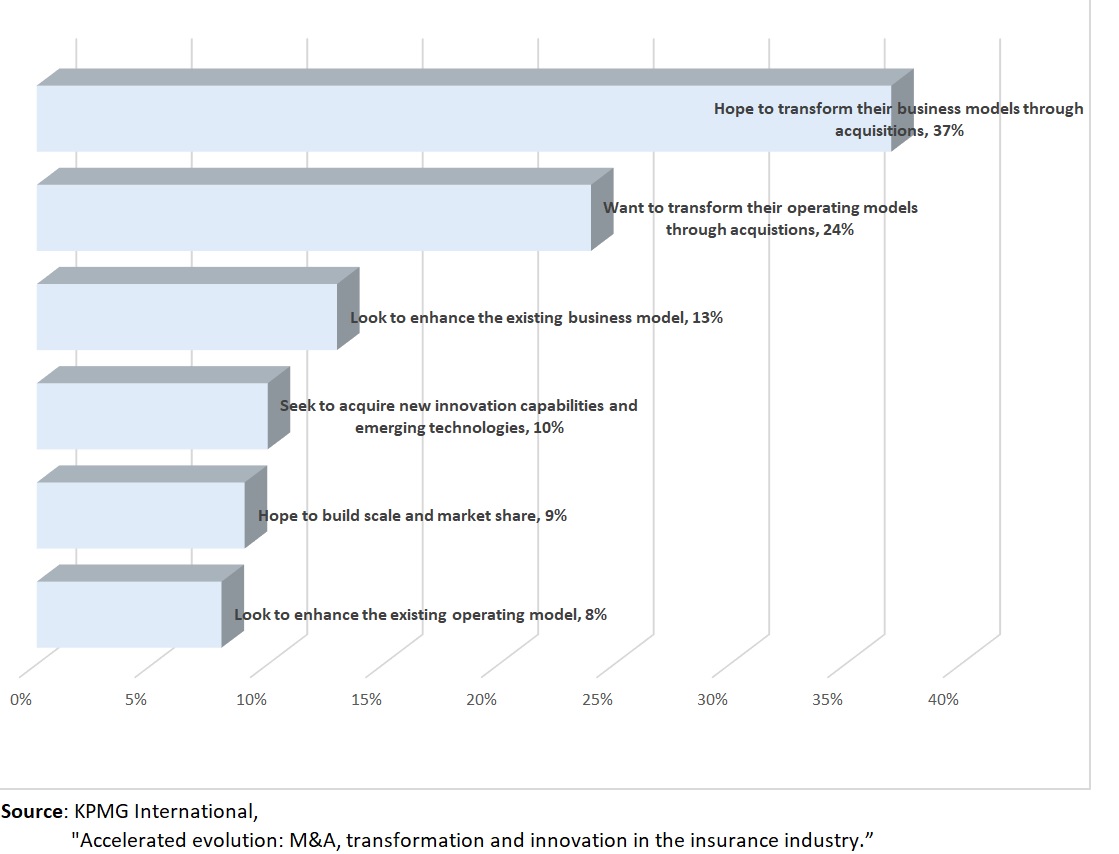

More than 60 percent of the 200 executives surveyed globally said transforming their business or operating model would be the key factors driving acquisitions, while just 21 percent identified a less sweeping goal—one of merely enhancing their current models—as the key factor.

Among the respondents, 10 percent said they would seek to acquire are innovation capabilities and emerging technologies.

They are also looking outside geographic borders, with two-thirds expecting to conduct cross-border deals (including M&A, partnerships and alliances, as well as divestures), and only one-third confining their interests domestically.

In spite of their intentions, the executives surveyed aren’t convinced that they’ll be able to find transformational targets. Only 10 percent said they are extremely likely to find a deal that is a strategic fit for their business, and just 7 percent expect to find a target find strategic fits for their operating models.

Problems in connecting with the right partners range from simply not having the internal capabilities for deal sourcing—72 percent rate their internal capabilities as “moderate to low” for evaluating the strategic fit of a target’s business model—to not having a proactive approach to M&A. Forty-four percent said the take a largely reactive approach to M&A. In addition, over half (54 percent) “don’t think their M&A teams are highly aligned to corporate strategy and innovation initiatives.”

Problems in connecting with the right partners range from simply not having the internal capabilities for deal sourcing—72 percent rate their internal capabilities as “moderate to low” for evaluating the strategic fit of a target’s business model—to not having a proactive approach to M&A. Forty-four percent said the take a largely reactive approach to M&A. In addition, over half (54 percent) “don’t think their M&A teams are highly aligned to corporate strategy and innovation initiatives.”

“Insurers are competing for market share in a slow-growth environment, that is experiencing an influx of dynamic new InsurTech players,” said Laura Hay, Head of Global Insurance for KPMG International, in a statement announcing the findings. “They know they can’t rely just on organic growth to meet their objectives, so alliances and acquisitions become essential as insurers look to engage with customers in new and different ways, and gain access to innovative operating capabilities and technology infrastructure to reshape their business and drive future growth.”

To accelerate their transformation goals, KPMG said that an emerging trend for insurers is setting up dedicated capabilities, including corporate venture capital (CVC) teams, to acquire and accelerate innovation. Eighteen percent of insurers surveyed indicated they either already had an established CVC or had plans to establish one, with the top ranked objective being acquiring innovation for business model transformation.

KPMG also asked executives to identify the regions and sectors expected to see the most M&A activity in the next three years. North America far outpaced the second-most likely choice, Asia-Pacific, with 83 percent expecting deals in North America and 51 percent in Asia. By sector, 87 percent predicted non-life insurers would find the most buyers during the next three years.

KPMG leaders putting some context around the geographic results indicated that changes in U.S. tax laws contribute to the attractiveness of North America deals, where insurers also see source of steady market growth and relative premium stability.

“The reduction in the corporate tax rate to 21 percent makes U.S. assets much more compelling,” commented Philip Jacobs, leader of the Insurance Tax practice with KPMG in the U.S. “The lower US tax rate has also eliminated some of the offshore tax advantage; the large Bermuda players may still be operating with relatively low effective rates, but the tax differential between operating in the U.S. versus Bermuda has narrowed,” he added in that section of the report.

The report also contains interviews of executives at Aviva Digital, Munich Re/HSB Ventures, and XL Accelerate about their innovation initiatives conducted by KPMG leaders, and summarizes survey results about the primary objectives of CVCs. The report also includes guidelines for more strategic deal sourcing and deal execution success from KPMG.

“The key…is to be able to look beyond the immediate metrics such as combined ratios or net profits over the next 24 months—you need to be thinking about what that deal is going to generate in terms of contribution to margin 10 to 15 years from now,” noted Giuseppe Latorre, Head of Corporate Finance for KPMG in Italy, at one point in the report.

Source: KPMG

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec