Actuaries and casualty insurance company financial officers who are not tuned into the revolution occurring in molecular biology may be blindsided by the next influx of asbestos claims, according to a new paper published last week.

Executive Summary

The casualty insurance industry could face a $7-$13 billion deficit on loss reserves carried for asbestos claims because of a chronic underestimation of mesothelioma claims. Moreover, insurers could face a new wave of costs for asbestos-related diseases fueled by advances in medical science and a changing legal landscape, according to a new research report.Property/casualty industry loss reserves for asbestos are already deficient by billions, according to the paper, “New Science and Law in Asbestos Litigation: A Multi-Disciplinary Look at Change and Future Directions,” which details advances in medical science that could add to reserving issues in the future.

The paper reveals that scientists can now analyze molecular data to identify an individual’s genetic propensity to develop mesothelioma or cancer from low-dose asbestos exposure—even non-occupational exposure, such as asbestos contained in the home. Researchers have alsod use molecular techniques to estimate the actual amount of exposure someone had to a toxin like asbestos, and investigate “signatures” of tumors to determine whether the tumors have genetic origins or whether they are caused by environmental toxins.

“You’ve really got to set aside what you came to know about asbestos back in 1995-2005,” says William Wilt, one of the paper’s authors and the president of Assured Research, a New Jersey-based insurance research firm.

Those years don’t seem so long ago but the science related to asbestos “has been revolutionized in the last 10 years.” Unlike the situation a century ago, when people could see evidence of the Industrial Revolution happening all around them, the equally consequential revolution in science in the last five-to-10 years is not visible to most insurance professionals because “It’s happening in test tubes and laboratories,” he notes.

“The next few years will bring earlier and more reliable detection of mesotheliomas and other cancers based on the wider availability of these molecular and genetic techniques,” adds co-author David Schwartz, Ph.D. and founder of Innovative Science Solutions.

The legal ramifications of the new science is complex, and the paper explores potential risks and benefits to both plaintiffs and defendants in asbestos lawsuits as it reports on how both sides are currently responding to the possibility of bringing tests for the BPA1 genetic mutation—the marker that some believe indicates a propensity to develop asbestos-related disease—into the courtroom.

Setting the stage for what’s to come, the paper begins with a review of pro-plaintiff legislative changes in Illinois—the home of one-third of all asbestos lawsuits—and in the EU. Co-Author Kirk Hartley, founder of LSP Group, a law firm specializing in mass tort and environment issues, also provides an in-depth analysis of pro-defendant ruling in the Garlock bankruptcy case last year (In re Garlock Sealing Technologies LLC, 10-bk-31607, U.S. Bankruptcy Court, Western District of North Carolina, Charlotte).

According to Hartley, defendants and insurers expecting the tide of asbestos litigation to turn in their favor as a result of a ruling that favored the gasket maker’s $125 million estimate of the future liabilities for mesothelioma claims over a claimants’ estimate that was 10-times higher, are missing unique aspects of the case outlined in the new paper.

In addition, the paper details more ongoing research, reporting that it’s not just mesothelioma and lung cancer that medical researchers can now link to asbestos through scientific study. Research presented at an influential asbestos conference in Helsinki last year even attributes laryngeal and ovarian cancers to asbestos exposure in some settings, according to the paper.

In a final section of the 72-page paper, Wilt and Alan Zimmermann, a managing director of Assured Research, estimate an P/C industrywide asbestos loss reserve deficiency in the range of $7-$13 billion just by focusing on mesotheliomas uncovered through traditional diagnostic techniques—without even attempting to put a value on the next wave of asbestos-related injury claims resulting from new science.

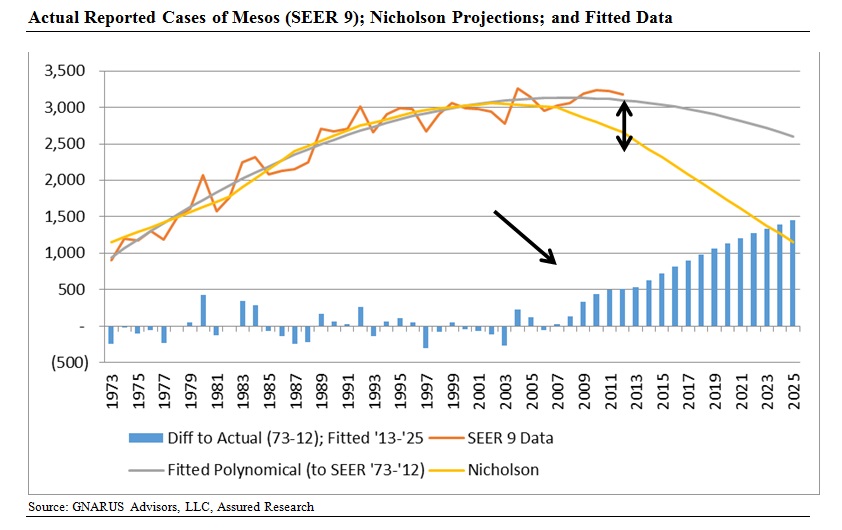

The multibillion-dollar shortfall, they say, comes as the result of another trend that is just starting to be appreciated by insurers—an unrelenting increase in the number of reported mesothelioma cases. The increase directly contradicts an expected falloff predicted decades ago (in the work of Dr. William Nicholson, who was a professor of environmental and occupational science at the Mount Sinai School of Medicine in the 1980s)—an expected decline that is baked into actuarial models used for asbestos reserving today.

Wilt and Zimmermann also point out that P/C actuaries need to understand a reality now accepted by their counterparts on the life insurance side—that people are simply living longer. The Society of Actuaries updated their mortality tables in 2014 to reflect this. But P/C actuaries relying on older tables (dating back to 2000) for their asbestos reserving models aren’t recognizing that advancements in the treatment of other critical illnesses (heart disease and prostate cancer, for example) allow people to live into their asbestos-induced diseases to a degree not contemplated in the existing reserving models.

The paper includes a list of estimated reserve shortfalls by company for the Top 30 insurance and reinsurance groups ranked by the magnitude of the shortfall.

The full report is available for purchase on the Assured Research website. To obtain a free nine-page summary report, contact William Wilt at william.wilt@assuredresearch.com

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next