This article is part of our insurance innovators interview series.

Stanley A. Galanski, President and CEO, The Navigators Group, Inc.

Stanley A. Galanski, President and CEO, The Navigators Group, Inc. Mark E. Watson III, President and Chief Executive Officer, Argo Group International Holdings, Ltd.

Mark E. Watson III, President and Chief Executive Officer, Argo Group International Holdings, Ltd. Kevin H. Kelley, Chief Executive Officer, Ironshore Inc.

Kevin H. Kelley, Chief Executive Officer, Ironshore Inc. John Wurzler, President, OneBeacon Technology Insurance

John Wurzler, President, OneBeacon Technology Insurance Alan B. Colberg, President and Chief Executive Officer, Assurant, Inc.

Alan B. Colberg, President and Chief Executive Officer, Assurant, Inc. Manny Rios, President and CEO, American Modern Insurance Group

Manny Rios, President and CEO, American Modern Insurance Group Dave Pratt, General Manager, Usage-Based Insurance, Progressive

Dave Pratt, General Manager, Usage-Based Insurance, Progressive Berto Sciolla, EVP and Manager of North American Treaty Reinsurance,Gen Re

Berto Sciolla, EVP and Manager of North American Treaty Reinsurance,Gen Re Greg Hendrick, Chief Executive, Insurance, XL Catlin

Greg Hendrick, Chief Executive, Insurance, XL Catlin Anand Rao, Principal, PwC U.S. Advisory Practice

Anand Rao, Principal, PwC U.S. Advisory Practice Mike McGavick, Chief Executive Officer, XL Catlin

Mike McGavick, Chief Executive Officer, XL Catlin David M. Lightfoot, Managing Director, Head of GC Analytics – Americas, Guy Carpenter

David M. Lightfoot, Managing Director, Head of GC Analytics – Americas, Guy Carpenter Conan Ward, Chief Executive Officer, Hamilton USA

Conan Ward, Chief Executive Officer, Hamilton USA Ming Lee, Chief Executive Officer, AIR Worldwide

Ming Lee, Chief Executive Officer, AIR Worldwide Laura Hay, National Insurance Sector Leader, KPMG LLP

Laura Hay, National Insurance Sector Leader, KPMG LLP John Lupica, Vice Chairman, ACE Group; Chairman, Insurance–North America

John Lupica, Vice Chairman, ACE Group; Chairman, Insurance–North America

Alan B. Colberg, Assurant Inc. President and Chief Executive Officer

Alan B. Colberg, Assurant Inc. President and Chief Executive OfficerQ1: In your view, what has been the greatest innovation in the P/C insurance industry in recent years? Explain.

Colberg (Assurant): The insurance industry has a reputation for being conservative when it comes to innovation, which is often appropriate as we balance risks, are highly regulated as an industry, and need to be compliant with applicable statutes and regulations. Sometimes this has affected the rate of change in our business. For example, homeowners insurance has not evolved dramatically over the last 30 years, and one of the biggest changes in auto insurance was carriers selling direct to consumers.

The pace of change has quickened in recent years as insurance companies begin to compete with nontraditional players in the market. Thus far, the most disruptive innovation has been in the use of telemetrics, a technology that involves the automatic measurement and transmission of data from remote sources. Insurance companies are using telemetery to self-select the risks they want. Essentially, they are implementing technologies to gather data on their policyholders to assess risks and price to those risks. It is brilliant.

Several auto insurance companies are using these technologies to identify and reward good drivers. Now some of these companies are beginning to use telematics to identify bad drivers and price to those risks. Drivers who thrill at speeding down the highway or running red lights may decide to pull out of these programs or face higher premiums.

Q3: In your view, what innovation or innovator outside the insurance industry has had or is having the greatest impact on the P/C insurance industry?

Colberg (Assurant): Apple’s iPhone has become ubiquitous and changed the way people access information, buy products and services, and communicate. It has had a dramatic effect on consumer expectations and how and where the insurance industry reaches its customers. From a customer experience perspective, Amazon is setting an extremely high bar, establishing digital experience standards without regard to industry and changing how businesses need to serve consumers. The biggest change, however, is yet to come as nontraditional players like Google enter the insurance arena. Their recent entry into auto insurance—offering comparison-shopping sites to consumers where they will be able to sell products directly—could eliminate the middle man in the process.

Q4: Describe one or more ways in which your company encourages innovation. (Feel free to describe any elements of the culture or process.)

Colberg (Assurant): At Assurant, our leadership development programs focus on fostering adaptive leadership skills to unleash the creative potential and tap into the entrepreneurial spirit that exists within our employee talent base. We need to employ innovative thinking to products and related services to best address customers’ evolving needs.

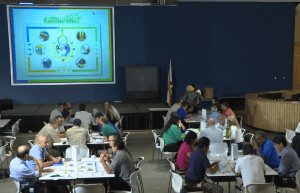

To further stimulate innovation, enhance decision-making skills and engage employees, we launched a strategy learning game at Assurant. The game encourages employees to adopt an enterprise mindset, helping to break down any silos that may exist between departments, and generate new ideas.

Business leaders have reported that the game is helping employees understand the company’s recent strategic decisions, particularly around acquisitions. Prior to playing the game, several employees had asked their managers why the company was making certain acquisitions and whether they were necessary. After playing the game, employees can see how the acquisitions support the company’s overall strategy and how they create new growth opportunities for Assurant. In addition, the game provides an opportunity for senior leaders and front-line employees to sit down at the same table and discuss company strategy.

Some business executives have played the game several times just to hear the discussions among employees and broaden their own perspective of the company.

Assurant is up to nearly 10,000 employees who’ve played the strategy learning game.

As another example, we identified a small group of talented employees in their 20s—the NextGen group—and paired them with members of our senior executive team. The NextGen group had the opportunity to “strategize” about potential growth areas to address emerging needs of millennials, which management might never have considered on their own.

Q6: Do you believe the next innovation to impact the P/C insurance industry will come from inside the industry or from an external innovator? Why?

Colberg (Assurant): Based on our collective breadth and depth of knowledge about risk and risk management, I would hope the next innovation would come from inside the industry. Realistically, it could just as easily come from nontraditional insurance players like Google, who have the data and relationships with customers that go beyond what the insurance industry has typically enjoyed. They may see opportunities where we cannot.

Q7: Describe your role in leading innovation at your company.

Colberg (Assurant): Championing innovation at Assurant is one of my most important roles. As an organization we need to adapt to changing conditions or we risk becoming irrelevant. We need to harness different perspectives, skills and experiences to serve and innovate for our customers around the world.

Alan Colberg, Assurant

Q8: What is the best book you have read about innovation? The best course or seminar you have attended? What was a key takeaway from the book or education session?

Colberg (Assurant): The best teacher in life is experience. When I worked at one of my first jobs, I learned that it can be very difficult to move businesses outside their traditional mindset even if what you are proposing saves them significant money.

The company had achieved great success with its iconic brands, and [they] resisted making changes to these products because they were afraid of tampering with the customer experience. While such reluctance is understandable, it creates an atmosphere that discourages innovation and may prevent a company from being able to quickly adapt to changing consumer needs.

I began to understand that big enterprises may be good at repeatable processes done on a large scale, but they are not good at quickly adapting to address changes in the marketplace. To innovate, you need to be nimble and be willing to accept change and sometimes even to embrace failure on your way to achieving your goals.

Q9: It is often said that tolerance for failure is one of the key cultural elements of a company in which innovation can thrive. Describe a failed initiative at your company and what you learned about innovation in the process.

Colberg (Assurant): We launched an insurance bundle for the solar industry several years ago that incorporated property and liability insurance with warranty management. While the solar industry recognized the need for the product and warmly welcomed us into the marketplace, we quickly realized we had entered the market too early to generate the returns we required. It is critical to consider the timing for new market entries carefully, have a solid understanding of a market’s maturity and the best time to invest.

Q11: Outside of providing risk transfer solutions, what are the most likely areas in which insurers can be innovators? Can P/C insurers disrupt other industries or provide noninsurance solutions by applying innovations developed through their core skills in underwriting and risk analysis, settlement negotiations, catastrophe modeling, environmental science or other areas?

Colberg (Assurant): Insurers are uniquely positioned to find problems that exist and create end-to-end solutions that safeguard customers where others cannot. Insurance companies are already disrupting markets in the way they are leveraging telemetrics and co-creating programs like we did with JUMP, a premium handset upgrade program that we launched in partnership with T-Mobile. Understanding consumer desire for the latest smartphone and the risk event, we were able to create a hugely successful program with T-Mobile that provides handset insurance, extended service protection and mobile security—and all with the ability to upgrade or trade in your device at any time.

Read more Innovation Insights by Person:

Stanley A. Galanski, President and CEO, The Navigators Group, Inc.

Stanley A. Galanski, President and CEO, The Navigators Group, Inc. Mark E. Watson III, President and Chief Executive Officer, Argo Group International Holdings, Ltd.

Mark E. Watson III, President and Chief Executive Officer, Argo Group International Holdings, Ltd. Kevin H. Kelley, Chief Executive Officer, Ironshore Inc.

Kevin H. Kelley, Chief Executive Officer, Ironshore Inc. John Wurzler, President, OneBeacon Technology Insurance

John Wurzler, President, OneBeacon Technology Insurance Alan B. Colberg, President and Chief Executive Officer, Assurant, Inc.

Alan B. Colberg, President and Chief Executive Officer, Assurant, Inc. Manny Rios, President and CEO, American Modern Insurance Group

Manny Rios, President and CEO, American Modern Insurance Group Dave Pratt, General Manager, Usage-Based Insurance, Progressive

Dave Pratt, General Manager, Usage-Based Insurance, Progressive Berto Sciolla, EVP and Manager of North American Treaty Reinsurance,Gen Re

Berto Sciolla, EVP and Manager of North American Treaty Reinsurance,Gen Re Greg Hendrick, Chief Executive, Insurance, XL Catlin

Greg Hendrick, Chief Executive, Insurance, XL Catlin Anand Rao, Principal, PwC U.S. Advisory Practice

Anand Rao, Principal, PwC U.S. Advisory Practice Mike McGavick, Chief Executive Officer, XL Catlin

Mike McGavick, Chief Executive Officer, XL Catlin David M. Lightfoot, Managing Director, Head of GC Analytics – Americas, Guy Carpenter

David M. Lightfoot, Managing Director, Head of GC Analytics – Americas, Guy Carpenter Conan Ward, Chief Executive Officer, Hamilton USA

Conan Ward, Chief Executive Officer, Hamilton USA Ming Lee, Chief Executive Officer, AIR Worldwide

Ming Lee, Chief Executive Officer, AIR Worldwide Laura Hay, National Insurance Sector Leader, KPMG LLP

Laura Hay, National Insurance Sector Leader, KPMG LLP John Lupica, Vice Chairman, ACE Group; Chairman, Insurance–North America

John Lupica, Vice Chairman, ACE Group; Chairman, Insurance–North America

Read other innovator’s response by question:

- Q1: The greatest innovation in the P/C insurance industry

- Q2: Describe the greatest innovation at your company

- Q3: Innovation or innovator outside the insurance industry

- Q4: How your company encourages innovation

- Q5: The biggest obstacle to innovation within the insurance industry?

- Q6: The next innovation to impact the P/C insurance industry

- Q7: Your role in leading innovation.

- Q8: Best book you have read about innovation

- Q9: Describe a failed initiative at your company

- Q10: Collaborating with market competitors

- Q11: Can P/C insurers disrupt other industries?

Get all 16 interview neatly packaged in a single PDF download. Explore ideas by personality and by question. More than 60 pages of content.

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report