A simpler consumer buying experience for pay-per-mile auto insurance awaits customers of Metromile, a leading Insurtech that’s integrating Verisk’s LightSpeed® Auto in its sales flow to increase speed to bind and conversion rates while lowering acquisition costs.

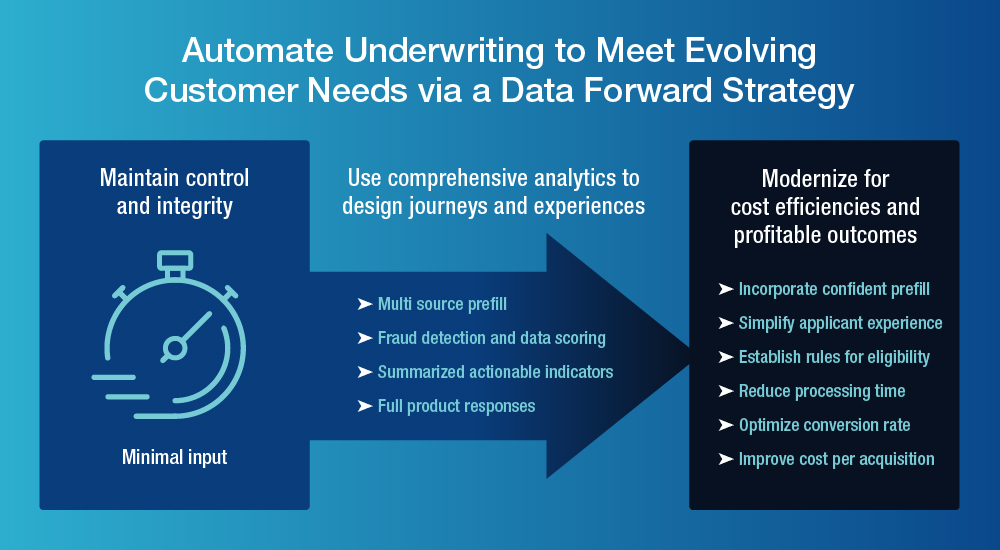

LightSpeed Auto is a digital underwriting platform that combines extensive data resources and groundbreaking predictive analytics from Verisk, a leading data analytics provider, to deliver superior results for auto insurers and their customers. Troy Dye, Metromile Senior Vice President, Growth, said, “With Verisk’s data-forward tools, we’ll be able to increase access so more drivers can get personalized coverage based on how much they drive.”

A Verisk study found that 89% of personal auto insurers accelerated digital transformation plans during the COVID-19 pandemic, a trend that will continue to be driven by consumer preferences. Many insurance customers value an expedited quote and an intuitive online application process. Verisk’s solution enables insurers to shorten application questionnaires and allows for more than 400 underwriting data elements to be delivered upfront at the point of quote, bringing key decision points further forward in the workflow.

Digital solutions eliminate hidden costs of outdated insurance models

In the past, many insurers evaluated service providers based on transactional costs and ordered data later in the quote workflow, often resulting in adjustments to initial quotes and unpleasant surprises for applicants. With LightSpeed Auto, underwriting attributes—including data on drivers, vehicles, coverages, licensing, violations and losses—can now be delivered in real time through a single transaction.

Speed and accuracy are critical for underwriting auto insurance in today’s rapidly evolving marketplace. By integrating with the Verisk data ecosystem, Metromile will have all of a policy applicant’s underwriting data and analytics on hand at the very beginning of the quote process, helping take a personalized and innovative customer experience to the next level.

Interested in developing innovative new solutions that can help you attain an edge? With LightSpeed Auto, Verisk believes modern insurers get the best of all worlds—fraud triggers that combat premium leakage, accuracy that enables precise business rules to be applied to each transaction, speed that boosts the customer experience and conversion rates, and scale that drives down cost per bind.

To learn more, explore Verisk’s LightSpeed Auto.

By: Jason Polayes

Jason Polayes, director of personal lines product management at Verisk, is responsible for product innovation and management strategies in the underwriting and point-of-sale space. Before joining Verisk, he had more than 15 years’ experience working at or with insurers in technology, innovation, process improvement, underwriting, and product management across auto, property, and small commercial lines of businesses, with a focus on new product development and profitable acquisition.

Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market