“Would you like fries with that?” was never meant to be a polite question to make sure that we were satisfied. It was meant as an upsell. It is a perfectly-timed, pressure-driven question that often gets a positive response. It was marketing in the moment. In today’s terminology, we might call it “soft-embedded,” opt-in marketing.

Insurers can take numerous cues from both retail point-of-purchase marketing and digital point-of-sale marketing. Food retailers, like DoorDash, currently do the upselling for their restaurants by asking, “Would you like to add a pint of ice cream from this store?” or UberEats might ask, “Would you like chips for just $2.99?” Brick and mortar retailers like Sephora utilize POP marketing as both in-store and online profit boosters, with messages like, “People also bought this…”

No matter which channels you currently utilize to market your products, these examples will always serve as reminders that good products are only as good as purposeful placement and good placement is only effective with good products. Products and placement must be synchronized in today’s digital world.

How and where your organization sells its products, however, is shifting. Keeping products and placement in synch will require flexible and expanded strategies. Some opportunities for key placement will need to be captured the moment they are recognized. To gain access to some of the most lucrative partnerships, insurers need to prepare to act quickly on opportunities that are presented. In today’s shifting markets, most insurers will encounter moments where they realize, “It’s now or never.”

Majesco and PIMA recently released a jointly authored report based on primary research with PIMA members, many of whom market through Affinity channels. Expanding Channels for Insurance: A Spectrum from Traditional to Affinity and Embedded will give you a current snapshot of channel options and which products seem to be marketed through which channels. The report highlights many of the “white space” opportunities for growth, and it discusses how to interpret trends in customer preference, digital capabilities, and newly-created channels.

In our last insurance channels article, we discussed the channel spectrum and how its expansion now requires a fresh look at digital capabilities that make embedded options more achievable than ever.

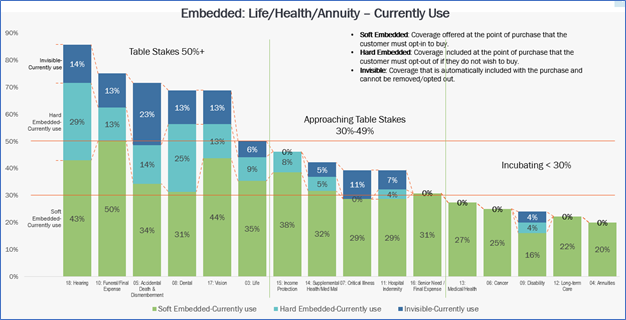

We defined levels of embedding as:

- Soft Embedded: Coverage offered at the point of purchase that the customer must opt-in to buy.

- Hard Embedded: Coverage included at the point of purchase that the customer must opt out of if they do not wish to buy.

- Invisible Embedded: Coverage that is automatically included with the purchase and cannot be removed/opted out.

Today, we focus on the L&AH product segment, an area that has been effectively marketed through affinity and multi-channels for decades. In many ways, affinity channels were the pioneers of all embedded options, so they are relevant to product placement discussions.

L&AH Products and Placement

How will L&AH insurers grow their market share? How do they reach a younger generation with different expectations and loyalties? Should they create new products, or should they try different product placement? Do they pursue both new products and new placements? Should they attempt to sell through their products with partnerships and embedded offerings?

There is so much change happening. Trying to manage that change as a fast follower is becoming increasingly difficult. You can’t do everything, but for some decisions, it’s now or never. Companies need to start prioritizing and asking themselves some crucial questions.

- Where are we going to place our bets strategically, not just to retain market presence but also to grow market presence with a shifting customer base?

- Which types of products, services, and experiences can we give our customers that are unique, provide value, and are available at the point of need?

To help answer these questions, Majesco and PIMA looked at which L&AH products were the most offered by the PIMA Community members surveyed.

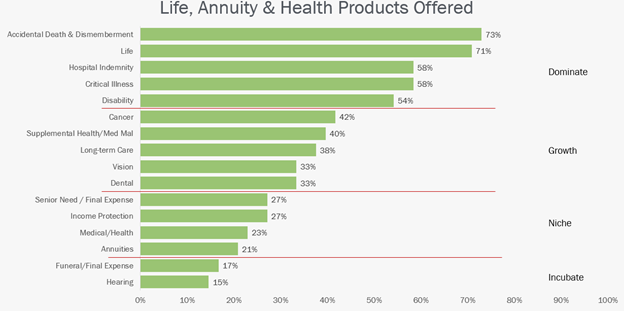

Surprisingly, there is already a very wide selection of products offered. Products were divided into four “adoption zones”: Dominate, Growth, Niche, and Incubate. Interestingly, there is a nearly even split in the number of products in the first four segments as shown in Figure 1.

While the Dominate segment highlights the most popular offerings, it also reflects the products with the most competition. The other segments, especially Niche and Incubate, represent “blue ocean” opportunities, especially if companies can take advantage of a broader, differentiated distribution channel strategy reflected in the channel spectrum.

These segments have L&AH products that are increasingly important to Boomers and Gen X as they move into retirement and want to retain insurance products they had as part of employment or to help them generate income in retirement. According to Pew Research, the COVID-19 recession and gradual labor market recovery have seen an increase in retirement among adults ages 55 and older. As of the third quarter of 2021, 50.3% of U.S. adults 55 and older said they were out of the labor force due to retirement. As a comparison of the acceleration of retirement, between 2008 and 2019, the retired population ages 55 and older grew by about 1 million retirees per year. In the past two years, the ranks of retirees 55 and older have grown by 3.5 million.[i]

Meeting the needs of this growing population who are retiring earlier offers significant growth opportunities, but only through distribution relationships they trust.

Figure 1: L&AH products offered by PIMA members surveyed

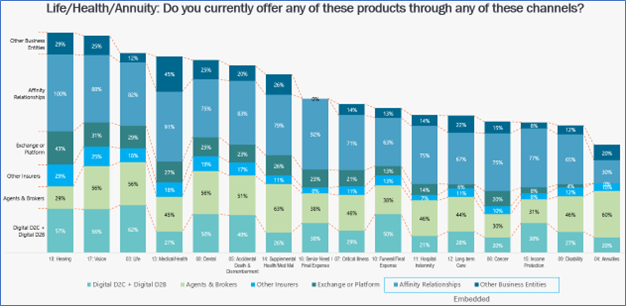

Figure 2 gives us a clear look at which channels are being used for each product. A pattern emerges here. Simpler products to administer, such as Hearing, Vision, and Life, are offered through more channels. Complex products requiring more information and specialized knowledge, like annuities, are offered through a smaller variety of channels. Not surprisingly, Agents and Brokers are the dominant channel for annuities.

Affinity relationships consistently have the highest use by most products, followed by Digital and Agents & Brokers across the L&AH segment. Exchanges and platforms likewise show consistent use of 20%-40% across most products, reflecting the growing use of these for purchasing insurance, particularly for health-related products that may be purchased during the purchase of medical insurance. Interestingly enough, Hearing and Vision are offered in more channels than Life (Dominate zone), even though they are not offered by many companies.

Figure 2: Channels used to distribute L&AH products

Soft Embedded options are consistently used for all products. When Hard and Invisible Embedded are added, three adoption zones emerge as represented in Figure 3. Nearly 70% of the products are Table Stakes (50%+) or Approaching Table Stakes (30-49%), reflecting a strong use of embedded overall. While Soft Embedded dominates, Hard Embedded has strong use with Hearing (29%) and Dental (25%), and Invisible Embedded is popular for Accidental Death & Dismemberment (23%).

Companies like Ladder Life, The Guarantors, and Bestow are examples of startups that are establishing embedded insurance partnerships to capture the market.

Figure 3: Embedded options used with L&AH products

L&AH Preferences and Possibilities

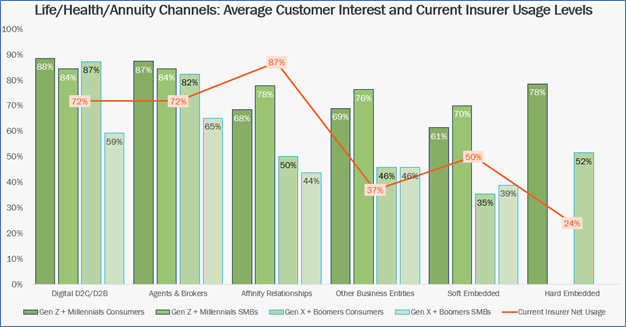

While there appears to be strong use of a range of channels, including embedded for L&AH, this segment still is not aligned with insurance customers – consumers and SMBs – when it comes to their channel spectrum preferences based on Majesco’s consumer and SMB research as reflected in Figure 4.

Gen Z & Millennial consumers’ and SMBs’ interest in Digital, Agents & Brokers, Other Business Entities, Soft Embedded, and Hard Embedded exceeds the level of use by L&AH insurers by up to 54%. This gap between customer expectations and what channels insurers use offers an opportunity to expand reach and drive growth into new channels, in particular embedded options.

Strategically, companies should ask themselves: What channels do I use in comparison to where customers want to buy? Should we redefine our channel strategy? How do we leverage new relationships to expand our reach? How do we differentiate by generational group?

Figure 4: Customer channel preferences for L&AH products compared to company channel usage

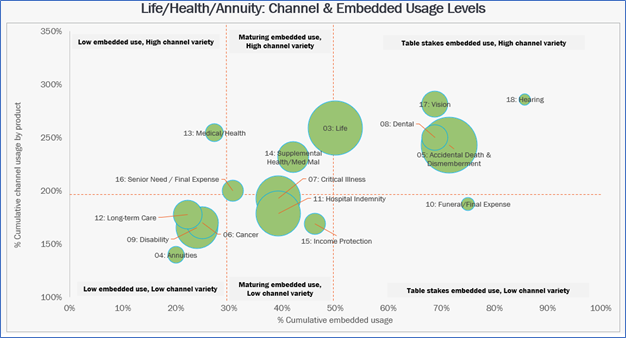

In analyzing the data, we looked at a combination of channel and embedded usage by L&AH products to identify potential market opportunities as reflected in Figure 5. The graphic reflects L&AH product offering popularity (the size of each circle), channel variety (the vertical axis), and use of embedded options (the horizontal axis). The result is four potential options for growth:

- Reach New Markets with Popular Products by Leveraging More of the Channel Spectrum

In the lower left and middle segments, Long Term Care, Cancer, Disability, Critical Illness, and Hospital Indemnity are offered by a large number of companies, but through too few channels, including embedded. Companies that offer these products or are considering offering them, can distinguish themselves from the competition and reach new customers by expanding channel options, including embedded.

- Expand Product Offerings in Less Crowded Spaces and Areas with Low Embedded Use

Income Protection, Senior Need/Final Expense, Medical/Health, and Supplemental Health/Med Mal are currently offered by relatively fewer companies. Those that do offer them are limited in using embedded. With the rise in retirees and the growth in Gig workers — there should be increased interest in some of these products, and an opportunity to gain market share by leveraging more channels and embedded options.

- Expand Product Offerings in Less Crowded Spaces

In the far right for mid to upper corner, Hearing, Vision, Dental and Funeral/Final Expense have strong embedded use and medium to high channel variety but are offered by relatively few companies. There is a growth opportunity for these products, given the high interest by generational groups. This would provide channel variety and embedded use that is at least as good or better than current offerings.

- Avoid Crowded Spaces

Life and Accidental Death & Dismemberment are high in all three dimensions: offered by many companies, use high channel variety, and are Table Stakes for embedded. While this suggests lower growth opportunities, the constant shifting of trusted and valued companies by customers offers new and innovative partnerships to grow market share. To do so, companies can develop and execute more effective embedded strategies that align with the changing lifestyles, preferences, and demographics of customers.

Figure 5: Market opportunities for L&AH products based on product popularity, channel variety and embedded usage

Is Modernization a Matter of Now or Never?

If L&AH products are increasingly out of synch with placement, and customer preferences aren’t matching up to insurer plans, how do insurers shift to capture new possibilities?

The answer is two-fold. Some insurers will require a new business model. Most insurers will require new technologies that support a new business model. The partnerships that will create new possibilities for insurers are based on foundational API-first architectures and always-on cloud infrastructures. Selling at the point of purchase requires split-second service and intuitive, data-driven suggestions that fit customers to products. Insurers would like to be able to say, “People like you also bought this…” or “Would you like to add hearing coverage for an additional $xx?”

The possibilities for new partners, however, are finite. There may always be partnership opportunities and there may always be new channels for product marketing, but today’s opportunities are greater than they will be in the future. That makes transformation an imperative. Because partnerships are being established today by your competitors. It may not be now or never, but the opportunities may certainly be greater now vs. lesser later — and that’s worth making a move.

For more information on products and channels across the full spectrum of insurance, including P&C, be sure to download the joint Majesco/PIMA report, Expanding Channels for Insurance: A Spectrum from Traditional to Affinity and Embedded.

By Denise Garth

[i] Fry, Richard, “Amid the pandemic, a rising share of older U.S. adults are now retired,” Pew Research Center, November 4, 2021, https://www.pewresearch.org/fact-tank/2021/11/04/amid-the-pandemic-a-rising-share-of-older-u-s-adults-are-now-retired/

Preparing for an AI Native Future

Preparing for an AI Native Future  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford