If you think your insurance technology job has been changing dramatically in the last three years, try working in Human Resources!

Working in today’s HR is kind of like trying to keep water in a colander. You attempt to keep valuable employees from quitting or retiring while at the same time hiring enough people to keep the colander full. You do this while trying to keep your employee population physically and mentally healthy, in addition to tracking their performance and benefits. You also deal with HR crisis situations, and you are responsible for upgrading HR technology to meet the increasing demands of HR management.

HR is so complex! Good HR execs need interpersonal skills, analytical expertise, and a generous dose of wisdom. They also need ways to increase their resilience because HR teams are suffering from burnout.

Needless to say, HR is stressed out.

It’s easy to see how we arrived here. From trying to set up remote operations during Covid, overseeing hybrid work situations now, fighting for talent, shifting employee demographics, and dealing with their own understaffed HR departments and an upgrade of their own technologies — there is too much to do and too little time in which to do it.[i]

Insurers now have an opportunity to relieve some of their customer stressors. How? Helping them with one of the most important issues related to employee retention and improving benefits packages. New types of workers are continuing to emerge, driving changes to product needs, eligibility, and offerings.

But this means that Group and Voluntary insurers must address one of their most impactful stressors … their operational model and technology foundation. It requires a focus on business transformation.

Transformation begins with listening.

Meeting today’s changing market need for benefits isn’t just a matter of simple conjecture or even market data. It requires an understanding around today’s real product, service, and technology issues. Where are the stress points? How can insurers transform to remove their own stress and customer stress?

At a recent roundtable discussion, Majesco and Capgemini listened to insurance executives as they discussed the challenges of new market dynamics in serving their Group & Voluntary insurance customers. They covered both internal and external issues. You can read the full report by downloading, Don’t Pull Back…Put the Pedal to the Metal for L&AH Transformation. In today’s blog, we will share insights from our conversations regarding issues such as:

- Market drivers

- Customer expectation gaps in a complex customer environment

- Product shifts (and employee expectations) that will require tech innovation

Each of these conversations resulted in lists of real, everyday issues that insurers and their customers face. These lists become the starting point for understanding how company stresses and customer stresses may actually be solved with solutions that meet the needs of both.

Layers of stress relieved by next-gen tech solutions

In 2023, we see cost-of-living challenges, rising medical expenses, lower disposable incomes, inflation, growing talent loss with projected retirements within the industry, the fight to acquire and keep new talent, and the challenge of legacy technology.

On the inside of the insurance enterprise…

…insurers compete in a post-COVID marketplace, where they are challenged with new employee expectations regarding work flexibility and the technology needed for their jobs. At the same time, long-tenured staff are retiring and taking crucial business knowledge with them, including about their operational processes, products, and legacy systems. The impact is new employees think differently and want digital technology to do their work.

On the outside of the enterprise…

Brokers are in dire need of new technologies, seeking solutions from insurers that make it easy to do business with them and technologies that provide a customer-centric view. Customers led by their HR teams are eager to embrace new technologies, products, and methods that will save them time and meet the growing employee diversity of needs and expectations.

Can insurers…

- improve their own business user experience,

- while their teams improve the broker experience,

- while the broker improves the employer experience,

- while the employer improves the employee experience?

“The younger talent, coming in through recruiters, ask for a digital profile of the company they’re applying for because they want to know what kind of technology they use. That’s a key point. The technology aspect of where we’ve been as an industry versus the expectations of new employees and associates coming in — there’s a big gap there.” – Roundtable Participant

One key and a growing layer of stress is the shifting demographics of insurer customers – both the business owner and their employees. The “traditional” Group & Voluntary Benefits SMB customers – Gen X and Boomers – that have been loyal for years, are now becoming more digitally savvy and demanding greater value from their insurance providers because of their changing employee demographics.

At the same time, there is an increasing dominance of SMB customers in the Gen Z and Millennial generation who are more in tune with today’s changing employee needs and expectations because they are one. With the fluid state of employment that is increasingly common for the younger generation and the rising retirement of the older generation — portability, personalization, new products, and flexibility of benefits has become imperative in the competition for talent to meet employee expectations.

But legacy technology, legacy sales, and enrollment methods can’t meet the shifting employee, broker, and customer demands.

Insurers can improve their ability to grow, make capital more efficient, and reduce costs while meeting growing customer expectations along with new risk and product demands. It will require insurers to rethink their business strategy, including their operational model and technology platform, but that’s the kind of rethinking that will maximize results.

Stressors require a shift from product to customer focus.

Until more recently, the Group and Voluntary business have been product- and broker-centric, depending on the broker to meet the needs of the customer with the right products and plans. But that does not work for all customers – particularly smaller ones who may not have access to a broker. If insurers shift from a product to a customer focus, they receive a fringe benefit — a better understanding of customer needs and expectations that can be invaluable.

In today’s L&AH market, both group and individual, customers want to do business when, where, and how they want. A customer-first focus is far more difficult to achieve because of the breadth of customer types and demographics insurers are attempting to serve.

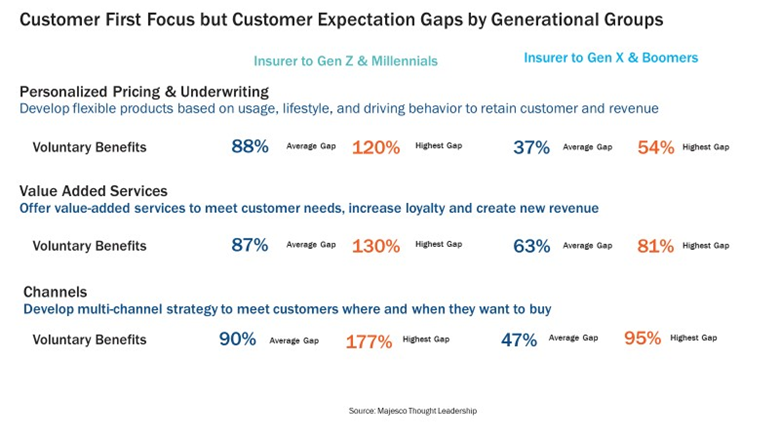

Employers need to be able to appeal to four vastly different generations in the workplace, which requires the right mix of products within benefit plans. Coverage gaps for personalized products and value-added services within a benefit plan (see Figure 1) cannot be closed without the development of and delivery of new products that meet the needs of the younger generations. Employers need the right benefits package to attract and retain talent across multiple generational and demographic groups. It is complex and getting more so.

Figure 1

This same scenario, from the carrier perspective, is similar, but more technology-based. As Baby Boomers and some Millennials are retiring in growing numbers, recruiting has become a major issue. Younger generations expect to use next-gen technology in their jobs – whether as an IT or business person. If not, many do not come or literally leave within a few weeks of joining. The younger generation has no desire, nor incentive to work on antiquated technology.

“It proved to be really challenging to get those Gen Z’s and the millennials up to speed on our tech and our process.” – Roundtable Participant

Solving these generational problems within insurers will ultimately help solve the challenges they have in filling the product, experience, and channel gaps for their customers – both the employer and their employees. It will be a huge step in becoming truly customer-centric and meeting the needs of product and digital experiences.

How does your product lower EVERYONE’s stress?

It’s interesting. If an insurer redefines “product,” to be all-inclusive of the risk product, value-added services, and the customer experience, then they instantly become a customer-focused and not a product-focused company. Suddenly, products become the tools that will enhance experiences and add value to life and work.

The voluntary benefits market must provide these kinds of value-driven products with the increasing shift in cost responsibility from employer to employee for most nonmedical, health-related insurance products and the demand for newer products that align with different needs. However, most of today’s products remain mostly traditional — focused on life, accident, disability, medical, dental, and A&H, lacking innovation and answers for new needs and expectations, particularly for Millennials and Gen Z.

Customers are expecting more niche, personalized products, services, and experiences that align with their specific needs, risks, lifestyles, and behaviors. From an increased interest in life, critical illness, and disability insurance, to portability, student loan repayment, pet insurance, or gig employee on-demand insurance, today’s customers expect a wider variety of insurance products offered in benefit plans.

“… you can’t compete on salary alone. Benefit packages have now become more and more robust, and we’re adding in things like pet insurance or travel and wellness, and mortgage insurance. We’re looking at student loan repayment and caregiver support. And it’s not even just about the product anymore. It’s also about services. The coaching, wellness, and assistance, — financial assistance and how to retire, [teaching] employees how to think about retirement and investment.” – Roundtable Participant

Insurers who offer new options in addition to traditional products have an opportunity to meet the broadening diversity of customers with increased sales and the ability to grow the relationship as they evolve along their employment and life journey. This includes going beyond the traditional L&AH products to expand into P&C products like auto and homeowners’ insurance, and pet or travel insurance. Developing or partnering with other insurers to offer the products demanded by changing employee demographics is more important than ever for both the insurer and their customer the employer.

Savvy, innovative companies are redefining insurance from an outside-in perspective to adapt to what customers – of any generation — want and expect, instead of following the generations-long practice of an inside-out perspective that requires customers to adapt to the way insurance works.

Part of the innovation involves improving experiences without adding dramatically to employer and employee benefits costs. In some cases, that means expanding purchase channels or guiding employees to select the products using AI-driven capabilities that are most relevant to them, their demographics, and their lifestyles. It means using technology to drive efficiencies and effectiveness and truly innovating with new products.

“HR budgets are not growing; they’re shrinking in many cases. We’re seeing lots of pricing pressures on the dental plans, vision, hearing, and student loan repayment plans. A lot of employers are saying, “Listen, I’m going to put a basic healthcare cost in some of the first initial ancillary benefits and then I’m going to cut the employee a check. I just need a platform that says, ‘Pick from one of these 10-12 things that are meaningful to you and relevant to you.” This is forcing us to think about different benefits, different partnerships we need. Do you go in with another carrier who’s got a different offering and approach?” – Roundtable Participant

The transformation that will relieve the pressures upon all stakeholders is dependent upon next-gen intelligent core solutions and digital technologies as a new foundation for a new era of group and voluntary benefits. These solutions have a different architecture, one based on the native cloud. APIs, Microservices & containerization, headless, and most importantly embedded analytics with BI, AI/ML, and Generative AI. These solutions enable insurers to think big, act fast, create quickly, and innovate when ideas and partnerships arise.

“We have to be willing to change so that we can take full advantage of the technology without customizing it so that we don’t continue to bear those costs of customization and we can deploy our people to our customers and let our products stand on their own. What’s most important are the people that we serve and how we serve them.” – Roundtable Participant

Of course, there is more to transformation than just technology change. It requires forward-thinking leadership and a culture that is willing to change. Majesco and Capgemini have been jointly leading these kinds of transformation efforts, with great results, positioning Group & Voluntary Benefits insurers for a successful future.

“I was aware of the partnership before I got here (to Capgemini), said Samantha Chow, Capgemini, Life and Annuity Sector Leader. “It is a pretty strong relationship out there in the industry, that Majesco and Capgemini have had. And not just on the systems, integration, and alliances side, but on that strategic partnership, supporting the life and benefits industry, with a focus on legacy modernization and claims, and how they can better fit the needs of our evolving customers.” – Samantha Chow, Capgemini, Life and Annuity Sector Leader

The time is right for Group & Voluntary leaders to make those decisions and step into this new era of benefits with the tools to make opportunities into profits. Majesco’s L&AH Intelligent Core, Majesco Global IQX Sales & Underwriting Workbench, Digital Enroll360 for L&AH, and ClaimVantage Connect360 for L&AH provide insurers with the next-gen cloud platforms they need to make the correct decisions on positioning their organization for success.

For a deeper look at executive opinions and more ideas about capturing the Group & Voluntary market, be sure to read the Majesco/Capgemini thought-leadership report, Don’t Pull Back…Put the Pedal to the Metal for L&AH Transformation today.

Today’s blog is co-authored by Denise Garth, Chief Strategy Officer at Majesco, and Kelly Reisling, Senior Director, Capgemini

[i] Ladika, Susan, Burnout Is a Problem for HR Professionals, HR Magazine, March 14, 2022

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash