2020 has already brought devastating wildfires to the western U.S. and is on pace to be among the most destructive years in terms of acres burned in recent history. As the U.S. population increases and residential development extends farther from metro areas, more homes and businesses will face the threat of wildfires.

This threat comes as the novel coronavirus (COVID-19) pandemic continues to sweep the globe, causing new roadblocks and challenges in all facets of life — wildfire preparation and response included.

For insurers, understanding risk at a granular level is paramount to adequately protecting homeowners—and supporting them at the first notice of loss. For homeowners, it is critical to work hand-in-hand with insurers to understand the financial implications of a given degree of risk and exposure. When communities work together to take steps in mitigating risk, these do have a significant impact on keeping homes, businesses and families safe.

This year’s annual CoreLogic Wildfire Risk report finds 1,975,116 homes in the United States with an associated reconstruction cost of more than $638 billion at elevated risk of wildfire damage. These homes are comprised of approximately 6.5% of the total number of single-family residences in these states.

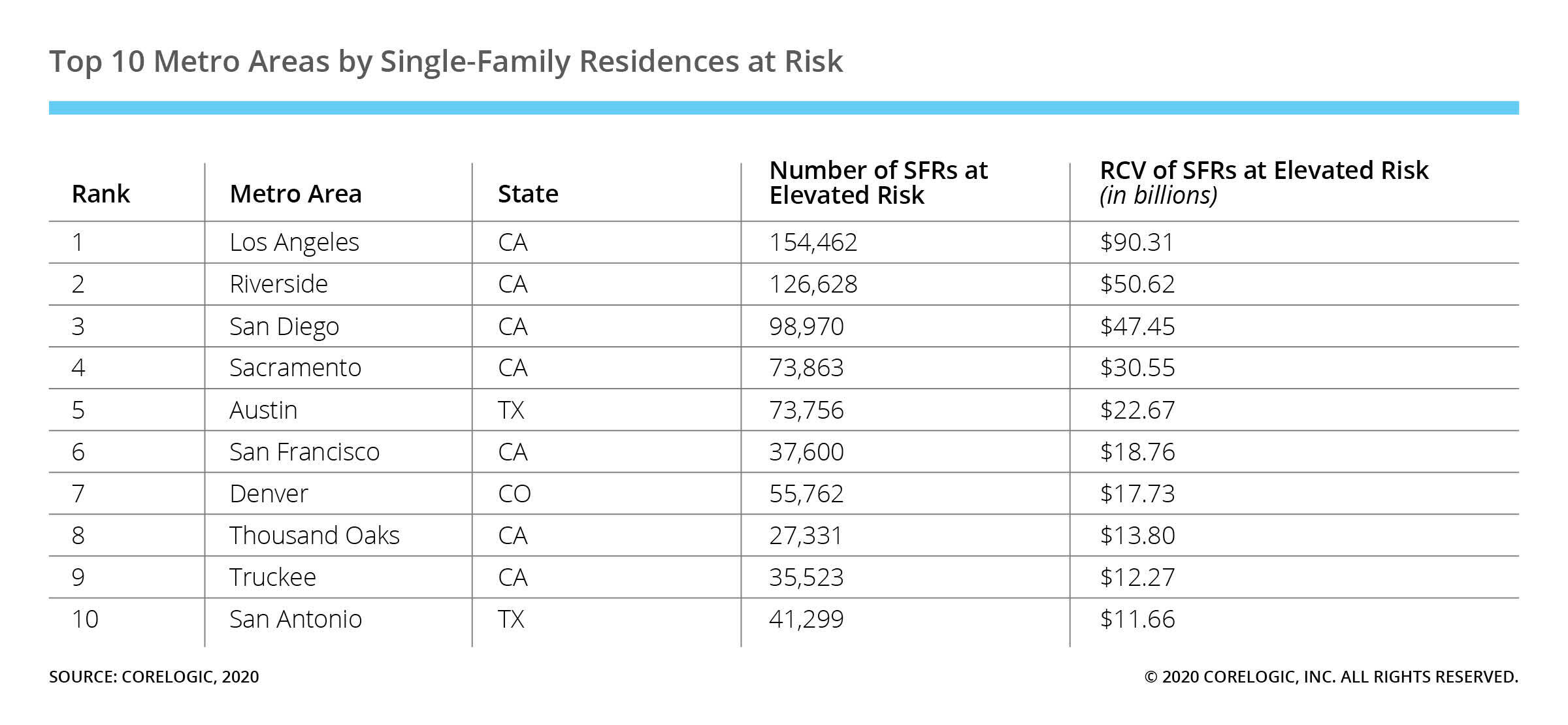

On a metro level, the Los Angeles metro area tops the list with the greatest single-family residences at wildfire risk, followed shortly thereafter by the Riverside and San Diego metro areas. California is home to 76% of these residences on the top 10 list—but the reconstruction cost value of these homes comprise nearly 84% of the list.

Download the full report to explore the wildfire analysis from CoreLogic.

What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll