Just a few days into earnings season for the third quarter, a number of carriers have published loss estimates for insurance claims from Hurricane Ian, or prewarned investors about loss figures that will dent their bottom lines.

A recap of individual company estimates, net of reinsurance, summing to over $7.5 billion as if Oct. 20 is presented below. (Editor’s Note: After the table was compiled, Munich Re disclosed its estimate of $1.6 billion which is not included.)

Hurricane Ian Loss Estimates By Carrier ($ Millions)

* Range of net losses provided by company; CM used the midpoint

** Includes catastrophes other than Ian, U.S. convective storms, Typhoon Nanmadol and the June French hailstorms.

Note: Loss figure of $2.6 billion used for Citizens assumes no reinsurance recoveries

Only a handful of these firms reported both gross and net of reinsurance loss estimates. The difference between gross and net losses for those carriers, or ceded losses, amount to $3 billion from: United Insurance Holdings Corp., $1 billion; Progressive Corp., $1.985 billion; Heritage Insurance Holdings, $550 million; Allstate, $671 million.

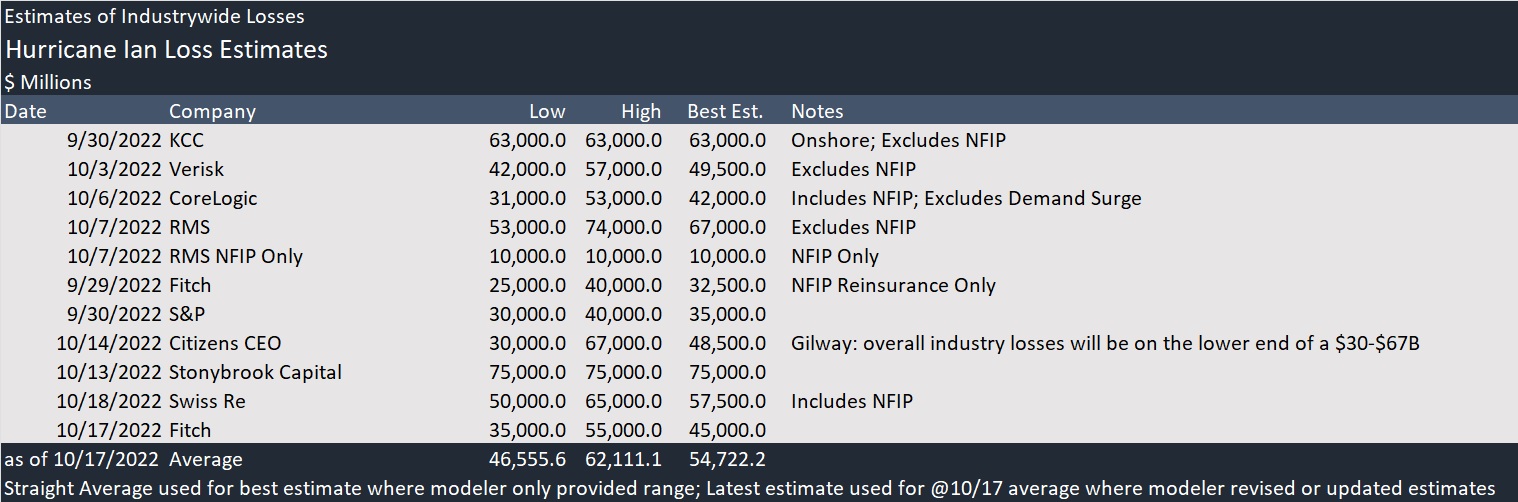

Adding the $3 billion in ceded losses lifts the total to $10.5 billion—a figure that is less than 20 percent of the industrywide estimates that modelers and rating agencies have published in recent weeks, averaging around $55 billion (Chart at the bottom of this article. $55 billion is the straight average of all modelers’ estimates; median estimate is roughly $50 billion.)

Separately, on Wednesday, Gallagher Re published a “Hurricane Assessment,” with various facts and figures about the storm, stating that the total financial cost from Ian is anticipated to result in total economic losses approaching or exceeding $100 billion. Included in the $100 billion are direct physical damage losses, direct non-physical financial loss, and net-loss business interruption, Gallagher Re said. According to the report, the total was derived from publicly available insured loss estimates from various catastrophe model vendors and initial loss data published by Florida’s Office of Insurance Regulation.

“This would make Ian not only one of the costliest U.S. hurricanes on record, but one of the costliest U.S. natural hazard events regardless of peril,” the report said.

As for the insurance portion of the economic losses, Gallagher Re said only that private and public insurance entities are facing claims payouts reaching well into the “tens of billions,” without providing a more precise estimate. “This would place Ian among the costliest natural catastrophe events ever recorded for the insurance industry,” the report said, stating that 2005’s Hurricane Katrina is the costliest at $96 billion (inflation-adjusted, including NFIP).

“Hurricane Ian will be remembered as Southwest Florida’s ‘Andrew.’ The widespread and substantial damage across the hardest-hit areas were marked by regionally historic storm surge, high winds, and inland flooding which will lead to high loss costs for the insurance industry and beyond,” commented Steve Bowen, Chief Science Officer, Gallagher Re.

“If not for numerous examples of building code success stories with newer constructed properties, the financial toll may have been even higher. While we cannot fully eliminate physical catastrophe risk, Ian proved that we can make meaningful steps to greatly reduce it,” he said.

A team of Gallagher Re scientists and engineers traveled to Florida during the first week of October 2022 to assess damage, offering these additional takeaways from their damage survey:

- Ian tied for fifth strongest U.S. mainland hurricane landfall on record with 150 mph winds

- Wind damage in Southwest Florida was extensive though newer construction showed limited impacts

- Newer metal and tile roofs, despite a higher purchase cost than asphalt shingles, were prevalent in Southwest Fla.

- Expansive storm surge damage (>15 feet) caused considerable impacts on the coast; tracked 0.4 miles inland

- There were heavy losses to coastal commercial exposure, automobiles, boats, and other marine interests

- Inland flooding left considerable damage from DeSoto to Lake Counties in Florida

Like Gallagher Re, Impact Forecasting, Aon’s catastrophe model development team listed North America’s losses from Hurricane Ian in the “10s of billions” when they were tallying global economic losses from all third-quarter natural disaster events at $227 billion. In the report titled “Q3 Global Catastrophe Recap—October 2022,” Aon said that $99 billion of that $227 billion was covered by public and private insurers, which means that insured losses will surpass $100 billion for the third year in a row.

Anticipated insured losses from Hurricane Ian constitute a significant portion of global insured losses, making tropical cyclone as the costliest peril for the insurance industry this year, said Aon, noting that U.S. losses now take up more than 70 percent of the total insured losses year-to-date.

On Monday, Fitch updated the rating agency’s earlier estimates of insurance losses from Hurricane Ian, now putting the range at $35-$55 billion. Earlier this month, Fitch had estimated a range of $25-$40 billion.

The main point of the Fitch report, however, was not the updated estimates. Instead, the rating agency called attention to the fact that reinsurers may face less supports from insurance-linked securities investors, who have been helping them manage risk, because Hurricane Ian losses will test the appetites of ILS investors.

Grouping catastrophe bonds, collateral reinsurance, sidecars and industry loss warranties under the ILS definition, Fitch said these represent around 20 percent, or $100 billion, of global reinsurance capacity, with cat bonds making up roughly 30 percent of the ILS market.

Since 2017, as a result of insured losses from Hurricanes Harvey, Irma and Maria, the number of cat bonds not returning full principal to investors totals 55 individual tranches with either a full or partial loss to investors, Fitch said, noting that this compares to 75 tranches in totality since 1990.

Nearly a third, roughly $10 billion, of outstanding cat bonds have some exposure to Florida wind damage. ILS investments exclusively or predominantly exposed to Florida wind or the southeast region and Hurricane Ian are $2.9 billion, Fitch said, concluding that without proper compensation, investors will look elsewhere.

Hurricane Ian Industrywide Loss Estimates ($ Millions)

| Date | Company | Low | High | Best Est. | Article Link | Notes | ||||||||||

| 9/30/2022 | KCC | 63,000.0 | 63,000.0 | 63,000.0 | KCC Estimates Near $63B in Hurricane Ian Insured Losses (insurancejournal.com) | Onshore; Excludes NFIP | ||||||||||

| 10/3/2022 | Verisk | 42,000.0 | 57,000.0 | 49,500.0 | Verisk: Up to $57B Insured Losses from Hurricane Ian (insurancejournal.com) | Excludes NFIP | ||||||||||

| 10/6/2022 | CoreLogic | 31,000.0 | 53,000.0 | 42,000.0 | Insured Damages From Hurricane Ian $31-$53B: CoreLogic (insurancejournal.com) | Includes NFIP; Excludes Demand Surge | ||||||||||

| 10/7/2022 | RMS | 53,000.0 | 74,000.0 | 67,000.0 | New and Revised Ian Loss Estimates, Images of Property Damage Published (carriermanagement.com) | Excludes NFIP | ||||||||||

| 10/7/2022 | RMS NFIP Only | 10,000.0 | 10,000.0 | 10,000.0 | RMS Range of Insured Losses From Ian $53-$74B, ‘Best Estimate’ of $67B (insurancejournal.com) | NFIP Only | ||||||||||

| 9/29/2022 | Fitch | 25,000.0 | 40,000.0 | 32,500.0 | Unrated Insurers at Risk From Ian; Reinsurers Impacted: Fitch (carriermanagement.com) | NFIP Reinsurance Only | ||||||||||

| 9/30/2022 | S&P | 30,000.0 | 40,000.0 | 35,000.0 | Ian Insured Loss Estimates Rise: New High Over $60B (carriermanagement.com) | |||||||||||

| 10/14/2022 | Citizens CEO | 30,000.0 | 67,000.0 | 48,500.0 | Information provided via email | Gilway: overall industry losses will be on the lower end of a $30-$67B | ||||||||||

| 10/13/2022 | Stonybrook Capital | 75,000.0 | 75,000.0 | 75,000.0 | Stonybrook Capital Says Hurricane Ian Is Largest-Ever Insured Loss Event at Over $75B (insurancejournal.com) | |||||||||||

| 10/18/2022 | Swiss Re | 50,000.0 | 65,000.0 | 57,500.0 | Swiss Re Expects Hurricane Ian Claims to Bring Q3 Loss (carriermanagement.com) | Includes NFIP | ||||||||||

| 10/17/2022 | Fitch | 35,000.0 | 55,000.0 | 45,000.0 | This article | |||||||||||

| as of 10/17/2022 | Average | 46,555.6 | 62,111.1 | 54,722.2 | ||||||||||||

Chart Notes: Straight Average used for best estimate where modeler only provided a range; Latest estimate used of overall average of all modelers where company revised or updated estimates

CM and IJ staff reports. Aon report summarized by Insurance Journal’s L.S. Howard

Five AI Trends Reshaping Insurance in 2026

Five AI Trends Reshaping Insurance in 2026  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll