Insurer Progressive incurred nearly $2.0 billion in gross loss and loss adjustment expenses for vehicle and property claims related to Hurricane Ian, sending over $1 billion of the total to reinsurers, the company reported Thursday.

In an earnings announcement disclosing financial results for the month of September and for the quarter ended Sept. 30, the insurer said it retained net catastrophe losses of $760 million—with the bulk of the amount attributable to $585 million of incurred but not reported vehicle claims. Unbundling the reported results further reveals that another $175 million of net property losses also hit Progressive’s books, along with$25 million allocated loss adjustment expenses—or $200 million in total net property loss and ALAE.

Prior to consideration of cessions to reinsurers, Progressive estimated that property loss and ALAE totaled $1.4 billion (making the ceded property loss and ALAE total about $1.2 billion).

Progressive said the $760 million in net losses across all lines added 19.6 points to the September loss ratio, which stood at 97.2. Although the September combined ratio came in a 116.2, for the entire third quarter Progressive reported a 99.2 combined ratio, down 1.2 points from 100.4 in third-quarter 2021.

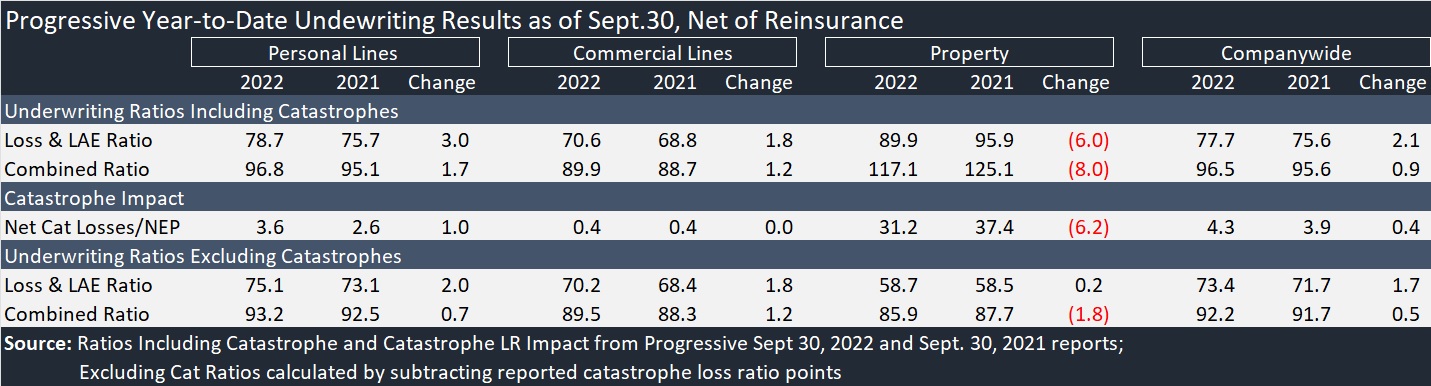

The earnings report did not break down the quarter’s results by line of business, but did provide separate tallies of results through nine months for Progressive’s personal lines (auto and recreational vehicles) commercial lines (commercial transportation and small business) and property (residential property) business segments.

Although Progressive has been aggressively increasing auto insurance rates since late last year, the year-to-date personal lines loss ratio, excluding catastrophes, increased 2.0 points over the comparable loss ratio for the same period in 2021.

Personal lines net written premiums grew 6 percent for the nine-month period compared to 2021, and the combined ratio (including catastrophes), at 96.8, is close to the carrier’s targeted level of 96.0. Net income was negative for the nine-month period, with the carrier reporting a net loss of just over $100 million on the bottom line.

For the third quarter, net written premiums grew 9 percent across all lines to $12.3 billion, and net income jumped 5 percent to $124.1 million in spite of flat premium growth for the month of September and red ink on the bottom line for September–a net loss of $684.4 million.

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage