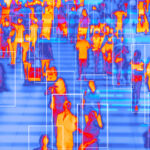

Sensor technology is no longer an emerging technology in commercial property/casualty insurance. It has emerged—and is rapidly growing, according to executives who bring the Internet of Things technology applications to carriers and their customers.

Executive Summary

"2021 is a year where we don't refer to IoT as this emerging technology for insurance. It's just a technology that's a part of insurance," Gordon Hui, an executive of Munich Re's Hartford Steam Boiler, told a virtual audience at a spring InsurTech conference. Hui and other participants in the IoT space discuss the benefits of sensor technology and the hurdles they're overcoming to strategically position their firms to take advantage of explosive growth in the space.Still, the issue of figuring out who pays for the technology—carrier or commercial insured—is one hurdle that potential users are still working through, Alex Schwarzkopf, chief executive officer and founder of Pillar Technologies, said during the InsurTech Spring Conference 2021, co-hosted by InsurTech NY and InsurTech Hartford in early March.

“It’s a dance,” said Schwarzkopf of Pillar, an InsurTech that collects data from sensors monitoring environmental conditions at construction sites and completed properties. “We’re definitely sitting there asking, ‘How do we grease the skids?'” he said, going on to explain to panel moderator Charlie Sidoti how he talks through the value of IoT with both sides to smooth the relationships when the payment questions are on the table. (Article continues below)