State Farm General Insurance revealed that it has asked the California Department of Insurance to approve an “interim emergency” homeowners insurance rate hike, citing declining capital and a potential downgrade as reasons.

State Farm General Insurance Company, the State Farm provider of homeowners insurance in California, is seeking interim emergency rate increases averaging 22 percent for non-tenant homeowners insurance and 15 percent for tenants to try to shore up its financial condition as it works to pay out claims related to the 2025 California wildfires.

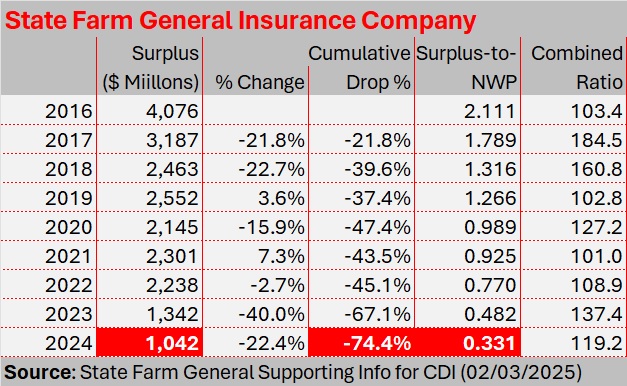

“Although reinsurance will assist us in paying what we owe to customers, the costs of these fires will further deplete capital,” the company said, referring to the fact that a 40 percent drop in capital in 2023 prompted AM Best to downgrade the company’s previous financial strength rating of “A” (fair) down to a “B (excellent)” in March 2024, and its long-term issuer credit rating to “bb+” (fair) from “a” (excellent).

Related article: AM Best Downgrades State Farm General Ratings (March 2024)

“If that were to happen, customers with a mortgage might not be able to use State Farm General Insurance as collateral backing for their mortgage,” the company said in a letter to CDI Commissioner Ricardo Lara, referring to the possibility of another downgrade with capital down another 22 percent in 2024, and wildfire claims now wiping more capital away in 2025.

Suggesting an overall market impact from the difficulties of the largest writer of homeowners in the state, the letter added: “With nearly three million policies in force, including more than one million homeowners customers, SFG [State Farm General] needs your urgent assistance in the form of emergency interim approval of additional rate to help avert a dire situation for our customers and the insurance market in the state of California.”

Contacted by Carrier Management, an AM Best representative was not able to disclose any information about any possible future rating action. Since the previous credit report, however, the outlook for the financial strength rating has remained stable while the long-term ICR outlook is negative.

“The continuation of the negative outlook on the long-term ICR reflects the uncertainty of the company’s ability to stabilize and strengthen its risk-adjusted capitalization given ongoing challenges regarding profitability and internal capital generation, trending adverse reserve development occurring on prior accident years, and the challenging regulatory environment within California’s marketplace that have constrained the ability of State Farm General (as well as its industry peers) to increase premium rates in a timely fashion,” AM Best said in the March 2024 rating announcement.

The most recent AM Best credit report notes that current AM Best ratings could be negatively impacted:

- If risk-adjusted capitalization were to weaken significantly, especially due to adverse reserve development, catastrophic events, or other significant underwriting losses.

- If the company’s business profile, with recent challenges in the California market, impacts its strategic importance to the parent company, State Farm Mutual Automobile Insurance Company.

- If AM Best’s perspective of State Farm Mutual’s ability and willingness to provide explicit or implicit support were to diminish.

State Farm General’s Feb. 3, 2025, letter to Commissioner Lara, signed by Dan Krause, president and chief executive officer of State Farm General Insurance Company, as well as the treasurer and general counsel of the company, focuses on the first possibility.

The letter and a supporting document summarizing key financial information note that policyholders surplus at the end of 2024 was already one-quarter of what it was at year-end 2016—and half of what it was at year-end 2022. That puts the premium-to-surplus ratio above the 3-to-1 threshold of the Insurance Regulatory Information Systems (IRIS) manual.

In addition, the company already failed to meet the risk-based capital requirements prescribed by the National Association of Insurance Commissioners in 2023, with its RBC ratio triggering a “company action level event,” requiring it to file a plan for corrective action with the Illinois Department of Insurance (the company’s domestic financial solvency regulator). The company will likely have to file another plan based on deteriorating surplus in 2024—and net losses from the January 2025 wildfires and related FAIR Plan losses will add to the strain, the supporting document says.

The letter and the supporting document also report that State Farm General has recorded $5.3 billion of underwriting losses between 2016 and 2024—a cumulative combined ratio of 125.7. “While this underwriting loss was partially offset by investment income, SFG’s after-tax net loss totals $2.8 billion over this same nine-year period.”

Reinsurance and Pending Rate Changes

As for the extent to which reinsurance will help State Farm General deal with this year’s wildfire losses, the executives note in the letter that State Farm Mutual is the primary reinsurer of a “prudently robust reinsurance program,” but that State Farm General’s “already stressed financial position will be further weakened, even after accounting for billions of dollars in anticipated [reinsurance] recoveries…”

“External reinsurer capacity to underwrite significantly greater portions of SFG’s massive risk portfolio at a reasonable price (or possibly, at any price) does not exist,” the letter continues.

“These fires reinforce why reinsurance is a critically important part of SFG’s claims-paying capacity, now and into the future, allowing SFG to write or retain significantly more property insurance in areas with significant risk such as wildfires than would otherwise be possible. The situation also reinforces SFG’s absolute disagreement with any characterization that its payments for necessary reinsurance are in any way inflated or that SFG may have ‘engineered’ its weakened financial condition,” the letter says, calling such assertions “irresponsible and simply not true,” without attributing them to any particular party.

The letter also refers to the “limited success” that State Farm General has had with its attempts to raise rates and restrict growth in recent years “in order to keep our risk profile in line with available surplus.” The efforts, the letter states, “were constrained by regulatory considerations.”

“This was due in no small part to intervenors in the rate review process, whose very efforts to delay and decrease needed rate adjustments prevented SFG from maintaining a capital position supportive of its risk profile and impaired its ability to support continued underwriting of California properties,” the letter says.

In California, so-called “intervenors are empowered to represent the interests of the public by a decades-old law, Proposition 103.

Since late June 2024, State Farm General has had three pending rate actions on file with the insurance department—a 30 percent rate increase for its homeowners line, a 52 percent rate increase for renters and 36 percent rate increase for condo coverage.

Related article: State Farm Seeks Large California Rate Hikes; CDI To Probe Financial State

Now, the company is requesting the smaller amounts of emergency rate hikes, to be effective May 1—ahead of any intervenor hearing or three-way settlement process—in order to “start rebuilding its risk-bearing capacity.” According to the letter, 17 months elapsed between a hearing notice and final rate order the last time the company was involved in such a hearing.

The company proposes that the CDI can subsequently determine a final approved rate after a future hearing (if no settlement is reached first), with refunds to be forthcoming from State Farm General in the event that rates lower than the emergency increases are ultimately approved.

Separately, Consumer Watchdog issued a media statement identifying the consumer group as the party alleging that State Farm General is overpaying for reinsurance and engineering a solvency crisis. The consumer group rejects the insurer’s report of significant net underwriting losses, countering that State Farm General had direct underwriting profits from homeowners insurance of $1.4 billion between 2020 and 2023.

In an earlier statement about the pending filings from last June, the consumer group stated that any California underwriting losses in recent years came from State Farm General’s commercial and liability policies, not homeowners.

(Editor’s Note: The Feb. 3, 2025, letter from State Farm General executives to Commissioner Lara does not address this. A statement accompanying the supporting financial information, however, identifies State Farm General as “almost exclusively a California insurer, with homeowners insurance being the largest line of business.”)

Noting that State Farm General buys its reinsurance primarily from the parent company, Consumer Watchdog reports that from 2014 to 2023, State Farm General paid reinsurance premiums of nearly $2.2 billion but was only reimbursed $0.4 billion. “A reinsurance return that low is a strong indication that the company is overpaying.”

“If State Farm [General] needs money, the parent company should step in with its $130 billion surplus, not California homeowners, some of whose homes are in ashes,” said Carmen Balber, executive director of Consumer Watchdog, in the media statement, which also notes that State Farm Mutual stepped in to help a Texas subsidiary in the past.

Consumer Watchdog’s earlier statement about the pending 30 percent rate increase for homeowners notes that State Farm General has acknowledged that “under the standard regulatory ratemaking formula that requires insurance companies to set rates based on reasonable projections of future losses, the company would be required to reduce its rates by at least 9.2 percent.” Two footnotes in the Feb. 3, 2025, letter to Commissioner Lara appear to address this, noting that the 30 percent rate indication adds a “solvency-related adjustment” to “what is otherwise the maximum permitted premium under the rate regulations.”

“Because of the upward impact of the Los Angeles fires on the maximum permitted premium, it’s possible that SFG’s rate increases for some lines may ultimately be supportable without [this adjustment], but the financial condition that led to its invocation has only worsened,” the first footnote says.

The second footnote offers a table with the rate indications from the prior filing without the solvency adjustment—including a 10 percent reduction for homeowners—and recalculates the indicated rate change for a May 1, 2025, effective date that includes a new catastrophe provision incorporating wildfire loss estimates up through the most recent fires. The new indication is a 21.8 percent increase, rounded to 22 percent.

Nonrenewals Paused

To date, State Farm General Insurance has received more than 8,700 claims for the Palisades and Eaton wildfires and has already paid over $1 billion to customers, the company reported.

As of Feb. 14, State Farm received around 11,400 total home and auto claims and had put more than $1.35 billion in advance payments back into customers’ hands, the company said on its website. Additionally, State Farm said that it made successful voice-to-voice contact with approximately 98 percent of customers who had filed homeowner claims.

Last year, just about a week before AM Best announced its downgrade, State Farm announced that State Farm General would nonrenew roughly 30,000 homeowners, rental dwelling and other property insurance policies (residential community association and business owners) starting in July and that the California subsidiary would also withdraw from offering commercial apartment policies (with the nonrenewal of all of those approximately 42,000 apartment policies, beginning Aug. 20, 2024).

Last month, State Farm announced that it would comply with a CDI order to halt any pending nonrenewals. “Homeowner policies impacted by the fires that were on the books on Jan. 7 will have an option to renew with State Farm for another policy term,” the company said.

Related Article: State Farm Pausing Nonrenewals in Compliance With CDI Notice

On Jan. 9, Commissioner Lara announced an order putting a mandatory one-year moratorium on insurance nonrenewals and cancellations. The order shields those within the perimeters or adjoining ZIP Codes of the Palisades and Eaton fires regardless of whether they suffered a loss.

In conjunction with the order, Commissioner Lara also issued a Notice calling on all admitted and nonadmitted insurers writing residential property insurance in California to stop any pending nonrenewals or cancellations for properties located near wildfires in order to help policyholders that were not already protected by the mandatory moratorium.

“This includes nonrenewals issued up to 90 days prior to January 7, but taking effect after the start of the wildfires. This pause on nonrenewing and cancelling policies would last six months as impacted communities begin the recovery process,” Lara said in the Jan. 9 media statement.

Photos: State Farm Media

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report