Although property/casualty insurance carrier executives and technical professionals remain bullish on the prospect that advanced analytics can enhance growth and bottom-line performance, implementation progress has been slower than expected, according to a recent survey.

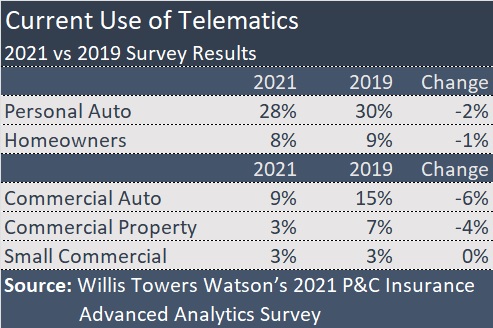

In addition, one particular area—analytics associated with telematics data—has become less attractive, based on responses to Willis Towers Watson’s 2021 P&C Insurance Advanced Analytics Survey, compared with a similar survey conducted in 2019.

As indicated in the chart above, the survey showed that carriers’ use of telematics data has slightly declined since 2019. This may be because the earliest and strongest adopters of telematics propositions “have taken off some of the sheen and attractiveness of the potential opportunities” for those that delayed, representatives of Willis Tower Watson speculated in a media statement about the survey report.

“Equally, companies may feel there are less complex advanced analytics targets and benefits for them to pursue,” the statement said.

Nearly 70 percent of those surveyed named the cost-benefit tradeoff as the main barrier to further exploration of telematics technology, the report says, also suggesting that another principal insurer concern about telematics is customer acceptance. Concerns about the costs vs. benefits and customer acceptance exceed concerns about implementation or technology issues, the report says.

Still, the survey report notes that even if the use of telematics “has lost some of its luster to insurers in all lines of business” since the 2019 survey, over 40 percent of auto insurers surveyed (42 percent in personal auto and 40 percent in commercial auto) said they plan to use telematics data in the next two years. According to Willis Towers Watson, the degree of commitment to telematics revealed in survey responses is strongly correlated with insurer size.

While the insights about planned and current usage of telematics are one feature of the Willis Towers Watson’s 2021 P&C Insurance Advanced Analytics Survey, published in late November, the main focus is on gauging insurer appetites for using all types of advanced analytics to help them with various activities related to underwriting, claims handling, reserving, expense management, marketing, and distribution management.

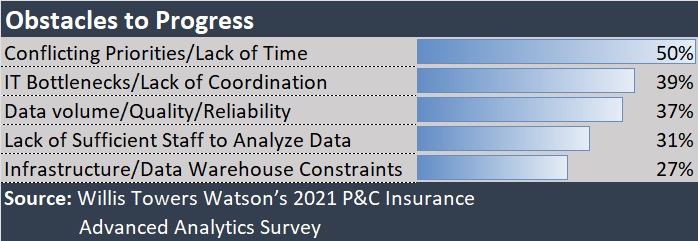

“The pandemic has certainly increased time pressures to do other things and delayed some investments in support of advanced analytics; however, it hasn’t affected plans to any great degree,” said Nathalie Bégin, director, North America P&C practice, Insurance Consulting and Technology, Willis Towers Watson, in a statement about the report, which highlights underwriting and pricing activities as the most popular current and planned uses of analytics.

“Other reasons for some of the struggles that insurers have faced in keeping their ambitions on track lie closer to home. These include IT infrastructure, the dexterity with which they handle data and corporate cultural barriers,” Bégin said.

While carrier progress in implementing advanced analytics has been spotty as a result, 20 percent of the carriers that have been using analytics for underwriting and pricing believe that this has had a strong impact on their top-line growth—up from just 10 percent in the previous survey. Assessments of bottom-line profit impacts were even stronger, with nearly half (46 percent) of 2021 survey respondents saying that analytics improved results, compared to 37 percent in 2019.

In pricing, underwriting and claims, P/C insurers report that their use and plans for advanced analytics have increased since 2021. Pricing was by far the highest reported use with 83 percent of respondents saying that analytics are used by their companies for rating purposes in 2021, up from 79 percent in 2019. But some the biggest jumps in analytics usage were reported for claims activities. The evaluation of future claims severity, topped the list for claims activities for which insurers are currently using analytics, with 41 percent of respondents reporting that their companies used analytics for this purpose—up from 30 percent in 2019.

Other jumps were reported for the evaluation of claims litigation potential, coming in at 24 percent in 2021 vs. 14 percent in 2019) and automation (or straight-through claims processing), selected by 20 percent of 2021 respondents vs. 7 percent of 2019 respondents.

Survey respondents in 2021 included 90 representatives of P/C insurers—56 who have technical roles and 34 senior executives—from 71 P/C insurers participating in the survey (62 multiline carriers, three commercial lines carriers and six exclusively personal lines carriers).

The Willis Towers Watson report this year also includes charts related to insurer plans for using advanced analytics by line (fidelity and surety and excess casualty are lines where most carriers aren’t planning to use analytics), planned uses in areas other than underwriting and claims (marketing had the greatest response from surveyed insurers), and insurer dealings with InsurTechs (56 percent have working relationships with the InsurTech community). In addition, there is a section devoted to the value that carriers put on more than a dozen different types of internal and external data sources for analytics initiatives, with response percentage broken down by personal, commercial and specialty lines.

A final section of the report titled, “Reigniting Momentum,” offers suggestions for getting analytics projects back on track, such as investing in data analytics expertise, harvesting InsurTech relationships, automating and leveraging on-demand capacity and API-enable software to avoid IT bottlenecks and bypass systems capability issues.

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered