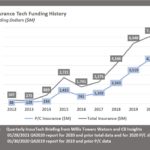

Carrier Management covered more than 30 property/casualty-specific InsurTech venture capital financings in 2020. The rough total of those combined investments surpasses approximately $1.7 billion.

More than half of that—$927 million—came from just five financings, rewarding InsurTechs that reached a level of maturity where a large cash infusion is designed to help reach critical mass.

Hippo drew the largest P/C InsurTech financing of the year, a $350 million investment from Mitsui Sumitomo. The investment came in November during the 2020 second half, after venture capital slowed down to a relative crawl in the first six months of the year.

Next Insurance came in second, attracting $250 million from a variety of investors at the end of September. The startup focuses on small business coverage and has used its new funding to develop more lines of cover and pursue acquisiti8ons.

Pie Insurance was the next highest. The InsurTech and MGA focused on workers compensation for small businesses nailed down $127 million in financing—money intended to fuel plans to acquire carriers.

Two other P/C-related InsurTechs attracted $100 million in new funding—broker startup Newfront and online insurance marketplace Policygenius.

The remaining InsurTech VC financings covered by Carrier Management all landed below that $100 million threshold—many at much smaller levels. Still, the VC wins covered a wide range of startups with focuses in areas including claims surveillance technology, customer policy management, cyber insurance, rideshare insurance and travel insurance. Some startups also pledged to spend the investments on revamped strategies designed to help themeselves grow better.

Links to all of the major InsurTech venture capital stories covered by Carrier Management in 2020 are provided below, listed most recent to oldest. Click them a second time as 2020 draws to a close, and investors prepare for 2021.

Major 2020 InsurTech VC Financings

- High-End Home Insurance MGA Openly Secures $40M VC Round for National Expansion

- UK Travel Insurance Startup Raises $12M; U.S. Headquarters Planned

- Multiple Investors Back Cyber Insurance MGU At-Bay’s New VC Round

- Germany’s Getsafe Raises $30M from Swiss Re, Others; Eyes Becoming Full Carrier

- Hippo Attracts $350M Investment From Mitsui Sumitomo; Reinsurance Treaty Also Planned

- Flyreel Raises $10M for AI Underwriting and Claims Technology

- Travelers, State Farm, Nationwide Lead $60M Financing for HOVER, a 3D Claims InsurTech

- InsurTech Veterans Debut MGA Startup Assurely, Disclose $3.7M Seed Round

- Broker Startup Newfront Raises $100 Million

- Next Insurance Nails Down $250M Financing Round; $631M Pulled in to Date

- EasySend Raises $16M for ‘No Code’ Digitization Platform

- Kin Raises $35M; Florida Home Insurance Carrier Pilot to Expand

- InsurTechs Focused on Commercial Auto and Climate Risk Secure New Funding

- Buckle Raises $31M; Seller of Digital Rideshare Insurance Is Going National

- AI Tech Firm Expert System Raises $29.4M; Clients Include AXA XL, Lloyd’s, Zurich

- Branch, an InsurTech MGA, Will Launch a Reciprocal Exchange After Raising $24M

- InsurTech Hippo Eyes 2021 IPO After Landing $150M in New Financing

- Aclaimant, a Safety and Risk Management Software Startup, Raises $10M

- High-End Home Insurance MGA Openly Raises $15M; Expansion Planned

- Immuta Raises $40M to Expand Reach of Automated Data Protection Tech

- Planck Raises $16 Million for Data Platform; Nationwide Becomes an Investor

- InsurTech Betterview Pulls in $7.5M Financing Round From Guidewire, Others

- Workers Comp InsurTech Pie Raises $127M With Plan to Acquire Carriers

- InsurTech Coalition Raises $90 Million to Fuel Cyber Insurance Global Growth Plan

- InsurTech INSTANDA Raises $19.5M to Expand Market for Customer/Policy Management Platform

- Updated: Tractable Raises $25M to Expand Reach of AI Accident Recovery Tech

- Tech Learning Startup Talespin Raises $15M; Farmers Is Early Investor

- At-Bay Pulls in $34M From Munich Re, Others; Cyber Insurance Expansion Planned

- Online Insurance Marketplace Policygenius Pulls in $100M From AXA and Others

- MGA Clearcover Pulls in $50M Financing, With Designs on Becoming Full-Stack Carrier

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best