Direct written premiums in the U.S. excess and surplus (E&S) lines market during 2018 grew at its greatest rate since 2012, increasing 11 percent and representing the eighth consecutive year of premium growth, according to Fitch Ratings.

The trend continued its upward trajectory in the first half of 2019 with premium growth of 15 percent, said Fitch in a report titled “U.S. Excess and Surplus Lines Market Review – Consecutive Weak Results Spur Stronger Revenue Growth.”

All major E&S lines of business contributed to the period-to-period growth, which nearly doubled the overall property/casualty market’s growth rate for the year, the report added.

At the same time, the E&S market significantly underperformed the broader P/C industry for the second consecutive year in 2018, reporting a direct statutory combined ratio of 107 compared with 116 in 2017, said Fitch, noting that large insured catastrophe losses during the past two years were key drivers of this poor performance. The ratings agency pointed to Hurricanes Michael and Florence and the California wildfires in 2018 and Hurricanes Harvey, Irma and Maria during the previous year.

Excess & Surplus Market Soars as Standard Carriers, Lloyd’s Drop Accounts

The poor results seen by the E&S sector in 2017 and 2018 contrast with an average combined ratio of 92 during the prior five years (2012-2016), said Fitch. While the E&S market historically reports better underwriting performance than the admitted P/C market, its specialized nature and more attractive competitive dynamics bring greater volatility, the report explained.

“Underwhelming underwriting results have accelerated premium rate increases, particularly in the commercial property and auto segments,” said Doug Pawlowski, senior director, Insurance. “The specialized nature of E&S attracts more challenging property and liability business, which generates more volatile loss experience over time. In the last two years, unusual catastrophe losses took their toll on market results.”

Representing a relatively steady 5 percent of the U.S. P/C industry, the E&S market provides an alternative to the standard admitted market for unique and hard-to-place risks, continued Fitch.

Above-Average E&S Growth Expected

Fitch predicted that further premium rate hardening and movement of underwriting exposures toward non-admitted markets will support above average E&S market premium growth in the near term.

“Reduced admitted insurer appetite for catastrophe-exposed property risks, and limits and capacity reduction in several liability segments, are driving further premium growth in 2019,” Fitch said, pointing to chronic losses in commercial auto that are pushing business to the E&S market.

Fitch added that certain emerging risks could add to growth in the E&S market, in areas such as cyber, autonomous vehicles, blockchain usage and the Internet of Things (IoT).

M&A, Organic Growth

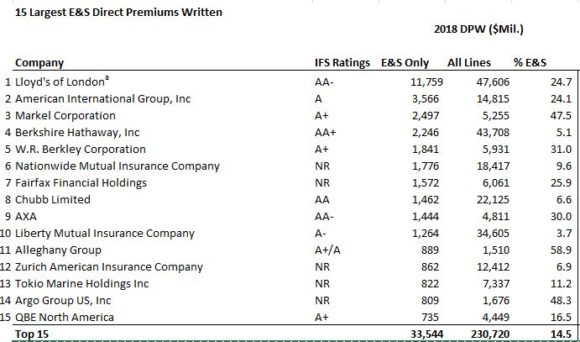

Efforts to improve profits by leading E&S market participants, including Lloyd’s and American International Group Inc., via changes in their policy limits and reduction in risk appetite are also significantly affecting underwriting conditions and pushing premium rates up. (Lloyd’s and AIG are the top two E&S underwriters, accounting for approximately one-third of 2018 direct written premiums. See related chart below.)

“The overall E&S market is anticipated to return to a slight direct underwriting profit in 2019, barring further large catastrophe losses, as pricing in commercial lines firms in nearly all segments except for workers compensation,” said Fitch, adding that commercial property and automobile lines are experiencing the sharpest rate increases.

M&A activity had less influence on E&S market share shifts during 2018 than during 2017 when there was a more robust acquisition environment, said Fitch. Transactions that included significant E&S business in 2018 and 2019 were AIG’s acquisition of Validus Holdings (July 2018) and Hartford Financial Services Group purchase of The Navigators Group in May 2019.

With its acquisition of Validus, AIG grew 10 percent in 2018, which offset the company’s ongoing effort to cut premium volume in existing business—a strategy designed to restore profits. For example, AIG has been cutting its exposure from longer-tail casualty lines. Fitch said AIG was the only top-10 E&S writer to shrink its direct written premiums during 2018, with a 6 percent decline. Although the company’s DWP have declined by 24 percent since 2014, the company has maintained its position as the largest E&S market outside of Lloyd’s.

From an organic growth standpoint, Fitch said, Berkshire Hathaway Inc.’s expansion continues to stand out, reporting a market-leading five-year average direct premium growth of 31 percent. BRK became the fourth-largest E&S player in 2018, with DWP of $2.2 billion, moving up the rankings from the sixth largest E&S writer in 2017.

*This story was originally published by our sister publication, Insurance Journal

Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly