Small business owners are reporting record levels of satisfaction with their insurance coverage, with carrier investment in products, service infrastructure, and technology likely driving the uptick.

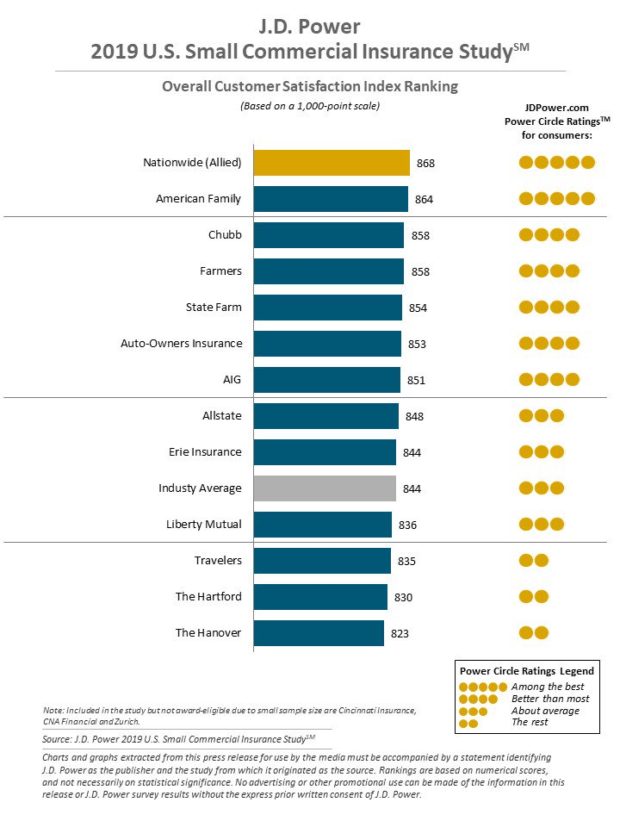

The customer sector produced an all-time high satisfaction score of 844 out of 1,000 points, according to the J.D. Power 2019 U.S. Small Commercial Insurance Study. The score increase comes after three years of stagnant satisfaction levels, J.D. Power noted, crediting carrier investment in multiple areas for generating new satisfaction momentum.

The customer sector produced an all-time high satisfaction score of 844 out of 1,000 points, according to the J.D. Power 2019 U.S. Small Commercial Insurance Study. The score increase comes after three years of stagnant satisfaction levels, J.D. Power noted, crediting carrier investment in multiple areas for generating new satisfaction momentum.

“Insurers have focused on improving their approach to the small commercial market and it shows,” David Pieffer, Practice Lead for J.D. Power’s Property & Casualty Insurance Practice, said in prepared remarks. He pointed out that these days, that investment effort must increasingly include technology in the mix.

“Technology has become an increasingly critical component in the small commercial insurance offering,” Pieffer said. “Digital channels are now more influential than ever before in shaping commercial customer experiences and this will be an important area of focus moving forward as technology continues to evolve rapidly and more customers interact with their insurers via electronic channels.”

As it did in 2018, Nationwide ranked highest in overall customer satisfaction, this year scoring 868. American Family moved up from fourth to second place, landing a score of 864. Chubb was third with 858, tying with Farmers.

J.D. Power compiled its study based on responses from 3,221 small commercial insurance customers submitted from April to June 2019. The study, now in its seventh year, examines overall customer satisfaction among small commercial insurance customers with 50 or fewer employees. Five factors help measure satisfaction. In order of importance, they are interaction; policy offerings; price; billing and payment; and claims. Satisfaction is calculated on a 1,000-point scale.

Source: J.D. Power

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers