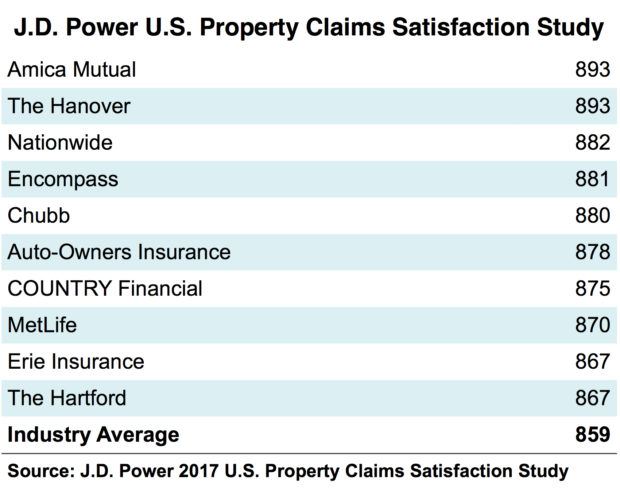

Amica Mutual may still lead the pack in terms of overall satisfaction among homeowners who have filed a property claim, but The Hanover and Nationwide are nipping at the insurer’s heels, according to a new J.D. Power ranking.

J.D. Power’s 2017 U.S. Property Claims Satisfaction Study ranks Amica highest in terms of property insurance claims experience for the sixth year in a row, with a score of 893 out of a possible 1,000. This year, however, The Hanover tied Amica with an identical score.

In 2016, The Hanover earned a score of 853, giving it a ninth place ranking.

J.D. Power noted that both Amica and The Hanover scored high in the settlement, estimation process and repair process factors.

Nationwide, meanwhile, landed in third place for J.D. Power’s 2017 ranking, with a score of 882. The insurer placed ninth in 2016, tying The Hanover with a score of 853.

Chubb, the product of a nearly $30 billion merger in 2016 between ACE and the old Chubb, also generated some improvement in its customer satisfaction ranking, landing in the number 5 slot with 880 points. In 2016, Chubb made the number 12 slot with an 851point tally.

The Hartford is another insurer that displayed significant improvement in customer insurance scoring. For 2017, the insurer rounded out the top 10 with a score of 867. That compares with 840 in 2016, and nineteenth place.

J.D. Power’s listing also displayed some notable drops year-over-year. For 2017, for example, Erie Insurance produced a score of 867 in terms of property claims customer satisfaction, giving it the number 9 slot. In 2016, Erie Insurance was in fifth place, with a score of 863.

As J.D. Power noted, the overall Customer Satisfaction Index increased by 13 points year-over-year to a score of 859 in 2017, which was an all-time high for the study. Driving this is “the settlement factor: which encompasses fairness of settlement amount, followed by estimation process and also service interaction.

J.D. Power noted that the Customer Satisfaction Index for property claims jumped to an all-time high even as the personal lines segment saw a spike in incurred loss costs and more focus on managing claims expenses. Also, current property claims satisfaction levels are now on par with auto claims satisfaction scores, which typically trend higher historically.

USAA, which insures only U.S. military personnel and their families, was not included in the J.D. Power rankings. If it had been, the insurer would have landed on the list right after Amica and The Hanover, with a score of 885.

Source: J.D. Power

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark