Overall satisfaction with the auto insurance claims processes has reached record levels in 2021, representing the fourth consecutive year of improvement, according to a new J.D. Power study.

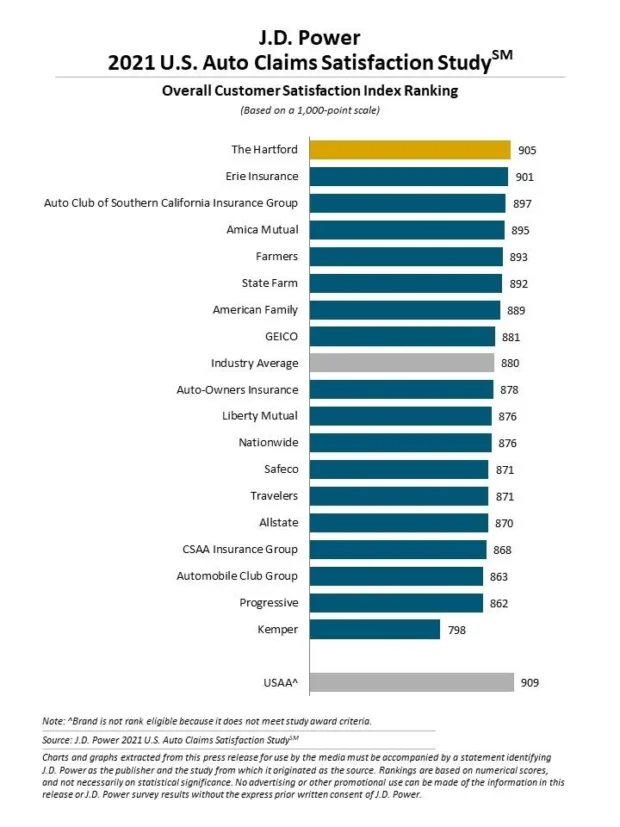

The Hartford also ranked highest in overall customer satisfaction involving U.S. auto claims, scoring 905 out of a possible 1,000.

There are two trends influencing the high satisfaction levels. A nationwide surge in vehicle prices has led to more insurance customers experiencing a total loss, leaving them with higher vehicle values than they may have realized, J.D. Power said. Additionally, there have been a number of advancements in streamlining claims processes which is leaving customers happier.

“The auto insurance industry has been investing heavily in streamlining the claims process and those investments are starting to pay off in the form of faster cycle times and record levels of satisfaction,” Tom Super, head of property and casualty insurance intelligence at J.D. Power, said in prepared remarks.

Super added however, that the trend faces at least one obstacle to maintaining momentum.

“The challenge now will be continuing to drive service improvements as vehicle prices normalize and claim severity continues to increase,” Super said. “Those carriers with more sophisticated claimant triage will be better positioned to navigate the growing cost and complexity ahead.”

Another element that could harm auto insurance claim satisfaction: increased vehicle complexity, particularly with growth of advanced driver assistance systems. J.D. Power said the technology is contributing to rising severity cost.

Here are additional highlights of the 2021 study:

- Overall satisfaction with the auto insurance claims process is now at 880 out of a possible 1,000. That’s up eight points from 2020 and a record high.

- Claimants who had to interact more manually and with three or more representatives during the claims process had the lowest levels of customer satisfaction. By contrast, claims that can be processed via a low-touch experience from the first notice of loss to a direct repair shop earned the highest levels of satisfaction – at 915 out of a possible 1,000.

- Claimants with an at-fault status is in dispute reported the lowest customer satisfaction scores.

The Rest of the Top 10

Erie Insurance Scored in second place with a 901 auto insurance claims customer satisfaction score. Auto Club of Southern California Insurance Group came in third, at 897. Amica Mutual and Farmers were fourth and fifth, respectively, with scores of 895 and 893, respectively.

Rounding out the top 5: State Farm at 892, American Family at 889, GEICO at 881, Auto-Owners Insurance at 878 and Liberty Mutual at 876.

J.D. Power’s 2021 U.S. Auto Claims Satisfaction Study is based on responses from 7,345 auto insurance customers who settled a claim over the past 6 months before taking the survey. The survey took place from November 2020 through September 2021. J.D. Power excluded claimants with a vehicle that only sustained glass/windshield damage or was stolen, or who only filed a roadside assistance claim.

Source: J.D. Power

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  The Future of HR Is AI

The Future of HR Is AI