Great American Insurance Group launched a professional liability endorsement covering the administration of a drug to counteract opiates such as heroin. Validus Holdings subsidiary Talbot Underwriting Services formed a $115 million political risk insurance binder for U.S. clients. An Allianz division unveiled updated cyber coverage meant to address emerging risks.

Great American Insurance Group launched a professional liability endorsement covering the administration of a drug to counteract opiates such as heroin. Validus Holdings subsidiary Talbot Underwriting Services formed a $115 million political risk insurance binder for U.S. clients. An Allianz division unveiled updated cyber coverage meant to address emerging risks.

***

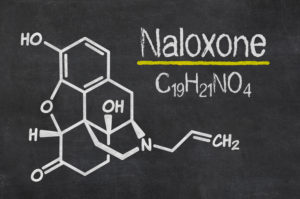

Great American Insurance Group is now offering a professional liability endorsement for the administration of Naloxone, a drug that counteracts opiates.

The Cincinnati, Ohio-based insurer said the endorsement, offered through its Specialty Human Services Division, is designed to protect human and social service organizations that could incidentally be dealing with a heroin or other opioid overdose situation.

Great American said that homeless shelters, recovery centers, rescue missions, nonprofit detoxification facilities, emergency housing programs and community outreach organizations could all benefit from the coverage.

***

Validus Holdings subsidiary Talbot Underwriting Services formed a $115 million political risk insurance binder for U.S. clients.

Tallbot is handling the product from its New York office, which is underwritten 100 percent by various underwriters at Lloyd’s and led by Talbot Underwriting Ltd. Syndicate 1183. It also includes syndicates managed by Ascot, Sompo Canopius, CAN Hardy and Starstone – all organizations that have expertise in writing political risks.

The political risk insurance binder is designed to give brokers and clients in the Americas a one-stop shop to access political risk insurance capacity in the Lloyd’s market. The facility can only be accessed via appropriately licensed brokers.

***

Allianz Global Corporate & Specialty is now offering new cyber coverage designed to address emerging risks.

Allianz Global Corporate & Specialty is now offering new cyber coverage designed to address emerging risks.

Dubbed ACCEPT Protect, the next-generation cyber and professional liability coverage product is designed exclusively for the North American market. It offers a streamlined form structure with flexible terms, plus individual or blended options for emerging threats across the cyber, media, technology and miscellaneous errors & omissions (E&O) markets.

ACCEPT Protects incorporates an existing Allianz product – Cyber Protect Premiums – with an added option of offering coverage, if needed, for various professional indemnity exposures as part of the same policy.

Sources: Great American Insurance Group, Allianz Global Corporate & Specialty, Validus Holdings/Talbot

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies

New Texas Law Requires Insurers Provide Reason for Declining or Canceling Policies