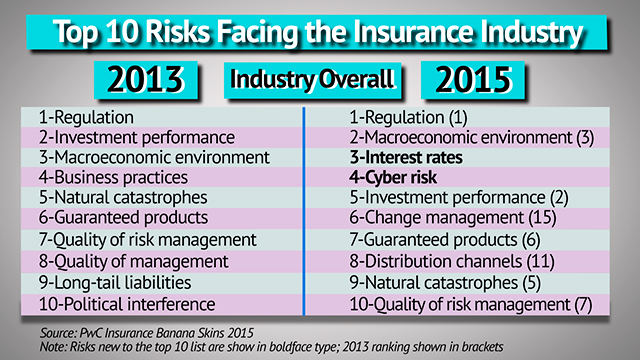

Regulation is the top insurance industry concern for the third year in a row, but cyber has grabbed carriers’ attention like never before, according to the Centre for the Study of Financial Innovation’s fifth annual risk survey, conducted in association with PricewaterhouseCoopers.

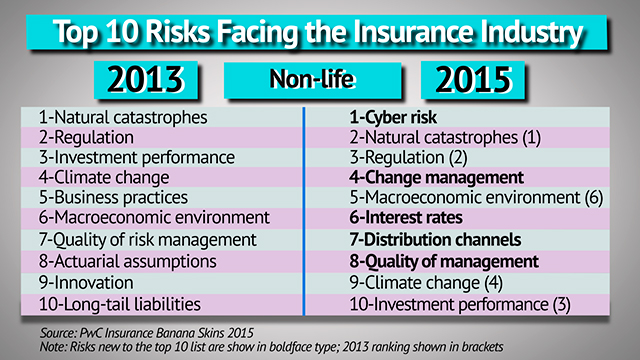

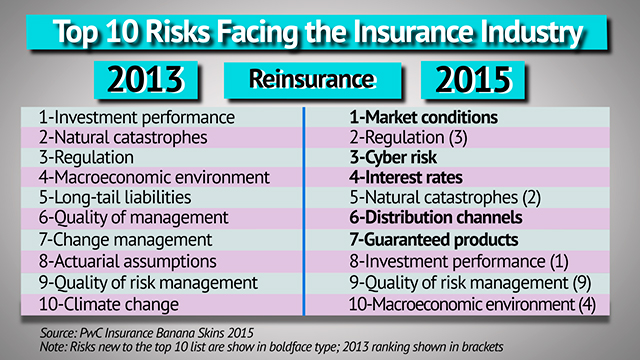

Cyber hit the survey’s top 25 risk list for the first time (4), as does interest rates (3), market conditions (13), and social change (20).

But the survey of 806 property/casualty and life insurance industry insiders and observers from 54 countries designated regulation as the most serious.

“Concern is driven by the quantity of regulatory reform at all levels, in particular the EU’s Solvency 2 Directive,” the PwC/CSFI survey concluded. “The fear is that these initiatives are loading the industry with costs, and distracting management from the task of running profitable businesses, as well as heightening compliance risk.”

Where does that worry about regulatory pressures come from? PwC/CSFI said that insurers are responding to a difficult economic environment that they must confront, including low interest rates, which leave investment results depressed and stagnant, affecting their bottom lines. Those same low yields are boosting competition as insurers seek to boost their top line revenues in response to the trend, the report explains.

The CSFI/PwC report includes cyber risk, in part, because of the unknowns that remain. “As an industry that handles large amounts of other people’s money and personal data, insurance is vulnerable to attack,” the report stated. “Cyber is also an underwriting risk which has yet to be fully scoped.”

The full report is dubbed “Insurance Banana Skins 2015 – The CSFI survey of the risks facing insurers.” Close to two thirds of the respondents were from the primary insurance industry. The rest came from various reinsurance and broking sectors, regulators, consultants, analysts and professional service providers.

Here’s a full roundup of the 2015 Insurance Banana Skins top 25 list:

- Regulation

- Macro-economy

- Interest rates

- Cyber risk

- Investment performance

- Change management

- Guaranteed products

- Distribution channels

- Natural catastrophes

- Quality of risk management

- Business practices

- Quality of management

- Market conditions

- Long tail liabilities

- Human talent

- Political interference

- Product development

- Reputation

- Climate change

- Social change

- Corporate governance

- Capital availability

- Terrorism

- Pollution/contamination

- Complex instruments

Source: PwC/CSFI

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance