Rating agency Standard & Poor’s announced Wednesday that it is introducing an Insurance Credit Scenario Builder, a new credit tool available on the S&P Ratings iPad App and on the web.

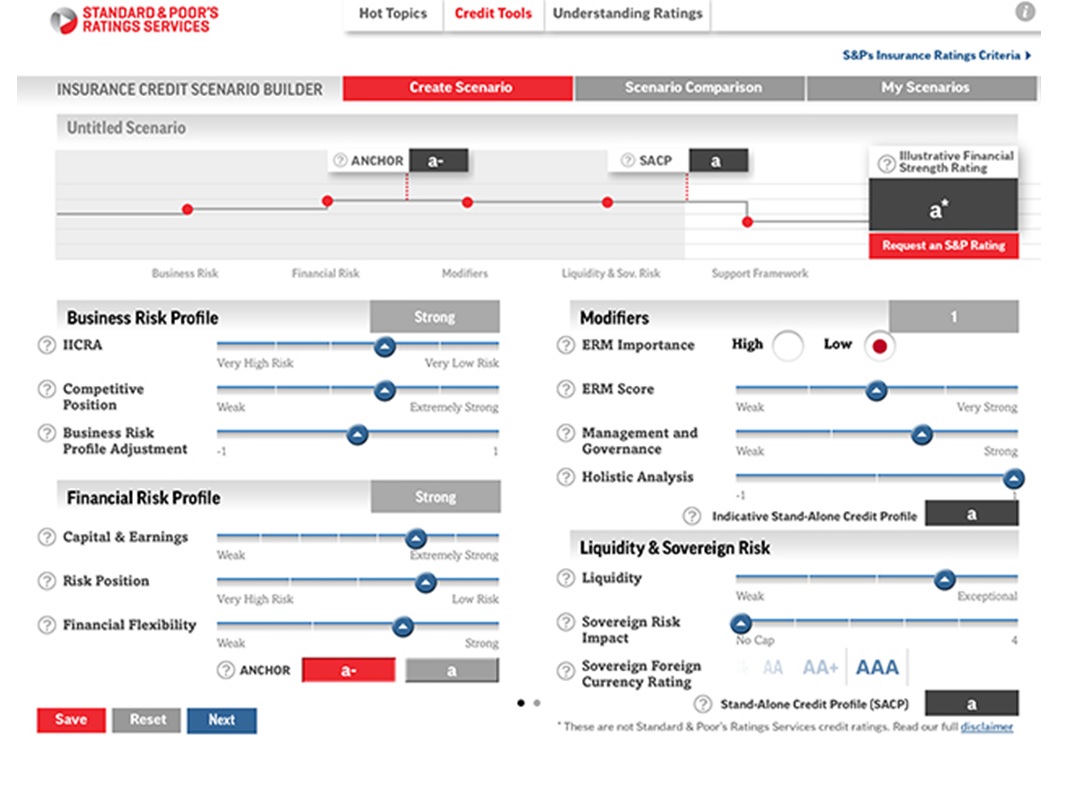

S&P included the accompanying snapshot with its announcement.

Carrier Management took a quick test on the web-based version, finding that tweaks in modifiers like ERM (enterprise risk management) scores from “strong” to “adequate” didn’t change an illustrative “a-” rating unless the ERM importance dial for the company was switched from “low” to “high.”

In place of such random ad-hoc tests, more thoughtful users can analyze the results of changes in other modifiers, like management and governance scores. Or they can vary the strengths of key ratings’ building blocks, such as the two factors that make up S&P’s business risk profile and the three resulting in a financial risk profile score. Here, even small changes—for example, moving “capital & earnings” from “strong” to “moderately strong”—might change an anchor rating from “a-” to “bbb+” depending on the settings of other financial risk profile and business risk profile factors.

To produce a rating on an insurance company, S&P analysts apply a methodology that divides the analysis into several categories. First, they analyze the company’s business risk profile and financial risk profile, and then combine them to determine their anchor. Analysts use several additional analytical steps to arrive at an ultimate rating recommendation, including the ERM and governance modifiers.

With the Insurance Credit Scenario Builder, users can create, save and compare illustrative financial strength rating scenarios for insurance companies based on their own parameters and adjustments as well as S&P rating methodology and assumptions, S&P says.

For more information on S&P ratings methodology, refer to the follow articles on Carrier Management.

- S&P’s New Insurance Criteria Released; Method Would Have Spotted AIG’s Past Problems (May 2013)

- Understanding S&P’s New Insurance Rating Criteria: Rodney Clark Q&A (May 2013)

- S&P, Fitch Offering Clearer Windows Into Insurer Rating Processes (Sept. 2014)

- Assessing ERM: S&P Puts Risk Culture in Focus (Oct. 2013)

- Insurer Ratings Unlikely to Change With New Governance, Mgmt. Criteria: S&P (March 2013)

- S&P Explains Rating Evaluation of Insurer Governance, Management Strategy (March 2013)

- Rating S&P’s New Method: Transparency Improved, But Execution Consistency Falls Short (Sept. 2013)

.

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly