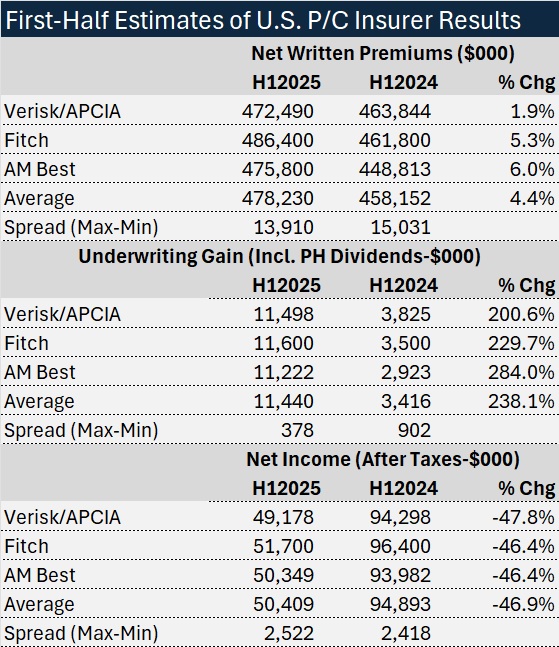

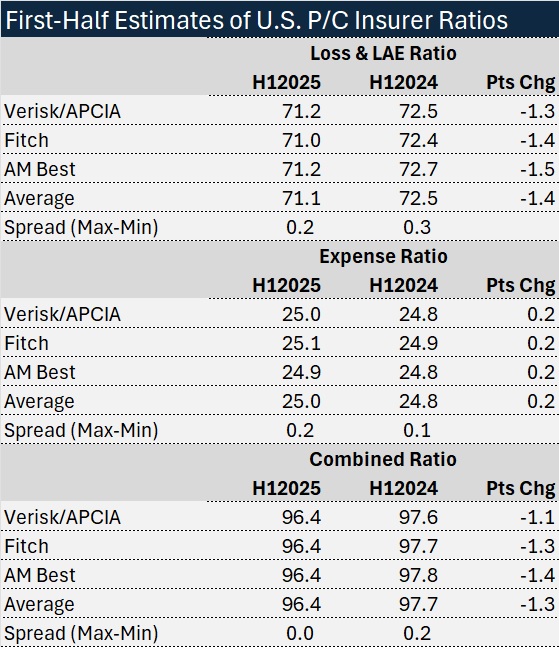

Analysts agree that first-half 2025 underwriting income for the U.S. property/casualty insurance industry more than tripled compared to first-half 2024, translating to a combined ratio of 96.4.

But how much did net written premiums grow during the first six months over the comparable period last year?

The answer isn’t as clear.

In early September, Verisk and The American Property Casualty Insurance Association teamed up to deliver their report on first-half 2025 financial results, showing that net written premiums grew 1.9 percent to $472.7 billion.

More recently, Fitch Ratings and AM Best offered their tallies. According to Fitch, net written premiums rose 5.3 percent to $486.4 billion. And AM Best says the first-half total was $475.8 billion, representing a jump of 6.0 percent.

Some readers may be yawning. Eh, the AM Best dollar total is pretty close to the Verisk/APCIA figure. What difference does it make?

When we reported the Verisk/APCIA number, we described the 1.9 percent jump as anemic by comparison to the growth in premiums indicated in last year’s midyear report—a 10.6 percent increase in net written premiums recorded for first-half 2024 over the prior-year six-month period.

Related article: U.S. P/C Insurance Industry First-Half Underwriting Profit Triples

So is this year’s growth figure about half of last year? Or less than one-fifth of last year’s jump?

Verisk nor Fitch were able to offer much insight into why their first-half 2025 net premium numbers are roughly $14 billion different from one another. A representative from Verisk simply noted that Verisk’s results are “based on annual statements filed with insurance regulators by private property/casualty insurers domiciled in the United States, including reinsurers, excess and surplus insurers, and domestic insurers owned by foreign parents, and excluding state funds for workers compensation and other residual market insurers, the National Flood Insurance Program, and foreign insurers.”

Fitch’s compilation, also published on Sept. 3, is also statutory data, accessed from S&P Global Market Intelligence. (Fitch made no indication about any exclusions listed in the Verisk statement.)

S&P GMI, itself separately published a U.S. P/C market report in August, showing histories of direct premium and net written premiums for the 2020-2024 full years and projecting 2025-2029. For full-year 2025, S&P projects “industrywide direct premiums written growth will slump by 3 percentage points to a five-year low of 6.8 percent in 2025 [from 9.8 percent in 2024], with mid-single-digit expansion in each of the next four years.” S&P GMI’s projected net premium growth figures, shown graphically, fall slightly above the direct premium growth projections.

As for AM Best, the rating agency’s Sept. 11, 2025 report, “First Look: Six-Month 2025 U.S. Property/Casualty Financial Results,” says its data is derived from companies’ six-month 2025 interim period statutory statements that were received as of Aug. 26, accounting for an estimated 96 percent of total industry net premiums written. The report includes total industry net written premiums for first-half 2025 and direct written premiums by line of business for half-years 2021, 2022, 2023, 2024 and 2025.

Like Verisk, last year, when AM Best announced its first look at first-half 2024 results in mid-September, the indicated net premium growth figure was over 10 percent. But the net written premium volume AM Best tabulated back then for first-half 2024 was actually was $463.2 billion (very similar to what Verisk is showing for first-half 2024), not the revised $448.8 billion set forth in the latest report.

Related article: Personal Lines Turnaround Fuels U.S. P/C Industry Underwriting Gain

Looking Ahead: Combined Ratio Still Below Breakeven?

S&P GMI also notes that previous iterations of its report excluded AIU Insurance Co., a subsidiary of American International Group Inc., when disproportionate effects of a 2013 restructuring on certain lines distorted historical results. Given the time elapsed since the restructuring, S&P GMI no longer excludes AIU.

Estimates change over time. Trustworthy bean-counters revise totals as new information comes in and they make adjustments to account for differences in data sources from one year to the next. We likely won’t know for months whether premium growth for the first six months of 2025 was actually below 2 percent or closer to 6 percent. (Read about other changing estimates in these articles: Ahem. Results for the U.S. P/C Industry Improved ‘Slightly’ in 2023; NCCI Offers Labor Market Insights)

For now, we have a handful of forward-looking estimates of what growth will look like for the full year.

Back in late July, Swiss Re Institute’s Q2 2025 report, “U.S. Property & Casualty Outlook: Sunny skies but pack an umbrella,” forecast overall U.S. P/C insurance industry direct written premium growth rates of 5.5 percent for 2025 and 4 percent for 2026—just about halving the 9.6 percent growth rate SRI said was recorded for 2024.

Related article: All Good Things Come to an End: U.S. P/C Insurance Premium Forecast Dips

S&P GMI’s August projections were a bit higher—6.8 percent for 2025 and 6.1 percent for 2026.

Where analysts’ projections are most similar is in their forecasts of 2025 and 2026 combined ratios. And that’s where calculations for first-half of 2025 line up exactly too. Verisk/APCIA, Fitch and AM Best all published a 96.4 estimate of the U.S. P/C statutory combined ratio for first-half 2025.

For the full year, Fitch predicts the industry full-year combined ratio to increase modestly from 97 in 2024 but remain below 100. “Wildfire losses and the potential inflationary effects of tariffs could manifest in 2H25, although their impact has been negligible to date,”

“While pricing remains positive overall, it continues to moderate. Further underwriting performance improvement could be tempered by hurricane activity and increased competition in the auto segment that has pressured rate growth, with tariffs potentially exacerbating loss-cost severity,” the Fitch report said.

S&P GMI similarly predicted that the U.S. P/C insurance industry will eke out an underwriting profit for 2025. In its August report, “2025 U.S. Property and Casualty (P&C) Insurance Market Report,” S&P GMI put the projected 2025 combined ratio at 99.2, anticipating “that outsized losses from the January wildfires in Southern California [would] partially mitigate the strongest underwriting results in the private auto business—outside of a global pandemic—in two decades.”

“It is also assumed that social inflation, or the rise in claims severity due to adverse claims litigation and settlement trends, will serve as a bigger near-term drag on the industry’s bottom line than any potential economic inflation triggered by U.S. federal government tariff policy,” S&P GMI said, also forecasting a 98.3 combined ratio for 2026.

The earlier report from Swiss Re Institute had similar forecasts but predicted 2025 would be better than 2026—with forecasted combined ratios of 98.5 for 2025 and 99 for 2026. The report noted the resilience of industry, exemplified by a sub-100 combined ratio for first-quarter 2025 (99) amid high-severity events like the January California wildfires.

“S&P GMI’s forecast for private auto direct premiums written growth of 4.7 percent marks a significant decline from the rapid expansion of the previous three years,” S&P GMI said in an August 2025 report. “Private auto direct premiums written growth topped 10 percent in both 2023 and 2024, which represented the first instances of double-digit expansion in that business line since 2002.”

“S&P GMI’s forecast for private auto direct premiums written growth of 4.7 percent marks a significant decline from the rapid expansion of the previous three years,” S&P GMI said in an August 2025 report. “Private auto direct premiums written growth topped 10 percent in both 2023 and 2024, which represented the first instances of double-digit expansion in that business line since 2002.”

S&P GMI, in its August report, offered projected combined ratios and projected direct premium growth figures for the full year 2025 by line of business, and for the personal and commercial segments as well. The 99.2 total industry forecast breaks down as 99.0 for personal lines and 99.6 for commercial. And 6.1 percent is S&P GMI’s projected commercial lines growth rate for the full year, vs. 7.4 percent for personal lines.

Fitch’s report provides breakdowns of direct premium growth and loss ratio changes for the personal and commercial lines segments for first-half of 2025 so far.

According to Fitch, the industry direct loss ratio was flat with personal lines decreasing by 0.9 points and commercial lines increasing by 0.4 points in first-half 2025. (Statutory direct loss ratios for first-half 2025 and first-half 2024 are also shown graphically for six individual lines: private passenger auto, homeowners, commercial auto, commercial multiple peril, other liability and workers compensation.)

Direct written premiums grew 6.7 percent for personal lines during first-half compared to last year’s first half, with ongoing substantial premium rate hikes for homeowners and “significantly moderated” increases for private passenger auto.

For commercial lines, Fitch said commercial lines DWP growth was 4.3 percent in 1H25, down from 5.3 percent in 1H24, even though commercial auto and other liability-occurrence business saw the large premium growth as a result of meaningful rate actions still being taken in those challenging lines of business.

Related Fitch report: Strong US P/C Insurance Underwriting Profitability in 1H25 to Continue

Extracting by-line direct written premiums for first-half 2025 and first-half 2024 from the AM Best report, Carrier Management calculated continued double-digit direct premium growth for the homeowners, commercial auto and other-liability occurrence lines (all showing jumps of around 11 percent), while private passenger auto growth came in at 4.8 percent vs. 15.4 percent for first-half 2024 over first-half 2023.

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  The Future of HR Is AI

The Future of HR Is AI