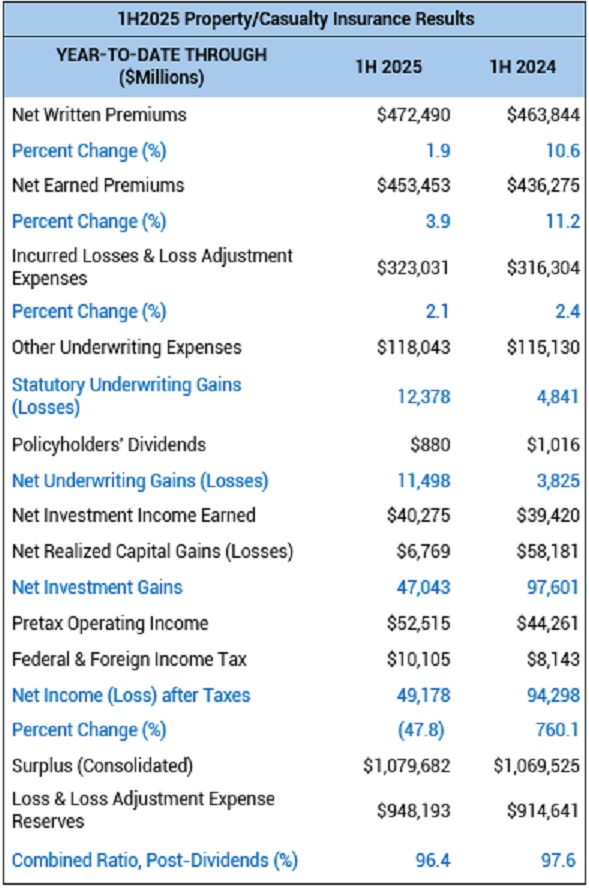

The U.S. property/casualty insurance industry recorded a net underwriting gain of $11.5 billion and net income of $49.1 billion for the first half of 2025, according to a new report.

“The lack of any significant natural catastrophes in the second quarter helped offset the record-breaking catastrophe losses related to the California wildfires and severe convective storms impacting Texas and Georgia earlier in the year,” said Robert Gordon, senior vice president, policy, research and international at APCIA, in a media statement announcing the figures released jointly by The American Property Casualty Insurance Association and Verisk yesterday.

The underwriting profit figure is three-times the $3.8 billion that APCIA and Verisk reported for first-half 2024.

Net income, however, came in at nearly half of last year’s six-month net income total of $94.3 billion, with a precipitous drop in realized investment gains explaining much of the drop. Last year’s net income figure was inflated by over $50 billion in capital gains realized by one insurer. Excluding that impact, first-half net income of $49.1 million is more in line with an adjusted net income figure of roughly $45 billion for first-half 2024.

Based on information from annual statements submitted to insurance regulators by insurers representing roughly 97 percent of private U.S. property/casualty market insurers, Verisk and APCIA reported that net written premiums grew just under 2 percent to $472.5 billion.

The 1.9 percent jump looks anemic compared with a 10.6 percent increase in net written premiums recorded for first-half 2024 over the prior-year six-month period.

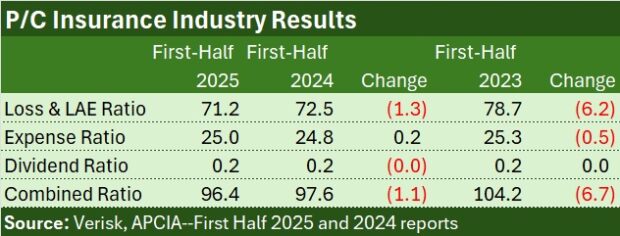

First-half 2025 losses and loss adjustment expenses rose at about the same pace, up 2.1 percent over first-half 2024, but earned premiums rose 3.9 percent, fueling more than a 1.3-point drop in the industry loss and LAE ratio.

With the expense ratio inching up slightly, the combined ratio for the first half of this year is estimated to be 96.4 compared to 97.6 for last year’s first half and 104.2 for first-half 2023.

The combined ratio “edged down slightly from this time last year, reflecting underwriting discipline, but escalating catastrophe losses—most notably January’s unprecedented California wildfires—underscore the volatility ahead,” said Saurabh Khemka, co-president of Underwriting Solutions at Verisk, in the media statement.

“While some lines are showing signs of improvement, the broader industry continues to walk a fine line,” Khemka said.

Related article: The Year So Far: Liberty Improves Most Among Nationals; Discipline Tested

The Verisk/APCIA report noted that private U.S. property/casualty insurers experienced losses in line with the escalated levels seen in recent years during the first half of this year. “First-quarter losses, driven largely by the Palisades and Eaton wildfires, outpaced historical averages but did not carry over at the same magnitude in the second quarter,” the report says.

During the first half, surplus levels remained historically high at $1.08 trillion, up slightly from $1.07 trillion at mid-year 2024.

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best

Premium Slowdown, Inflation Factors to Lead to Higher P/C Combined Ratio: AM Best  Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers

Viewpoint: Runoff Specialists Have Evolved Into Key Strategic Partners for Insurers  Beyond Automation: The Emerging Role for Contextual AI in Insurance

Beyond Automation: The Emerging Role for Contextual AI in Insurance  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best