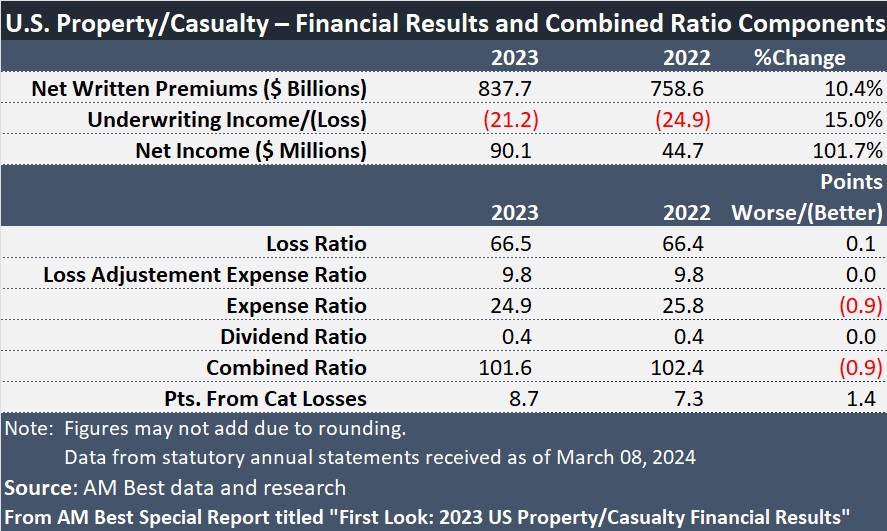

A new report from AM Best reveals that the U.S. property/casualty industry recorded a $21.2 billion net underwriting loss in 2023, slightly improved from a $24.9 billion underwriting loss recorded in 2022.

The corresponding combined ratio, 101.6, is almost a point lower than the 102.4 recorded in 2022, according to AM Best’s Special Report, titled “First Look: 2023 U.S. Property/Casualty Financial Results,” published yesterday.

The 2023 loss ratio of 66.5 is nearly unchanged from 2022, even though 2023 includes 8.7 points of catastrophe losses. In 2022, catastrophe losses added only 7.3 points to the loss and combined ratios.

The expense ratio improved nearly a point to 24.9, yesterday’s report shows.

Net written premiums jumped 10.4 percent to $837.7 billion in 2023.

With net investment income was virtually unchanged from the prior year, the lower 2023 underwriting loss boosted pre-tax operating income by 4.8 percent to $50.0 billion, and net income more than doubled to $90.1 billion. A $51.1 billion change in net realized capital gains at National Indemnity Company was a key driver of that jump, the AM Best report notes.

While still written in red ink, the 2023 underwriting loss figure set forth in a new Best’s Special Report, and the 101.6 combined ratio, look different from bleaker estimated results that AM Best published a few weeks ago. Readers of Carrier Management will recall that we reported that AM Best analysts had estimated the underwriting loss total would come in at $38 billion of underwriting losses for 2023—worse than 2022—with a corresponding combined ratio of 103.7 in CM’s early March article, “U.S. P/C Industry Underwriting Loss Reaches 10-Year High: AM Best.”

That article was based on AM Best’s “Review and Preview” report, published on March 6.

While the new March 25 AM Best report may actually seem like a second look, the “First Look” title refers to the fact that key metrics like the $21.2 billion loss and 101.6 combined figure are initial calculations from actual results reported by P/C insurers on their annual statutory blanks. The data in the “First Look” report are from companies whose 2023 annual statements were received as of March 8, 2024, representing roughly 97 percent of total industry net premiums written and 96 percent of policyholder surplus.

The figures in the report could change as more insurers file their annual statements.

But the changes between the figures presented in the “First Look” report and the “Annual Review and Preview” report have nothing to do with how many carriers filed their statements.

Even though the “Review and Preview” report was released in early March, “the calculations had largely been done a month or so prior, when full-year results weren’t yet available,” explained an AM Best representative. Asked specifically about the 103.7 combined ratio estimated in the “Review and Preview,” which is more than 2 points higher than the 101.6 tallied from annual statements filed so far, he noted that the 103.7 was based on results through the first three quarters of 2023, with a fourth-quarter estimate derived based on historical patterns.

“The report this morning is based on actual year-end filings to date,” he wrote in an email yesterday.

The spokesperson said that the gap (from a P/C underwriting loss of $38 billion in earlier reporting to a loss of $21.2 billion now) might be explained by reserves. Analysts think it is possible that either a majority of P/C companies—or enough of the largest companies—decided they were overly conservative with reserves for prior accident year losses, and may have made significant enough adjustments to these reserves so the year-end total was decreased to a loss of $21.2 billion.

The actual year-end filings to date still indicate an underwriting loss for 2023, but it is almost $4 billion lower than the underwriting loss for 2022.

(Editor’s Note: The “First Look” report also includes results of the mortgage and financial guaranty insurance. The estimates in the “Review & Preview” report exclude these lines.)

Reporting by Susanne Sclafane (Carrier Management) and Allen Laman (Insurance Journal)

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best

High Court Ruling on Trump Tariffs to ‘Ease Uncertainty,’ Says AM Best  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage