AM Best published its annual estimate of the U.S. property/casualty insurance industry’s financial results yesterday, reporting that $38 billion of underwriting losses for 2023 was a 10-year high for the sector.

Severe weather-related losses, stubborn inflation and upward reinsurance pricing fueled the record, analysts said.

Roughly $65 billion in catastrophe losses—mainly from secondary perils—impacted the 2023 underwriting results, according to AM Best’s estimates.

“Are secondary perils secondary?” the report writers ask in one section of the report, which notes other estimators put average annual losses from secondary perils at $35 billion, making the 2023 amount almost double the average figure. Last year included a record 28 single catastrophe events that individually exceeded the $1 billion loss mark, according to the National Oceanic and Atmosphere Administration, AM Best reported. Only one hurricane made landfall.

Still, the P/C industry managed to post pretax operating profit of $39.2 billion, with higher investment yields boosting net investment income to $75.8 billion in 2023.

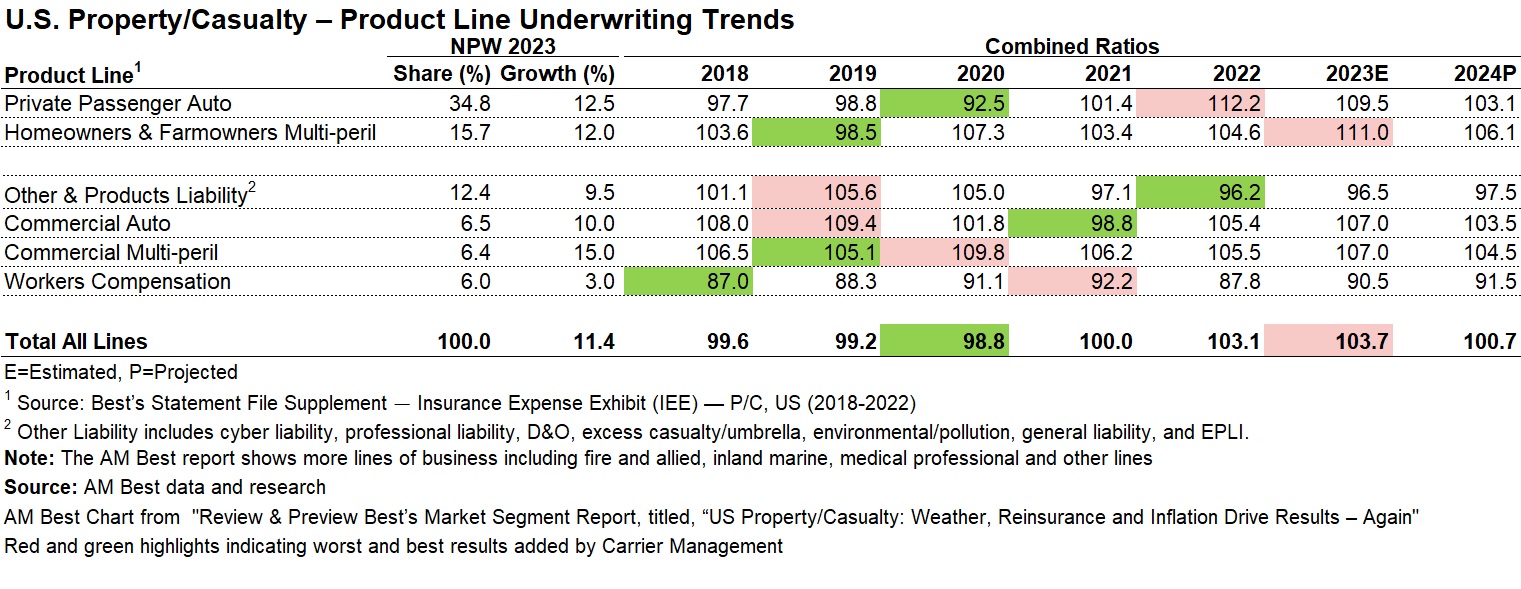

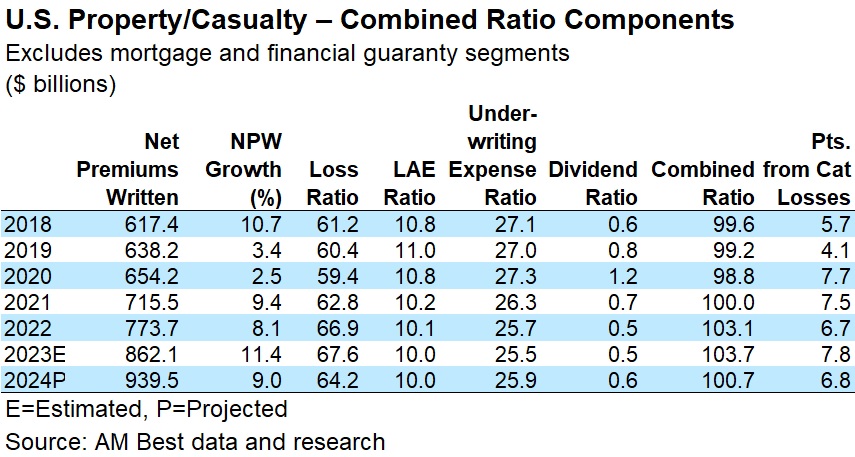

The report reviews components of the overall combined ratio, which came in at about 103.7, along with combined ratios by line, also offering outlooks for 2024 and discussions of loss reserve adequacy, PFAS, artificial intelligence and cyber insurance trends.

The chart below, taken from the report, reveals that the 103.7 overall combined ratio was higher than the 103.1 ratio recorded in 2022. The loss ratio deteriorated roughly 0.7 points, while the expense ratio improved slightly (0.2 points).

Net written premiums grew 11.8 percent last year.

The 2023 loss ratio included 7.8 points of catastrophe losses, up just over 1 point from the 2022 impact of 6.7 points. The cat impact last year blew through AM Best’s expected cat load of 6.3 points, which was already higher than prior years’ cat loads (5.7 points), prompting AM Best analysts to up the projected cat load figure yet again—to 6.8 points for 2024.

Overall, AM Best expects improved underwriting and operating results for 2024, driven by continued profitability in commercial lines, improvements in personal lines, and better investment returns from higher yields and strong cash flow. But AM Best still expects another year of underwriting losses in 2024. Underwriting losses “may moderate as carriers work to get ahead of severity trends,” the report says, indicating a projected combined ratio of 100.7 for 2024.

Diving into individual lines, the report shows that while the overall underwriting result was the worst in a decade, the combined ratio for the largest line—personal auto—actually improved more than 2 points to 109.5 in 2023. Still, the private passenger auto line has posted net underwriting losses for three straight years. AM Best expects that to continue in 2024 as well.

Diving into individual lines, the report shows that while the overall underwriting result was the worst in a decade, the combined ratio for the largest line—personal auto—actually improved more than 2 points to 109.5 in 2023. Still, the private passenger auto line has posted net underwriting losses for three straight years. AM Best expects that to continue in 2024 as well.

Combined ratios for most other lines deteriorated in 2023 (inland marine was the exception), with the cat-driven homeowners line showing the biggest upward movement—rising 6.4 points to 111.0 based on AM Best’s estimates.

On the chart above, extracted from the AM Best report, Carrier Management highlighted the best and worst results for each line over the period set forth in the report—2018-2023. (The actual report shows results for several additional lines of business.)

Among the remaining lines, workers compensation, which has been a profit driver for commercial lines insurers, showed nearly 3.0 points of deterioration in the industry combined ratio, with premiums growing only 3 percent.

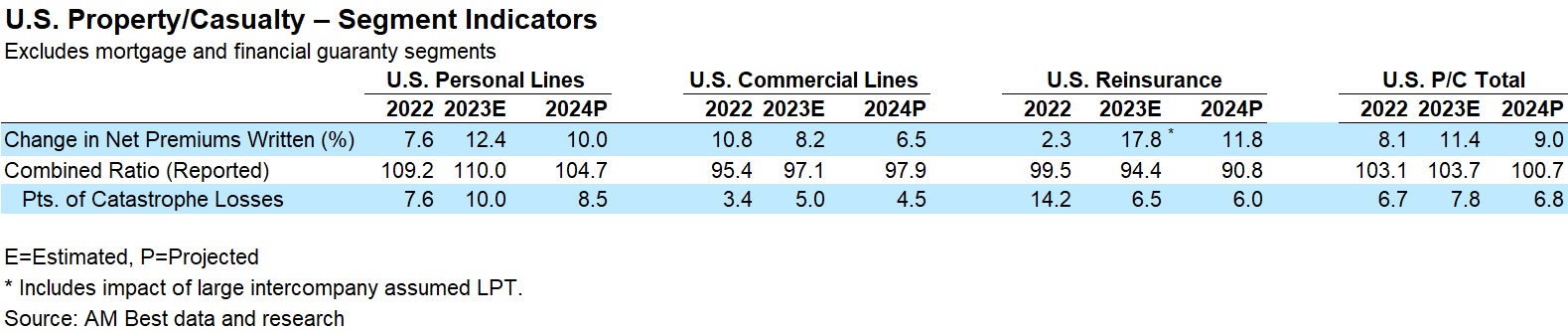

Across all lines, AM Best estimates that premiums grew 11.4 percent in 2023, with personal lines premiums jumping more than 12 percent in 2023 and commercial lines collectively growing 8.2 percent. For 2024, Best’s analysts expect continued double-digit growth for personal lines, although they selected the lowest double-digit for their projection—10 percent.

Commercial lines, they expect, will also grow less in 2024 than in 2023—at around 6.2 percent.

The annual Review & Preview Best’s Market Segment Report is titled “U.S. Property/Casualty: Weather, Reinsurance and Inflation Drive Results. The report offers the following observations about the two non-weather drivers of poor underwriting results: inflation and reinsurance.

Inflation—both economic and social—remains a disruptive influence on insurance results, even in commercial lines where pricing momentum continued in 2023. While net commercial lines premiums jumped 8.2 percent, the report references a social inflation figure of nearly twice that published by Swiss Re economists last year. According to Swiss Re, liability costs in the U.S. have risen an average 16 percent in the past five-year period, four times higher than the average economic inflation rate.

Economic inflation continued to do damage also, even in commercial property lines where rising property replacement values and higher repair costs (for labor and materials) continue to pressure commercial insurance rates and reinsurance pricing upward.

Turning to reinsurance, comparative results in the AM Best report reveal that U.S. reinsurers reported net premium growth of nearly 18 percent and improved underwriting results across the board. The improvement was driven primarily by better property results. (The report notes that the U.S. reinsurance segment’s underwriting results were also impacted by a large intercompany assumed loss portfolio transfer, which added $6.8 billion to both incurred losses and premiums last year.)

Notably, “catastrophe losses did not impact U.S. reinsurers as much as they did primary insurers in 2023, due mainly to the use of higher attachment points and the elimination of aggregate covers,” the report says. Reinsurers also benefited “from considerable risk-adjusted rate increases in the property reinsurance market at 2023 renewals,” the report said, adding that reinsurers “robust results” last year came after a multiyear period in which reinsurers returns fell below their required costs of capital. “As a result, we do not expect that reinsurance underwriting conditions will ease significantly through 2024,” the report says.

Summing up, Dan Ryan, an AM Best senior director and one of the authors of the report said that in all three areas—weather, inflation and reinsurance—2023 “was one of the most challenging years for the industry.” But to Ryan’s mind, the change in weather was the one thing that stood out the most, highlighting the record number of secondary perils that occurred in the absence of any mega-catastrophe.

“The pattern of weather is one of the problematic areas that insurers—and reinsurers—need to find a solution for,” he said, speaking on a video posted on the AM Best website in conjunction with the release of the report. Suggesting that reinsurers have already found their solution—higher attachment points—Ryan pointed out that leaves “a lot of the onus and risk in the hands of the primaries.”

The disproportionate amount of loss that personal lines insurers picked up in 2023 compared to other years came about because of the change in behavior of reinsurers, he stated.

Inflationary pressures, he said, are much more pronounced for personal lines than commercial lines insurers. Even though rates of economic inflation have dropped from the 40-year highs of 8-9 percent in 2021 and 2022, down to roughly 3.5 percent, the cumulative effect of past years leaves a problem for insurers to continue to work through, he said.

On a positive note, Ryan said AM Best expects net investment income to grow 15 percent in 2024.

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage

Telematics and Trust: How Usage-Based Insurance Is Transforming Auto Coverage  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits