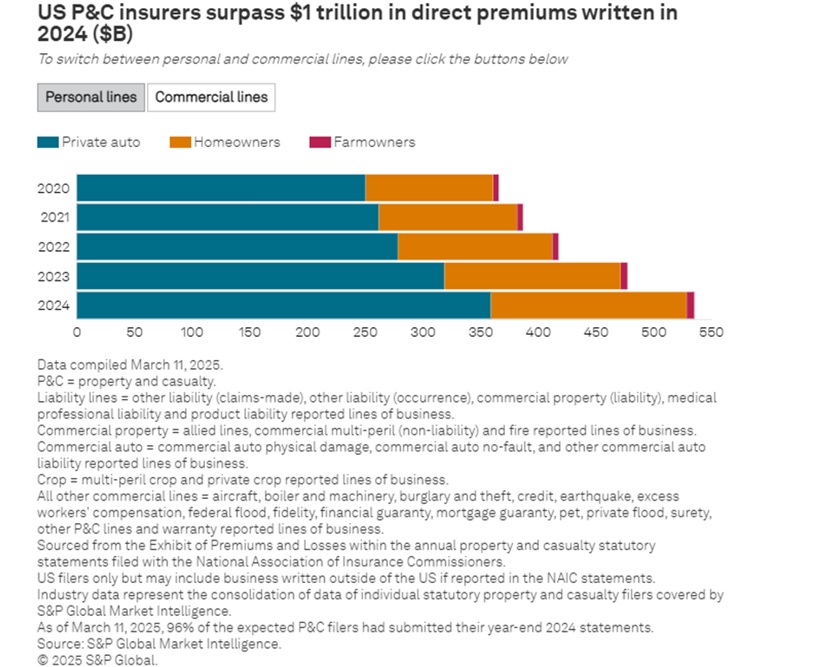

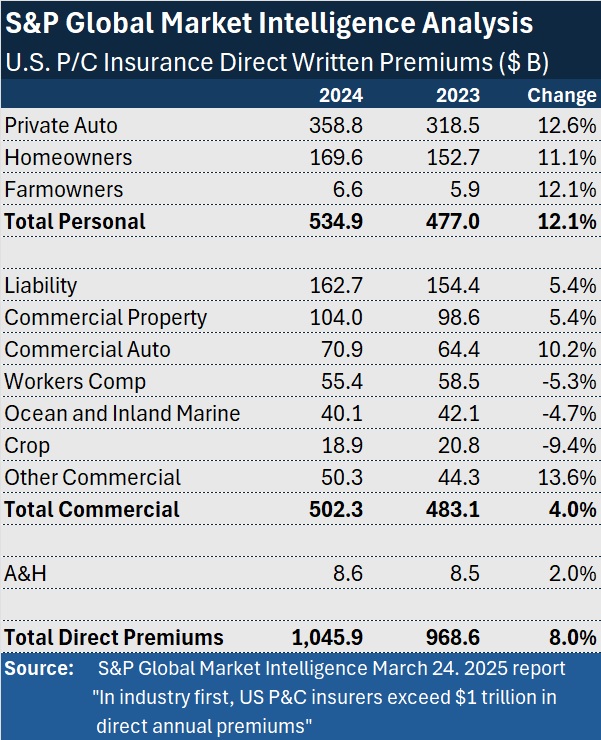

An industrywide direct written premium total of $1.05 trillion in 2024 marked the first time in the history of the industry that U.S. property/casualty insurer premiums eclipsed $1 trillion, according to a recent report.

The report from S&P Global Market Intelligence late last month also noted that the 8 percent jump in 2024 direct premiums over 2023 got big boosts from the private passenger auto, homeowners and commercial auto insurance lines, each posting double-digit percentage jumps over 2023 levels.

In aggregate, personal lines direct premiums—for private auto, homeowners and farmowners—rose 12.1 percent to $534.9 billion, compared to $477.0 billion in 2023. Private auto saw the biggest increase of any line—with direct premiums rising 12.6 percent to $358.8 billion last year. For the homeowners line, 2024 aggregated industry direct premium were $169.6 billion, roughly 11.1 percent higher than in 2023.

Commercial lines contributed $502.3 billion to the 2024 direct premiums total for the industry, growing just 4.0 percent above the 2023 total. While aggregate direct premiums for the commercial auto line jumped 10.2 percent, commercial liability and commercial property premiums each rose just 5.4 percent, according to S&P GMI’s calculations. S&P GMI includes premiums for product liability, medical professional liability, commercial multi-peril (liability) and “other” liability in the commercial liability analysis.

The biggest premium jump—13.6 percent—was indicated for a combination of “other commercial lines”—lines other than liability, property, auto, workers comp and marine. These include pet insurance, which used to be part of the inland marine line of business but started being included as a standalone line of business in 2024. Excess workers comp, aircraft, boiler and machinery, burglary and theft, credit, earthquake, federal flood, fidelity, financial guaranty, mortgage guaranty, private flood, and surety are some of the other P/C lines represented in the “other commercial lines” total.

From a direct incurred loss ratio standpoint, the U.S. P/C industry’s overall performance improved 3.5 points to 61.9 in 2024, compared to 65.4 in 2023. Interactive graphics included in the S&P GMI report reveal weakening in the direct incurred loss ratios in several commercial lines—notably other liability, which deteriorated more than 7 points.

Reference the full S&P GMI report, “In industry first, US P&C insurers exceed $1 trillion in direct annual premiums | S&P Global,” for more details.

The industrywide improvement across all lines was driven by substantial improvement within personal business lines, which posted a 9.3 percentage point decrease to 64.6.

The data in the S&P GMI report was sourced from the Exhibit of Premiums and Losses within the annual property and casualty statutory statements filed with the National Association of Insurance Commissioners. As of March 11, 2025, 96 percent of the expected U.S. P/C filers had submitted their year-end 2024 statements, S&P GMI noted.

Source: S&P Global Market Intelligence

What to Expect in 2026: U.S. P/C Results More Like 2024

What to Expect in 2026: U.S. P/C Results More Like 2024  Viewpoint: Agentic AI Is Coming to Insurance Industry – Much Faster Than You Think

Viewpoint: Agentic AI Is Coming to Insurance Industry – Much Faster Than You Think  Viewpoint: Mapping Evolving Regulatory Terrain for MGAs, MGUs and Other DUAEs

Viewpoint: Mapping Evolving Regulatory Terrain for MGAs, MGUs and Other DUAEs  Hong Kong Fire Reveals Contractor Safety Breaches, Residents’ Revolt

Hong Kong Fire Reveals Contractor Safety Breaches, Residents’ Revolt