When this reporter started her career in insurance a few decades ago as an actuarial quality control technician for the National Council on Compensation Insurance, the only computers we had sitting on our desks were printing calculators.

Executive Summary

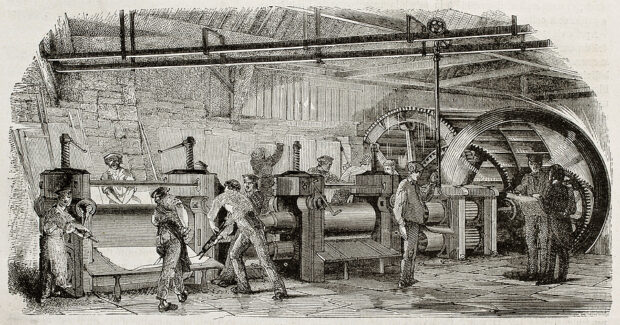

Borne out of the need to address the consequences of workplace injuries, worker compensation insurance—and the National Council on Compensation Insurance—trace their roots back to the days of the First Industrial Revolution. Mark Mileusnic, NCCI’s chief customer operations officer, reflected on the history of the rating, data collection and advisory organization and recent moves to address the needs of insurers and agents delivering comp insurance to workers of the Fourth Industrial Revolution.Computers—or what we called “CRT terminals” back then—were clustered behind the cubicles in a hub at the back of the office.

Marked-up state benefit comparisons and rate filings were sent to a typing pool for final printing. And two women sitting across from one another in the back of the typing room alternately read off text and long columns of class codes and rates, one at a time, in an effort to proofread those documents before they were sent off to insurance departments for approval.

Fast forward to 2023—100 years after the workers compensation rating, advisory and data collection organization came into existence—and Mark Mileusnic, NCCI’s chief customer operations officer, is talking about server-to-server delivery of data to insurance carriers, the prospects of AI and efforts to train a future generation of workers compensation professionals.

While Mileusnic, himself, missed the calculator and typing pool days, the 37-year veteran of the industry has seen his share of change over the 17 years he’s been with NCCI, highlighting moves to expand data, deliver thought leadership, events and one-on-one customer service to carriers and agents. During the last eight of those years, the industry has recorded underwriting profits in the workers comp line even though prices continue to drop, keeping carriers wary of a return to the 115-120 combined ratios that followed the Great Recession.

He talked about milestones of NCCI’s century of operation and the state of the market with Carrier Management earlier this month.

Service to 900 Carriers

After progressing through a variety of management positions at Chubb, Mileusnic joined NCCI in 2006 to lead the customer operations team. The team is “responsible for all of our outward-facing customer relationships,” he said, reporting that a direct carrier engagement and relationship management team works closely with roughly 900 insurance companies across the country.

NCCI’s reach expands across 36 jurisdictions today. In the early days, the organization provided services to just 69 workers comp insurers in 10 jurisdictions.

“We’re either visiting them in person or virtually,” Mileusnic said, referring to the 900-carrier cohort today, also noting that carrier professionals engage with NCCI at events, such as the Annual Insights Symposium scheduled to take place in May this year, and participate on NCCI boards and committees.

Officially, NCCI reports that the customer operations team includes affiliate services, product management, experience rating production, assigned risk and a customer service call center. That means the group is responsible for all of the applications for the residual market, all of NCCI’s experience ratings, and all online tools and solutions, Mileusnic said. “We have a call center that takes hundreds of thousands of phone calls each year from both carriers and agents,” he added.

While confirming that financial and actuarial professionals are among the carrier stakeholders engaging with NCCI’s customer operations team, Mileusnic said his team deals with “everyone from the CEO to the chief underwriting officers to the work comp line of business manager” depending on the company and the size. “Those using our tools every day, though, are line underwriters, loss control, claims folks,” he said.

Mileusnic highlighted “utilization reviews” as a newer form of carrier engagement. It’s important “to make sure there’s a great awareness of all of the things that are available to our carriers to use,” he said, referring to annual reviews arranged for individual carriers to go over the tools they are currently using across the divisions, and those tools and events they may have missed. “NCCI has a very robust website. There’s a lot of information, lots of tools and services. But there’s regular change that happens at carriers with staff coming and going,” he said, highlighting the value of utilization review.

The Affiliate Services department of the NCCI’s customer operation group is primarily responsible for the relationships and engagement with the carriers on an ongoing basis. “They will have 2,000 engagements with carriers over the year,” gathering feedback to guide NCCI’s activities going forward.

“We really do serve as the nation’s most comprehensive source of work comp data and insights and solutions. So, we’re more engaged than ever with those stakeholders through those relationships [and] through the information that we provide like ratemaking and classification, experience rating. We do reform analysis across the states, probably 800 bills a year. And pricing. And residual market management. They’re just important to the everyday workings of the work comp system,” Mileusnic said, stressing the idea that the mission of NCCI—to foster a healthy workers comp system—has not changed in 100 years.

Decades of Change; Academy Launched

Still, NCCI’s role for the industry has expanded over the decades through added services, enhanced solutions and data analysis. Over the course of NCCI’s existence in support of a system of insurance once known as workmen’s compensation, the firm has delivered data and insights through 17 recessions, a world war and a fourfold expansion of the U.S. workforce to 165 million people, CEO Bill Donnell noted in a January website article, referencing a Bureau of Labor Statistic figure for the U.S. civilian workforce.

“We’re currently working on a transition to assume the residual market administration in Oklahoma next year,” Mileusnic said, giving one example of service expansion. “We’re not pursuing that change, but it still happens as changes happen in the marketplace. It’s much like a lot of the things that we focus on for research or the tools that we offer. They are driven by the needs that have evolved over the decades.”

Asked about NCCI milestones during his tenure, Mileusnic said the collection of key additional data that informs our ratemaking and analysis stands out, highlighting the launches of medical data and indemnity data calls in 2010 and 2020 as significant changes. “We’re constantly looking to improve the information access for stakeholders, too. So, we offer web services. Carriers can have a server-to-server connection with us where they’re directly taking information. That didn’t exist before,” he said.

Updating 100 years of workers comp manuals has been another big project, he reported. “We have been taking all of that content and rewriting it and making it easier to read and access.”

Mileusnic also led the development of NCCI Academy, which launched in 2021. “We’re making a whole new level of learning available that really complements what carriers might be doing already. We’re not trying to train anybody how to be an underwriter or claims person. [Instead], classification and experience rating and ratemaking—all of those elements are things that we focused on.”

“We’re making a whole new level of learning available that really complements what carriers might be doing already.”

Mark Mileusnic, NCCI

Explaining the impetus for creating NCCI Academy, Mileusnic noted that NCCI’s website has offered longer form webinars on those topics for a long time. “But there’s a lot of changes that have happened in the industry. More experienced folks are retiring, and a lot of new people are coming into the industry that learn differently. They want shorter, quick bites” of knowledge, he said, noting that NCCI partnered with Cornerstone, a learning platform, to build logical training paths into NCCI Academy. Mapping out what courses a learner needs to take first, and subsequent modules to build upon the initial ones, the platform “tracks your progress and tests your knowledge along the way. You can earn a certificate at the end of it,” he said.

Launched with core curriculum on classification, experience rating and ratemaking, NCCI has been adding content about three times each year, now offering 53 different courses and 13 different curricula. “Since its introduction, we’ve had over 25,000 individual courses taken and over 5,000 certifications completed. We’re really encouraged by the uptake from it,” Mileusnic said.

“As we continue to add more content, we’re now adapting how we’re presenting that.” The experience used to be “click on this, click on this. Now, we’re moving to like a Netflix-like carousel” to view course offerings.

“We’re going to be adding digital badging, which a lot of folks are keen on getting to recognize the achievement of the learning,” he added.

On the horizon, Mileusnic talked about the possibility of presenting different groupings of content for different types of professionals. In other words, in addition to a group like a 10-course introduction to workers comp basics, the Academy offer curricula specific to the needs of underwriters or claims professionals.

According to the NCCI executive, 70 of the companies working with NCCI have indicated that they’re making NCCI Academy courses part of their required learning for their staffs. “Because we use an outsourced platform, there’s a per-user fee, but we have made it free to carriers,” he said, confirming that carriers use the platform at no charge to them. “A better educated workforce is good for us, too.” Carriers do not pay the per-user fee, NCCI confirmed.

So far, the introduction to worker comp group of courses is the most popular with students. “Next month, we’re going to be doing some new releases on data for a non-data reporter,” he said, explaining that understanding the different type of data collected might be important to an underwriter thinking about the drivers of changes in rates and loss costs.

NCCI’s website also has a Data Now Program, separate from NCCI Academy, that is geared to the data reporters. “That’s an annual program that we offer also free of charge to all of our data providers to help them have the tools and the know-how to report their data in a quality and timely fashion to NCCI—because that in turn flows into all of our other products and services, be it ratemaking or research or tools and solutions that we offer.”

During the pandemic that transitioned to a virtual program, but Mileusnic said carriers have told NCCI they would like it to go back to an in-person format because of the networking and engagement benefits. NCCI is likely to bring that back next year, he said.

State of the Market

Among the other NCCI developments Mileusnic highlighted as part of NCCI’s evolution in recent years has been the its expanded thought leadership role through the delivery of research derived from the mass of data collected from the industry. Among the recent insights on NCCI’s website are a four-part series of articles on “Inflation and Workers Comp Medical Costs” and a December post delivering “An Interactive View of Workers Compensation Frequency and Severity,” allowing readers to better understand how factors such as the COVID-19 pandemic and changes in industry mix may impact aggregate claim frequency.

Surveys, Mileusnic said, are another form of customer engagement, including an annual survey of top insurance executives in which they have shared front-of-mind concerns in recent years. Chief among the worries cited in the 2022 survey is rate adequacy—and the question of when the loss cost trends contributing to historically low combined ratios and declining premium rates will turn.

Mileusnic noted that an ongoing trend of lower frequency has certainly contributed to the low combined ratios for the last seven or eight years. “It’s really unprecedented to see such a long run of good news for work comp from a combined ratio perspective while rates are also continuing this downward movement in most jurisdictions, and for most classes, too. So, carriers are certainly anticipating a market turn, with rates turning upward. But that really varies. Differences in books of business are really going to give one carrier a different view on that than another,” he said.

Overall, NCCI believes frequency will continue its long-term downward trend. “We don’t see that changing in the near term. And I think there’s also been this whole generation of underwriters who’ve learned to exercise discipline in the underwriting process—to underwrite to profitability. That’s certainly a factor that will continue to play into this.”

“And through our analysis, and the filings that we make, we’re looking to continue to make rate recommendations that represent rate adequacy for the line.”

Asked about another key concern that surfaced in the executive survey—medical inflation—and whether wage inflation is acting to counterbalance cost trends, Mileusnic said that NCCI’s Chief Actuary Donna Glenn is going to present a deep dive into the topic at the upcoming Annual Insights Symposium. Giving a higher level view for now, he said that when people think about inflation generally, the high numbers, like those cited for general price inflation last year, spring to mind. “When you parse that down within work comp, and within medical, it’s a much lower number than that. It’s actually been quite moderate for the last few years. Nothing like we saw a decade ago or more.”

“A few years ago, medical severity was a lot higher, but today is more moderate.”

Beyond medical inflation, “technological changes and staff changes are among issues that are going to occupy people’s minds right now, [and] this long-term frequency decline’s been happening since at least the late ’90s. When you think about the things that are contributing to that, certainly there’s increased workplace safety. There’s mix shifts toward safer industries that have occurred, too, and advancements in technology,” he said.

What’s Next?

NCCI has come a long way since the 1920s when Schedules W and Z, based on Unit Statistical Plan (individual policy exposure, premium and loss data) were the primary sources for ratemaking.

“Today, data collection is obviously way more automated than a century ago. We also collect [aggregated policy and calendar accident year] financial data and claims data—the detailed medical and indemnity data among others. But that data collection role is the first step,” Mileusnic said. “Then there’s the validation part of it for us, so there’s high confidence in the quality of the information that’s going into all of our tools and services.”

“And then the stewardship role that NCCI has to contribute to a healthy work comp system. We’re collecting this information from all of these different companies to ensure the accuracy of the products and services that go back, in turn, to them. We take that very seriously,” he said.

Asked about current and future applications of AI for NCCI and workers comp carriers, Mileusnic said, “We’re certainly looking at the implications of it, like everybody else is,” noting that insurance company presentations he’s seen are cautious but optimistic about the potential of AI to inform decision-making.

Mileusnic also confirmed that NCCI looks at what InsurTechs are doing in terms of accessing third-party data with the promise of faster and more efficient underwriting and pricing processes. “We’re looking at all of those things, but nothing that is imminent,” he said. Through NCCI’s committee structure, and carrier participation on an actuarial and underwriting committees, in particular, “we’re regularly hearing about the things that different carriers are doing around data. Their role with data and our role with data are obviously a little different, but all of the things that we’re talking about, they’re certainly regularly being evaluated here [so] we can do even better moving forward.”

Mileusnic also confirmed that NCCI looks at what InsurTechs are doing in terms of accessing third-party data with the promise of faster and more efficient underwriting and pricing processes. “We’re looking at all of those things, but nothing that is imminent,” he said. Through NCCI’s committee structure, and carrier participation on an actuarial and underwriting committees, in particular, “we’re regularly hearing about the things that different carriers are doing around data. Their role with data and our role with data are obviously a little different, but all of the things that we’re talking about, they’re certainly regularly being evaluated here [so] we can do even better moving forward.”

It there anything unique that carriers are looking for that NCCI isn’t offering today?

“I ask that question on every visit that I go on. And usually, because of the regular engagements that we have, we’re hearing pretty quickly about research areas of interest and insights they’re seeking.”

Carriers, he reported, are pleased with NCCI’s responsiveness, based on scores coming through annual customer surveys.

Internally, NCCI staffers seem pretty pleased with the 100-year-old backbone of a healthy U.S. workers comp system, too. “Our average tenure here is over 15 years,” Mileusnic said, noting that some team members have 40 years at NCCI. “It’s such a great company—a lot of dedicated folks doing great work….Technology continues to be a game changer in how we’re doing things.

“We’re excited about that, and adapting to that. And even if they’re here 40 years, team members are adapting to that, and they’re liking it, too.”

“We are grateful for the role that we play with the industry and the partnerships that we have across the industry,” he concluded.

The Future of HR Is AI

The Future of HR Is AI  Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits

Focus on Ski Guides After Deadly California Avalanche Could Lead to Criminal Charges, Civil Suits  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  10 Do’s and Don’ts of a Smart ORSA Report

10 Do’s and Don’ts of a Smart ORSA Report