Cash flow in excess of cost of capital was utilized as the primary metric to measure the amount of value generated by each of the 100 carriers analyzed in “The ACORD U.S. P&C Value Creation Study.” (Related article, “Digital Maturity: The Path to Sustainable Value Creation”)

Cash flows were adjusted for the impact of accounting treatments and other factors and segmented across underwriting and investments.

Cost of capital was determined by the performance of a diversified portfolio—the compound annual rate of return of the S&P 500 during the 20-year study period, or 4.0 percent.

Why use this measure of value creation?

Markets will draw capital away from firms not achieving baseline minimum returns. Therefore, ACORD measured the amount of free cash flow generated through both underwriting and investments versus a minimum required capital charge. This required rate of return, which an investor could have achieved by investing in a diversified portfolio of investments, was represented by the returns of the S&P 500 over the 20-year period: 4.0 percent.

A key benefit of this approach is that it enables a consistent comparison across all types of insurers, including mutual, publicly traded, reciprocals, large national and regional.

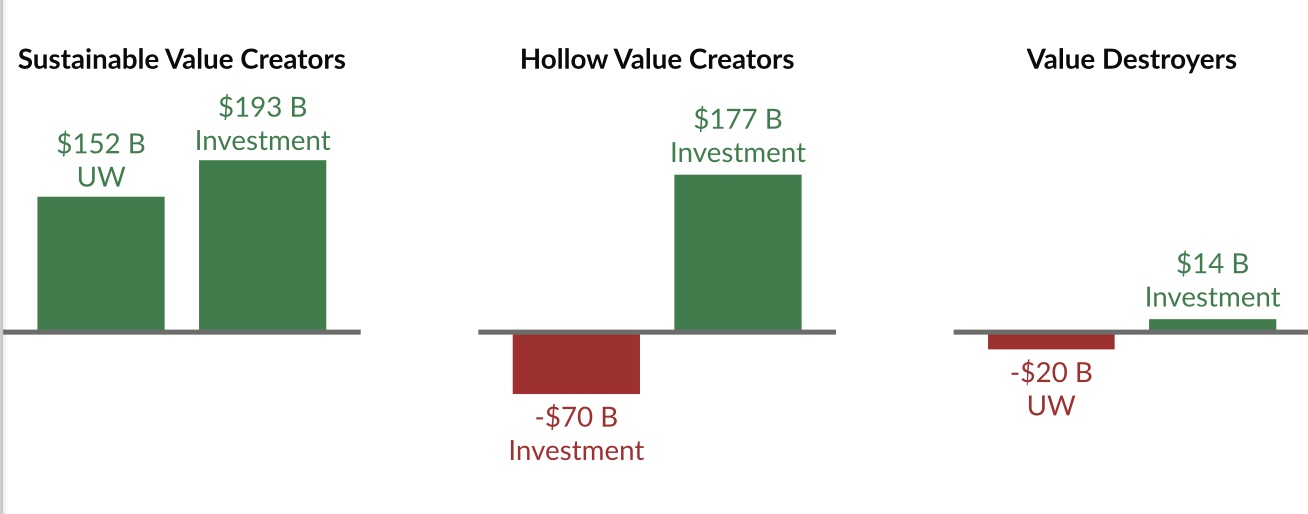

Based on the sources and level of value created, companies were classified as either value creating or value destroying. Value creating companies were then further segmented into one of two categories:

- Sustainable carriers were those that generated value through both underwriting and investment activities.

- Hollow value creators destroyed value through underwriting but generated a high enough level of value through investment activities to overcome the deficit.

Source: The ACORD U.S. P&C Value Creation Study, February 2021

Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  Teens’ First Year on the Road Most Deadly

Teens’ First Year on the Road Most Deadly  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next