In the wake of current events, industries and economies worldwide are scrutinized daily. How have they weathered the pandemic? Who is best positioned in the aftermath? What lessons have been learned from this unprecedented upheaval?

Executive Summary

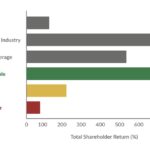

The performance gap between leading insurers and the market is becoming more profound and evident, according to ACORD's Bill Pieroni, who notes that a clear differentiating factor between the two groups has been their systematic and disciplined investment in digital capabilities. Here, he reveals the overall results of ACORD's "U.S. P&C Value Creation Study," reporting that while 91 of the top 100 U.S. P/C carriers created value—defined as cash flow in excess of their cost of capital—for more than half, value creation came only from investment income. Digitization, he says, allows carriers to execute simultaneously on the four fundamental strategies of operational excellence, customer intimacy, product leadership and innovation, without having to make tradeoffs to focus on one and not the other three.The insurance industry is no exception. But insurance, as always, is a long-term story.

Recent events have served to increase the transparency, urgency and impact of market forces affecting our industry. However, these forces were underway well before 2020. The global insurance industry was—and continues to be—in the midst of a critical and material inflection point. Forward-thinking organizations are positioned to address key challenges, but the gap between the “haves” and “have-mores” continues to widen. The performance gap between leading insurers and the market is becoming more profound and evident. A clear differentiating factor has been their systematic and disciplined investment in digital capabilities. Digital enablement is the key to not only surviving current difficulties but thriving now and in the future.

Studying Value Creation

The U.S. property/casualty insurance industry is the largest and most complex in the world. It accounts for nearly 40 percent of global premiums. Moreover, it is a hyper-mature market and exhibits many of the most important forces driving global markets. Due to the variety of ownership structures, product lines, regulatory jurisdictions and customer segments, it has historically been difficult to accurately measure value creation among U.S. carriers—let alone understand its drivers.