COVID-19 has exacerbated socioeconomic inequality and exposed vast racial and economic disparities in America. Millions have lost their jobs, and research shows that historically under-resourced communities have been hit especially hard both by the virus itself and the economic fallout.

Executive Summary

“It is our responsibility to customers to do all we can to eliminate bias from the processes, models and systems we use to price insurance products,” writes Alex Timm, CEO of Root Insurance.In October last year, Carrier Management asked P/C carrier executives to tell us what issues they care about and how their companies and others can work to right social wrongs. Here, Root’s CEO answers the call, describing his company’s commitment to eliminate a rating factor that exacerbates inequality in auto insurance—credit scores—and invites others to join him.

The auto insurance industry has an opportunity to help those communities recover and eliminate a longstanding source of bias. We believe the time is right to take steps to create meaningful change.

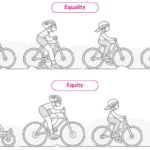

Currently, the industry relies heavily on credit scores and other demographic factors to determine insurance risk, with over 90 percent of U.S. auto insurers using it to price policies. And yet, demographics and credit do not cause increased risk, even if they may be correlated. Under this system, those with lower credit scores are often forced to pay more, even if they are the safest drivers on the road. This means drivers with poor credit can pay $1,500 more on average than those with good credit, according to data from The Zebra.

Relying on credit scores entrenches bias into pricing, which disproportionately impacts historically under-resourced communities, recent immigrants, and those facing economic crises such as job losses and large medical expenses. This system has profound effects that are well-known and well-documented. For instance, access to banking and credit has been far harder for historically under-resourced communities. According to the Urban Institute, while 50 percent of white households have FICO credit scores above 700, only 21 percent of Black households do. More problematic, many communities lack access to credit all together.

In a December 2016 report, the Consumer Financial Protection Bureau found that about 15 percent of Black and Hispanic Americans are credit invisible compared to 9 percent of whites and Asians. Since over two-thirds of Americans rely on a car to get to work, the result of a credit-based pricing system is a vicious cycle that targets those who can least afford auto insurance and charges them more.

At the end of the day, we should all agree that the best drivers should pay the lowest rates, regardless of their demographics or credit score.

But phasing out this practice will take time. Measuring risk is a hard and complex process, but it is our responsibility to customers to do all we can to eliminate bias from the processes, models and systems we use to price insurance products. Thankfully, we can now measure risk based on actual driving behavior regardless of demographic factors like credit score. Using telematics, we can measure every aspect of driving, such as hard braking, speed of turns and whether a driver uses their phone while driving. Based on this data, we can calculate a rate that more accurately reflects how someone drives and how much risk they pose.

“At the end of the day, we should all agree that the best drivers should pay the lowest rates, regardless of their demographics or credit score.”

But we also know change does not happen overnight. Credit scores are permitted for use in auto insurance in 47 states, and yet asurvey of 1,003 adults conducted by Root reveals that 66 percent of Americans do not know that credit score is a factor in determining auto insurance price. Once aware, however, 63 percent feel that the practice is unfair, and 93 percent think it is important for the industry to remove bias and discrimination from its pricing practices.

At Root, we’ve already made significant strides to eliminate bias by making the decision never to use occupation and education level—two factors which can lead to biased outcomes—for any policy we issue. Then, last August, we went one step further and became the first auto insurance company to commit to removing credit-based scoring entirely from our pricing process. But even when we fully remove biased credit-based scoring from our pricing, we recognize this still will not be enough.

Thankfully, the industry is waking up to the need for change.

The National Association of Insurance Commissioners recently formed a special committee on race and insurance to engage with a broad group of stakeholders to “examine and determine which current practices or barriers exist in the insurance sector that potentially disadvantage people of color and/or historically underrepresented groups.” This is a positive development, and we are hopeful that the industry will put forward creative ideas and policy solutions to create a fairer system of insurance.

A strong, healthy and well-regulated system of insurance that helps empower people is more important than ever. Insurance helps manage risk, create jobs and expand opportunity. It will also play a vital role in restarting the economy and helping Americans get back on track. Over the last year, we’ve seen just how deeply divided we are as a country. Between the COVID-19 pandemic, its economic impacts and the renewed focus on our country’s crisis of racial injustice, the basic assumptions that shape our economy have been called into question as consumers demand change.

Businesses—including the auto insurance industry—not only have a responsibility to their shareholders and employees but also to society and must take action to address these systemic inequities. By eliminating credit scores as a factor in our rating system, we will do our part in creating a future that is fairer.

It’s a vision we’re committed to at Root, and one which we hope others in our industry will share.

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages