“Legitimizing the Shared Economy.”

Executive Summary

With goals of moving gig economy workers up from subprime credit status into the middle market, Marty Young, co-founder of Buckle, joined forces with nonstandard auto insurance agent Dustin Walsey to create an InsurTech modeled on the credit, insurance and advocacy platform that USAA built for members of the military. Drawing from his own background in the military, in automotive retail and in the turnaround restructuring world, Young also envisions a place for a different kind of InsurTech—one that deconstructs the pieces of an insurance carrier into claims handler, paper provider and risk taker and prepares for a future when reinsurers and tech oligopolies offer insurance and everything else.The phrase, with a trademark symbol at the end of it, is the first thing visitors see on the “About Us” page of InsurTech Buckle’s website.

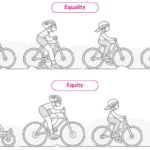

On another website page, co-founder Marty Young summarizes the Buckle philosophy: “We believe in fairness,” he writes. “Forgiveness of debt is a moral high ground agreed upon by most faiths, creeds and cultures. Therefore, there should not be such a focus on the notion of charging someone more for poor credit.”

Like other InsurTechs recently featured in Carrier Management, Buckle is intent on taking credit score out of the formula for auto insurance pricing and building a business model around the notion of fairness. In fact, Buckle’s founders ultimately aim to create a full financial services platform that also actually extends credit to a group that’s predominately subprime: the soldiers of the gig economy, including Uber and Lyft drivers and DoorDash delivery workers.