In June of 2007, Apple released its first iPhone — a big step for mobile technology and an even larger step for mobile app developers. The first steps in app development were web apps — sites that were formatted for use in mobile and launched from the screen with an icon button. But in July 2008, a momentous thing happened. Third-party developers were invited into the iPhone portion of the Apple ecosystem. Apple’s head of iPhone software development, Scott Forstall, said, “Starting today, we are opening up the same native APIs and tools that we use internally to build all our iPhone applications.” He then described all of the device features and technologies that developers would have access to, including Core Location data and Address data. Suddenly a platform was a near-instant bridge from development to new markets. In the same presentation, Steve Jobs introduced the App Store.[i]

The iPhone and the App Store gave developers the freedom to develop within an ecosystem that would act as pipeline, a marketing tool and a feedback device. App developers were players in the ecosystem, but they were also value-creation providers. They did as much for Apple as Apple did for them. The MacBooks, the iMacs, the iPods and the iPads may have been the tangible devices in the full Apple ecosystem, but it was the open development within the mobile ecosystem that gave users more value than the sum of the devices.

An equation that works.

True ecosystems capitalize on the functionality brought in by third parties to platforms, devices and systems, utilizing the technology and data hubs found within the ecosystem. In some cases, insurers act as the ecosystem core. In others, such as in Group & Voluntary Benefits, they are now beginning to act as the third-party developers. If we consider how every feature of an iPhone became a potential enabler of new products and services, we can extrapolate how insurers are now open to creating an increasing array of customer-focused products that are integrated to employer ecosystems and other devices within their ecosystems.

Nearly every lesson learned in those first few years of app development and ecosystem building is applicable to Group & Voluntary Benefits insurers today. We are in the midst of a crucial juncture in Group & Voluntary Benefits market development — the point where employment trends, technology, partnership and ecosystems are going to radically reconstruct how employee Group & Voluntary Benefits are created, distributed and used. It is, for the time being, a wide-open realm of possibilities for insurance product and service creation teams.

However, to take advantage of the opportunity, insurers need to adopt a development mindset. Technology is the ecosystem enabler, as Celent points out in its recent Majesco-commissioned report, Next-Gen Platforms in Group and Voluntary: Exploiting New Opportunities Across the Worksite Ecosystem. In a previous article, we set the stage for our technology discussion by assessing the market opportunity and how the timing is right for Group & Voluntary Benefits insurers to position themselves or reposition themselves by building customer-friendly technology solutions using real-time, cloud-based processes facilitated through API integrations. Today we go deeper into the technology, seeking some additional guidance from the Celent report. How have insurance system architectures advanced to enable insurers to participate in the Group & Voluntary Benefits ecosystem space?

A new way to build systems using blocks and layers.

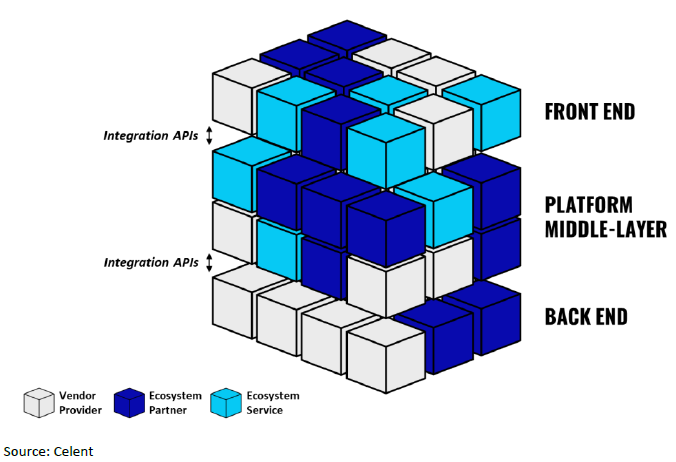

System development, as we all know, is a series of advancements and trends. One of the most recent trends in digital transformation has been to split out front-end tasks and solutions into their own digital layer to enable more efficient communication. As fruitful as that pursuit was, it was only a stop-gap solution because the legacy systems below the digital layer would always be less than optimal in allowing for true real-time access and flexible use. Celent discusses this next shift, architecting the next-gen ecosystem using a building block approach.

“Increasingly, architecting for the ecosystem requires a building-block mindset, where front-end services and back-end services are pulled together in an increasingly essential middle orchestration layer, abstracting critical business logic, packaging it into a set of reusable services capable of being consumed easily up and down the value chain, and then opening up these same services to external partners in the ecosystem for service enrichment, client proposition innovation, and new distribution.”[ii]

The building block approach in layered stacks makes it far easier to plug in the latest developments and microservices — and of course, it allows insurer capabilities and products to be just as useful to developing Group & Voluntary Benefit ecosystems. With building blocks, insurers live out the full definition of enablement. A building block stack enables the technology that then enables the insurer to partner and produce with an innovation mindset. Ecosystem enablement will make Group & Voluntary Benefit insurers more confident in what they have to offer.

The idea factory of the Group & Voluntary future.

An ecosystem is a great idea, made greater by ecosystem contributors. This is why insurers should want to be a part of the Group & Voluntary Benefit ecosystems that have already been created as well as those ecosystems they may create on their own. These ecosystems will be greater than the individual products, services or features that an insurer might bring to the table. They will be participants in the building of something remarkable, if they choose to use the right blocks to build. It is the foundation of technology that will allow the ideas and the products to flow. If insurers could pick a foundational “style” for their technology, what might that style look like?

Central to ecosystem enablement is a business philosophy that champions ideas and innovation. Re-architecting core systems for plug and play is ideal for organizations that crave innovation and have the drive to let their ideas take flight. The new ecosystem enablement will allow for rapid creation, integration and iteration of Group & Voluntary Benefits products. It will allow insurer teams to think big and think fast. Right now, though, these same organizations need to think ahead in order to plan for which blocks of the ecosystem they can quickly create, integrate or tap into with the help of a strategic partner, such as Majesco.

Here is where an assessment should occur. Those who are considering entering the Group & Voluntary Benefits space or those who are already players, but are rapidly needing to expand their services, should look at the direct links between necessary features and the technologies that they must employ to provide them. What will be needed? Will the new products need to tie into existing enrollment technologies, or will they need to stand on their own? How will underwriting and policy work? How do fulfillment and billing work? What are the methods for keeping new products portable? According to Celent,

“Group & Voluntary insurers must both modernize and be able to flexibly plug into new distribution and exchanges at will…a digital middle layer, supported by open-integration APIs, is essential for orchestrating an engaging customer experience capable of knitting together products and services from across the enterprise and beyond.”

Potluck data with a party of connections.

With Group & Voluntary Benefits insurance, one of the greatest ecosystem benefits happens after you arrive at the party. Insurers don’t just bring their service or product and drop it into the ecosystem. In many cases, they also become the partakers of a joint data hub that will improve the user experience, improve the insurer experience and enrich their analytics. Celent states that,

“For Group & Voluntary insurers in particular, the opportunity to combine employer data with employee generated data, whether via smart devices or through enrichment using public sources, presents a significant opportunity to tailor propositions and build long-term loyalty. Put simply, a portable, individualized, personally managed, and data-informed platform is needed.”

And it isn’t just provider and employer data that may be available. The potential is that a host of employee devices will also become sources of data that could be beneficial in improving customer engagement, customer health or lowering risk through improved communication.

The forecast? Cloudy, with a greater chance of enablement.

Every insurer is different, but nearly all of the opportunities and roles available in the new Group & Voluntary Benefit ecosystems will require a hybrid cloud or cloud-native approach. Cloud services are opening doors to easier and faster development, better customer service, greater security and improved data management. (For more on this see our Covered by the Cloud article by Majesco’s CTO, Ravi Krishnan.) Celent points out that,

“To take advantage of what the ecosystem has to offer (and avoid obsolescence), many insurers now express a preference for targeting cloud-native solutions from the outset. It stands to reason. You want a system that’s been architected to take full advantage of what cloud infrastructure and modern approaches to connectivity have to offer.”

Rapid market shifts call for rapid decisions and deployment.

At some point in the employee benefits ecosystem space, next gen core and ecosystems will begin to become entrenched. Their value will be so complete that employers will hesitate to move from one core and ecosystem to another, meaning that now is the time to get in. There will always be space for new products, but once the market swells, insurers will want to be on the leading edge — already a part of the dominant core and ecosystems, and not on the outside, waiting for a turn to get in.

The last fringe benefit of a new approach to Group & Voluntary Benefits technology is that the design and development can happen quickly. Majesco has perfected a process that will move Group & Voluntary players from decision to deployment with speed and excellence in the final result. You’ll gain new markets, but as you can see from the evidence above, your organization will also gain better data, flexible technology, the benefit of experienced partners and the freedom to distribute your ideas through improved Group & Voluntary strategies.

For a closer look at the opportunities, be sure to download the Celent report, Next-Gen Platforms in Group and Voluntary: Exploiting New Opportunities Across the Worksite Ecosystem, and view our recent conversation with myself, Seth Rachlin, Executive VP, Global Insurance Industry Leader, Capgemini and Jamie Macgregor, CEO, Celent, Untapped Market Opportunities for Group and Voluntary Benefits with Diversified Plays, Open Ecosystems and Next-Gen Platforms.

By Denise Garth, Chief Strategy Officer, Majesco. Denise Garth is widely regarded InsurTech and industry thought leader and recognized InsurTech Top 50 Influencer and Top 50 Women Leaders in SaaS, Denise Garth is the Chief Strategy Officer at Majesco. Majesco is a global leader of cloud insurance software solutions with products that empower insurers to modernize, innovate, and connect their business at speed and scale. Garth began working at Majesco in 2015 as a Senior Vice President in Strategic Marketing, Industry Relations, and Innovation. Garth leads the company’s strategy, marketing, industry relations, and innovation in support of Majesco’s client-centric strategy. With both P&C and L&A insurance experience, Garth has also authored research and articles grappling with the key issues and opportunities facing the insurance industry.

[i] https://www.youtube.com/watch?v=MfQtnQHLNcs

[ii] Macgregor, Jamie and Dan McCoach, Next Gen Platforms in Group & Voluntary: Exploiting new opportunities across the worksite ecosystem, p. 16, Celent, August 26, 2021

Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll