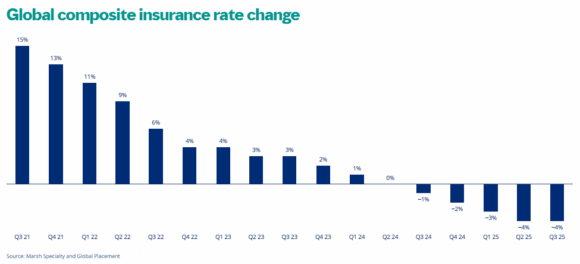

Global commercial insurance rates fell, on average, by 4 percent in the third quarter of 2025, repeating the 4 percent decline recorded in Q2 2025, according to the latest Global Insurance Market Index published by Marsh, the insurance brokerage business of Marsh McLennan.

Q3 marks the fifth consecutive global quarterly decrease following seven years of quarterly increases and is a continuation of the moderating rate trend first recorded in Q1 2021.

Growing competition among insurers, coupled with favorable reinsurance pricing, were the primary drivers for the rate decline along with increased market capacity, Marsh said. (Related: An Unsustainable Trend – Declining P/C Rates and Rising Cost of Risk: Marsh’s Doyle)

All global regions experienced year-over-year composite rate decreases in Q3 2025. The Pacific (at 11 percent), Latin America and the Caribbean (LAC) (6 percent), and UK (6 percent) regions experienced the largest composite rate decreases.

Rates declined in Asia and India, Middle East, and Africa (IMEA) by 5 percent each; in Europe by 4 percent; and in Canada by 3 percent. The overall composite rate in the U.S. – which remained flat in Q2 2025 – declined by 1 percent.

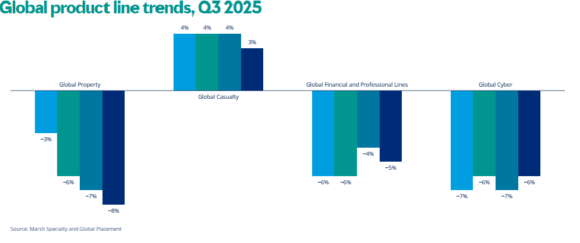

Rates for property, cyber, and financial and professional insurance declined in every region.

Other findings from the Q3 report included:

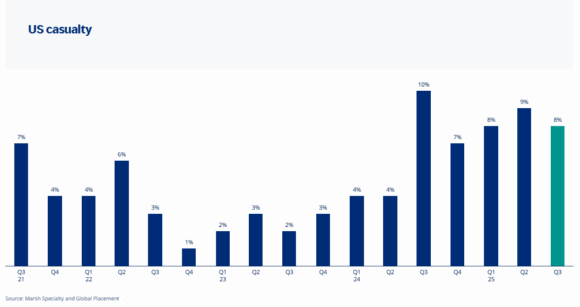

- Casualty rates increased 3 percent globally – down from 4 percent in Q2 2025 – which was driven by an 8 percent increase in the U.S. due largely to the frequency and severity of casualty claims, many of which are characterized by large (so-called “nuclear”) jury awards.

- Cyber insurance rates decreased by 6 percent globally, with declines seen in every region, including double-digit decreases in Europe (12 percent); LAC and the UK (11 percent); and Pacific (10 percent). Cyber insurance rates in the U.S. decreased 3 percent.

- Property rates declined by 8 percent globally, following a 7 percent decline in Q2. The Pacific (14 percent) and U.S. and LAC (9 percent) regions experienced the largest decreases, while all other regions declined between 3 percent and 7 percent.

- Financial and professional lines rate decreases continued, at 5 percent globally in the third quarter compared to a 4 percent decrease in Q2 2025. Rates declined in every region, ranging from 10 percent in Pacific to 2 percent in the U.S.

“With the exception of U.S. casualty, clients are benefiting not only from lower rates but also from opportunities to negotiate improved terms and broader coverage,” commented John Donnelly, president, Global Placement, Marsh, in a statement.

“These rate trends remain consistent in a market characterized by ample capacity. Barring unforeseen changes in conditions, we expect these trends to continue and look forward to helping clients to take advantage of the competitive insurance market,” Donnelly added.

*Note: All references to rate and rate movements in this report are averages, unless otherwise noted. For ease of reporting, Marsh has rounded all percentages regarding rate movements to the nearest whole number.

Is Risk the Main Ingredient in Ultra-Processed Food?

Is Risk the Main Ingredient in Ultra-Processed Food?  How State Farm, USAA Boost Customer Retention: Historic Dividends

How State Farm, USAA Boost Customer Retention: Historic Dividends  Senators Sound Alarm After New Data Shows Fewer OSHA Inspections, Fines

Senators Sound Alarm After New Data Shows Fewer OSHA Inspections, Fines  State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists

State Farm Inked $1.5B Underwriting Profit for 2025; HO Loss Persists