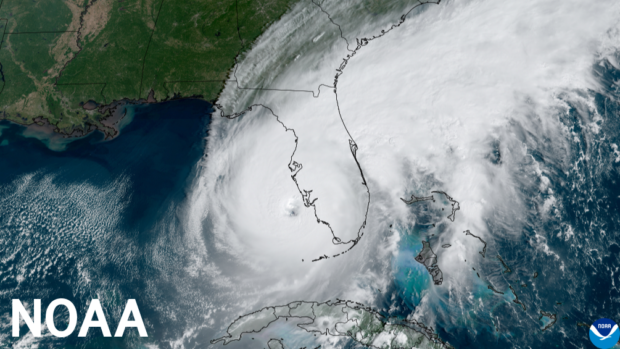

The Florida Office of Insurance Regulation (OIR) announced penalties amounting to $2,075,000 against eight insurers, which it said mishandled claims in the wake of Hurricanes Ian and Idalia.

In 2025, the OIR’s Market Conduct Unit reported that it will finalize examinations of ten companies, of which eight have several findings of misconduct for business practices during Hurricanes Ian and/or Idalia.

Findings included using adjusters not properly appointed, not acknowledging receipt of claims communications in a timely manner, not including certain disclosure statements when providing estimates on damage claims, failing to provide Homeowners Claims Bill of Rights, failing to pay interest when owed, and more.

In one examination, the Market Conduct Unit identified error rates of over 60 percent for Hurricane Ian and over 80 percent for Hurricane Idalia, where the company did not include disclosure statements.

In several of the examinations, OIR found companies failed to pay or deny claims within 90 days.

The market conduct examinations included the following companies and penalties:

- American Coastal Insurance Company — $400,000

- American Mobile Insurance Exchange — $400,000

- Centauri Specialty Insurance Company — $100,000

- Clear Blue Insurance Company — $400,000

- Monarch National Insurance Company — $325,000

- Sutton National Insurance Company — $50,000

- Tower Hill Prime Insurance Company — $250,000

- TypTap Insurance Company — $150,000

Two additional market conduct examinations are pending and could result in additional fines.

Fines assessed by OIR do not negatively affect policyholder insurance rates.

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford