Tariffs. Economic volatility. Technology trends. Changing insurance market conditions.

These are all having an impact on property/casualty insurers. But how are they impacting consumers? More specifically, how are they impacting consumers’ insurance buying decisions and their opinions about interactions with personal lines insurers?

Several studies released over the past two weeks reveal that drivers and homeowners have been shopping for insurance deals. One, published by J.D. Power late last month, puts the incidence of auto insurance shopping over the past year at the highest level recorded in nearly two decades. More recent reports from KPMG and TransUnion also find consumers shopping —although not quite reaching the proportions tallied by J.D. Power. These reports also reveal changing homeownership patterns arising as different individuals across generations work to manage personal finances against a backdrop of uncertain economic trends.

Below, we summarize the key findings of all three, disclosing differences in survey time frames and respondent populations. Why are policyholders shopping? How? (What channels are they using?) Who is doing the most shopping? Which carriers give them the best experiences?

KPMG’s American Perspectives Survey: Price and Weather Concerns

Americans are becoming more discerning with their personal finances, evaluating ways to cut costs and weighing major purchase decisions amid escalating economic volatility including tariffs, sticky inflation and elevated prices, according to a new study released by KPMG LLP , the U.S. audit, tax and advisory firm.

Still shopping in 2025? Carriers announcing first-quarter earnings recently confirmed that drivers are still searching for better deals. That caused some head-scratching among analysts listening to the reports.

“Clearly, competitive rate increases are slowing down. Why do you think that is?” one puzzled analyst asked Progressive’s Chief Executive Officer Tricia Griffith. “In the absence of significant rate increases, what’s promoting more shopping behavior?”

Griffith responded: “I think it’s just easier to shop. And I think with all the other inflationary items out there, people are looking to figure out a way to save money—whether it’s eggs at the grocery store or insurance. So, because it is easy—you can easily shop and if the price is right, switch—I think customers are just trying to figure out how to balance their own budgets.”

The second annual KPMG American Perspectives survey covers areas beyond insurance where consumers are reacting to economic pressures.

The second annual KPMG American Perspectives survey assessed the views of 2,500 adults nationwide to understand their outlooks on their personal financial situations, spending plans and preferences, as well as attitudes toward the forces shaping their experiences in banking, insurance, energy, retail, automotive, healthcare, technology and higher education.

The main finding across these topics: Consumers are being cautious—and penny wise.

For example, 68 percent of respondents, including 89 percent of boomers, say they have a low appetite for taking on more credit in this current economic environment. And those that drive say they are trying to time vehicle purchases around tariff increases. Forty-three percent of the surveyed drivers who said they are in the market for cars plan to delay the purchase of a new or used vehicle until they know the impact of new tariffs on vehicle prices. Another 17 percent are trying to rush—buying before any price increases.

While telematics-based pricing may help some drivers cut their insurance bills, the survey finds that only 41 percent of drivers are comfortable with insurance companies having access to their driving data. Seventeen percent are not comfortable at all with the idea of car insurers accessing data about their driving activity and behavior.

Customers have been shopping for insurance, though.

“Some consumers are choosing policies with their wallets,” said Scott Shapiro, KPMG U.S. Insurance Sector Leader, in a media statement about the report, referring to survey data collected about shopping.

Specifically, when asked if an increase in insurance premiums has led them to shop for different insurance providers over the course of the last two years, 21 percent said they have shopped for or switched auto insurance providers, up from 19 percent in last year’s survey. Those making $200,000 or more are the most likely to have switched providers (30 percent), compared with 20 percent of those making between $35,000 and $49,999.

“Insurance companies are grappling with how to reduce churn and increase customer loyalty, while assessing how tariffs might impact prices going forward” Shapiro said.

Another 17 percent of American drivers surveyed said rising insurance costs caused them to shop for different coverage or to change coverage with their current provider.

On the homeowners insurance front, 13 percent said that a price hike had caused them to shop for another provider or switch. The same percentage—13 percentage—said increased premiums prompted them to shop for or change coverage.

Other findings:

- Forty-nine percent are concerned that extreme weather events will continue to increase their home insurance, but nearly the same percentage—46 percent—said no when asked if they have ever considered supplemental home coverages, such as flood, windstorm and hurricane, extended replacement cost or earthquake coverage.

- Sixteen percent said they are not at all aware of supplemental homeowners coverage options.

- Flood insurance (16 percent) and valuable personal property coverage (14 percent) are the top two choices for supplemental coverages.

KPMG also asked about consumer perceptions regarding carriers’ use of technology. Only 29 percent agreed when asked if they thought their insurance company is adequately leveraging technology, such as GenAI, to improve services and interactions. Opinions on this, however, varied by income group with those making more having more favorable views, KPMG reported. For example, 43 percent of Americans making between $75,000 and $99,999 agreed, compared to just 27 percent in the $50,000-$74,999 income bracket.

Should insurers used AI agents to improve their experiences?

When asked if they trust the accuracy of the information and recommendations provided by AI agents in handling their insurance needs, less than one-third (32 percent) agreed. Millennials (40 percent) and Gen Z (36 percent) consumers were most likely to agree.

KPMG LLP conducted the survey online, questioning a representative sample of 2,500 U.S. adults aged 18 and over, with respondent population demographics similar to the 2020 U.S. Census Bureau demographics, according to the report. The survey was conducted nationally and in the regional markets from April 3, 2025 to April 23, 2025.

Not specific to insurance but nonetheless useful information for insurance marketing professionals to know, KPMG also reported that 70 percent of those 2,500 adults said they are using or will likely use free TV that is ad-supported in the next six month, as an alternative to ad-free streaming.

J.D. Power Digital Experience and U.S. Insurance Shopping Study: New Records

Auto insurer websites and apps have become the key competitive “battleground for new customers,” according to the latest insurance-themed customer satisfaction report from J.D. Power, “The 2025 U.S. Insurance Digital Experience Study.

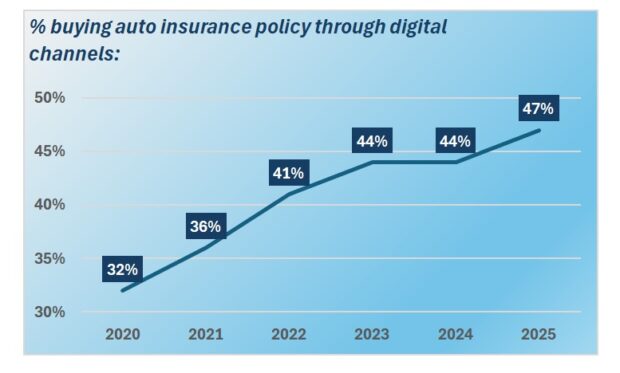

The mid-May report reveals that nearly half, or 47 percent, of all insurance policy buyers now purchase through digital channels, while just 35 percent buy through insurance agents. Even less buy through call centers (17 percent).

The 47 percent revealed in the latest digital survey compares to just 32 percent five years ago, according to prior survey results which J.D. Power shared with Carrier Management.

The U.S. Insurance Digital Experience Study is based on 11,529 evaluations of the digital consumer experiences of auto insurance customers—both shoppers seeking quotes and existing customers conducting typical policy-servicing activities. It was published two weeks after the 2025 U.S. Insurance Shopping Study, which examines the entire auto insurance policy selection process for those customers who requested a price from at least one competitive insurer in the previous six months.

Based on responses from these 12,720 insurance customers who requested at least one quote, gathered from April 2024 through January 2025, 57 percent said they “actively shopped for a policy in the past year.” According to J.D. Power, this is the highest shopping rate ever recorded in the 19-year history of the study.

A separate survey report for the first quarter of 2025—the Loyalty Indicator and Shopping Trends (LIST) report from J.D. Power, conducted in collaboration with TransUnion—revealed that the shopping rate for auto insurance remained elevated during the quarter, coming in at 14.1 percent, compared to a quarterly quote rate of 12.8 percent in first-quarter 2024. The switching rate was nearly flat—4.1 percent in first-quarter 2025, compared to 3.9 percent in first-quarter 2024.

For residential property policies, the first-quarter LIST report showed that shopping was relatively flat for both home and renters insurance, as was the switching rate for home insurance. The switching rate for renters insurance showed the most movement—in this case downward to 3.8 percent. Renters insurance switching peaked in the summer of 2024 (at close to 6 percent) and is now down to pre-peak levels, the LIST report noted.

For the J.D. Power Loyalty Indicator and Shopping Trends (LIST) data, 1,000 surveys are collected daily from the general population of U.S. consumers. The 14.1 percent auto insurance shop rate is based on asking the respondents each day if they shopped for auto insurance “in the last 30 days.” The Q1 2025 LIST numbers are the averages of all the surveys collected from 1/1/25 to 3/31/25, a representative of J.D. Power told Carrier Management.

The representative said that the 57 percent shop rate in the Insurance Shopping Study represents an annualized number: 57 percent of consumers said they shopped for auto insurance during 2024.

For homeowners insurers in 2025, “the rising urgency is to address profitability,” the LIST report says. “We expect to see rate increases and aggressive underwriting actions well into 2026.”

“For auto, focus is shifting toward increasing policy growth and returning to traditional rate approaches—higher premiums assessed to higher risk,” the LIST report says.

TransUnion: High Risk Drivers on the Move

Providing some information from an internal analysis by TransUnion, the LIST report graphically displays year-over-year percentage changes in auto insurance shopping rates for customers in three different credit score bands over a period extending from first-quarter 2021 to fourth-quarter 2024. While those with the best credit (scores of 700 or better) have shopped more than others since early 2022, that started changing during the second half of 2024.

Higher-risk consumers are once again the most active shoppers for the first time since fourth-quarter 2021, TransUnion reported in a separate “Insurance Personal Lines Trends and Perspectives Report,” which includes updated shopping information for the three credit score bands for first-quarter 2025.

“Unlike the relatively broad-brushed base rate increases of 2022-2024, auto insurers may…be returning to traditional rate approaches where the greatest premium increases skew to riskier policies that historically have disproportionately contributed to losses,” the report says, suggesting that the hypothesis is supported by the shift in consumer shopping its more traditional pattern—where the lowest credit score segments exhibit the most shopping behavior.

“As rates have settled for the majority of auto insurance customers, we are experiencing a return to historical insurance shopping patterns, which correlate price sensitivity closely to relative insurance risk,” said Patrick Foy, senior director of strategic planning for TransUnion’s Insurance business, in a statement about the report. “However, uncertainty in the cost and availability of parts for vehicle and home repairs, could eventually lead to a return of broad-based price increases, and weather-related catastrophes—while still unpredictable—have also become a far more common and costly phenomenon,” he said.

Bundling and Embedded Policies

The separate J.D. Power U.S. Insurance Shopping Study suggests insurers should prioritize winning auto insurance customers who bundle home and auto insurance. One-third of customers who actively shopped for auto in the last year sought to bundle, the report said. In addition, customers who bundle stay put with their insurers for 7.0 years, on average, compared to 5.5 years for those who buy auto and home separately.

Offering a general observation about the overall shopping-rate trajectories in the annual Insurance Shopping study, Stephen Crewdson, managing director of insurance business intelligence at J.D. Power, said, “We are seeing signs that shopping rates are starting to normalize” for auto insurance.

“A potentially bigger concern for the [auto insurance] industry right now might be the increased interest many consumers are showing in embedded insurance providers,” he said in a media statement referring to findings about consumer interest in buying insurance from auto dealers, financing companies and manufacturers who integrate the customer’s insurance-buying experience in a product, service or platform.

Interest is particularly strong with Gen Y and Gen Z (47 percent) and with those consumers who say “service” is the primary reason for shopping for an auto insurance policy (48 percent).

The TransUnion Trends and Perspectives report, meanwhile, offers information for home insurers about generational shifts in homeownership.

According to the report, Gen Z and Millennial consumers are less likely than their Boomer and Gen X predecessors to own homes at younger ages. In 2009, 52 percent of Gen X consumers owned homes. But in 2024, only 41 percent of similarly aged Millennials did. “This is primarily due to the increasing size and cost of housing inventories that led to delays in homeownership or have priced many young adults out of the housing market entirely,” the report says.

Executive Summary

Why? How? Who? Auto Insurance Shopping Questions Answered

Why are policyholders shopping?

“Americans are becoming more discerning with their personal finances, evaluating ways to cut costs and weighing major purchase decisions amid escalating economic volatility including tariffs, sticky inflation and elevated prices”—KPMG American Perspectives survey

How are they shopping?

47 percent of all auto insurance policy buyers now purchase through digital channels, while just 35 percent buy through insurance agents—J.D. Power 2025 U.S. Insurance Digital Experience Study.

37 percent of auto insurance customers say they are interested in embedded insurance—J.D. Power 2025 U.S. Insurance Shopping Study

Who is doing the most shopping?

Higher-risk consumers (measured by credit score) are once again the most active shoppers for the first time since fourth-quarter 2021—TransUnion’s Insurance Personal Lines Trends and Perspectives Report

Which carriers give them the best experiences?

Erie Insurance, Automobile Club Group (AAA) and State Farm ranked first, second and third in J.D. Power’s the 2025 U.S. Insurance Shopping Study. (Full ranking list available in related CM article, ” JD Power: Drivers Keep Shopping Even as Auto Insurance Price Increases Slow.”

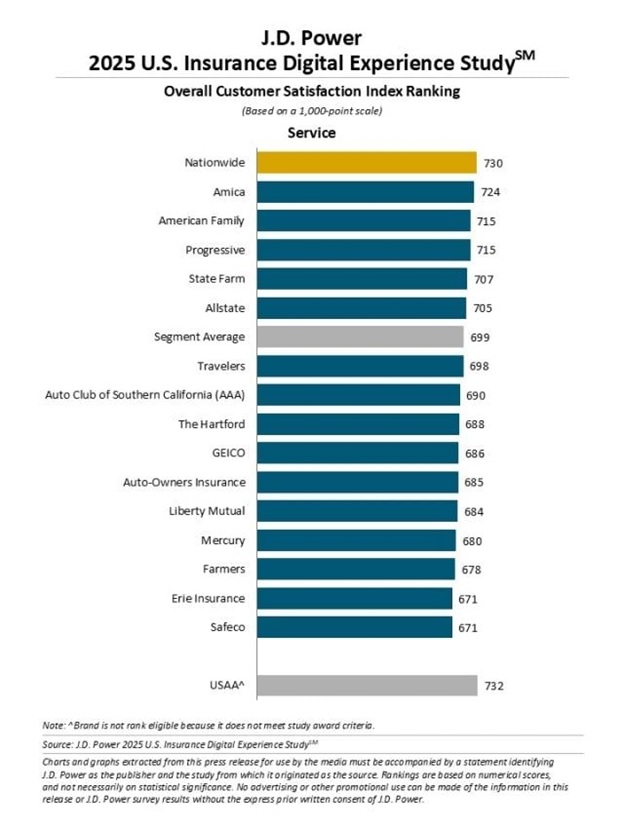

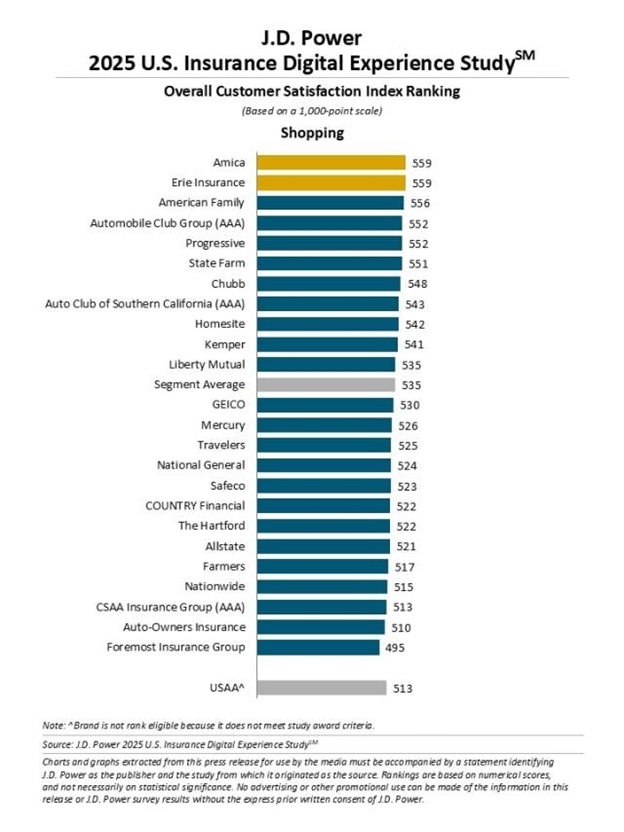

For digital experiences, auto insurance customers rank Nationwide tops for service and Amica No. 1 for digital shopping experience—J.D. Power 2025 U.S. Insurance Digital Experience Study

(Full digital experience rankings displayed at the bottom of accompanying article.)

As a result, there is a shift in home composition, with two- and even three-generation households becoming more common, the report says.

Consumers expect this trend to continue, according to a recent TransUnion consumer survey, revealing that 18 percent of Gen X respondents, 26 percent of Millennials and 35 percent of Gen Z plan to provide financial support to parents and grandparents in the next five years.

“As consumers are readjusting their lifestyles in the face of new economic realities, insurers must also become flexible with their policy offerings,” said Foy. “Multi-generational households represent a different risk profile as well as a different audience segment for their marketing.”

Who’s Delivering Digitally

In addition to documenting a record level of customers moving to digital channels to shop and to complete policy-servicing actions, the most recent J.D. Power report, the “2025 U.S. Insurance Digital Experience Study,” offers customer satisfaction rankings of carriers for both activities.

Nationwide ranks highest in the service segment with a score of 730. Amica (724) ranks second. American Family (715) and Progressive (715) each rank third, in a tie.

Amica and Erie Insurance rank highest in a tie in the shopping segment, each with a score of 559. American Family (556) ranks third.

The study lists 16 insurers in the service ranking and two dozen in the shopping ranking, with very different average scores for the two categories—699 for service and 535 for shopping. J.D. Power notes that the largest gaps between top and bottom digital experiences occur in quote-related functions, such as requesting a quote and comparing prices and coverage.

In a statement about the study, J.D. Power also noted that customers place a high importance on data security. More specifically, customer satisfaction with the auto insurance desktop website and mobile website is higher when multifactor authentication is required.

Finally, the analysis revealed, perhaps unsurprisingly, that customers who have the best digital experiences are more likely to keep using digital channels than those who have poor experiences. When customers have an excellent digital experience—overall satisfaction score of 801 or higher—92 percent say they “definitely will” use digital channels in the future. On the flip side, only 40 percent of unsatisfied customers—those giving satisfaction score of 500 or less—are likely to use digital channels in the future.

Featured image: AI-generated (Adobe Firefly)

Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next

Machine Learning for Mutuals: What’s Working, What’s Not, and What’s Next  State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers

State Farm Mutual to Pay $5B Dividend to Auto Insurance Customers