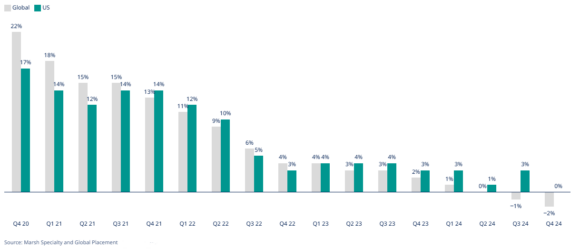

Global commercial insurance rates fell 2 percent in the fourth quarter of 2024 following a 1 percent decline in Q3 2024 — marking the second consecutive quarterly decrease following seven years of rising rates, according to the Global Insurance Market Index published by insurance broker Marsh.

Marsh said the result continues the moderating rate trend first seen in its index in Q1 2021, which is being driven by intensified competition in commercial property insurance, a moderation of casualty rate increases, stabilizing pricing in financial lines, and accelerated rate reductions for cyber risks.

The UK and the Pacific regions again experienced the largest composite rate decreases during Q4, at 5 percent and 8 percent, respectively, while U.S. rates were flat, following a 3 percent increase in Q3 2024.

Asia saw 3 percent composite rate decreases; Europe and Canada both recorded declines of 2 percent; while Latin America and the Caribbean (LAC) and India, Middle East, and Africa (IMEA) experienced increases of 1 percent.

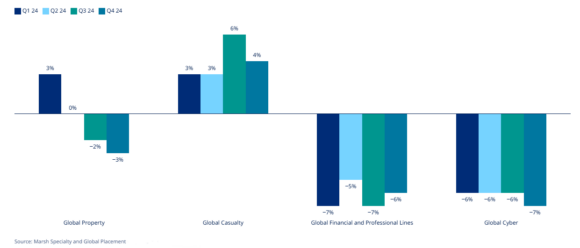

Casualty insurance rates again were the only major coverage line to show an increase globally, rising 4 percent, compared to an increase of 6 percent in the prior quarter. Global property insurance rates declined 3 percent, compared to 2 percent in Q3 2024.

“The softening of rates across property, financial lines and cyber are a positive development for clients, while the challenges in other areas of the market, particularly in U.S. casualty, are acute,” according to John Donnelly, global head of Placement, Marsh, in a statement.

(Click on images below to expand them).

Other findings from the report included:

- Property rates declined 3 percent globally during Q4, following a 2 percent decline in the prior quarter. The Pacific region experienced the largest decrease, at 8 percent. In the U.S., property rates declined 4 percent, compared to a drop of 1 percent in the prior quarter. The UK rate decrease of 4 percent was level with Q3 2024, while Canada saw average decreases of 3 percent, compared with 1 percent in the prior quarter. Property rates were flat in Europe, and IMEA experienced a 3 percent increase in Q4. LAC recorded a decline of property insurance rates of 1 percent (versus a 3 percent hike in Q3 2024), which was the first decrease in 25 quarters. Asia’s property insurance rates declined 3 percent, level with the previous quarter. Marsh said the global property market remains sensitive to loss events, particularly the ongoing Los Angeles wildfires, which will likely affect aggregate catastrophe losses in 2025.

- Casualty rates increased 4 percent globally, following an increase of 6 percent in the prior quarter. U.S. casualty rates saw the largest increase at 7 percent, driven largely by excess/umbrella rates (versus an increase of 10 percent in Q3 2024). Latin America and the Caribbean experienced a 5 percent increase, while all other regions ranged from 2 percent declines to 1 percent increases.

- Financial and professional rates decreased by 6 percent globally (versus a drop of 7 percent in Q3 2024). This marked the 10th consecutive quarter of FINPRO rate decreases. Q4 rate declines were recorded in every region as a result of robust competition and available capacity.

- Cyber insurance rates decreased 7 percent globally, following a 6 percent decline in the previous quarter. Every region saw rate decreases driven by strong competition among both incumbent and new insurers as well as continued improvements in cybersecurity at many companies, Marsh said.

* Note: All references to rate and rate movements in this report are averages, unless otherwise noted. For ease of reporting, we have rounded all percentages regarding rate movements to the nearest whole number.

Source: Marsh

What Berkshire’s CEO Abel Said About Insurance

What Berkshire’s CEO Abel Said About Insurance  How Modern Is ‘Modern Enough’ for Insurance Applications?

How Modern Is ‘Modern Enough’ for Insurance Applications?  NYC to Install Red Light Cameras at 600 Intersections by Year End

NYC to Install Red Light Cameras at 600 Intersections by Year End  As SCS Losses Grow, Demex Offers Modeled-Loss Reinsurance

As SCS Losses Grow, Demex Offers Modeled-Loss Reinsurance