Balance sheet risks and financial performance vary depending upon property and casualty insurers’ ownership structure, according to a special report by Fitch Ratings.

Material differences in operating and financial strategy were found in companies organized by mutual or stock ownership, according to an analysis published in Fitch’s latest report, “Structural Differences Shape U.S. Mutual and Stock Insurers.”

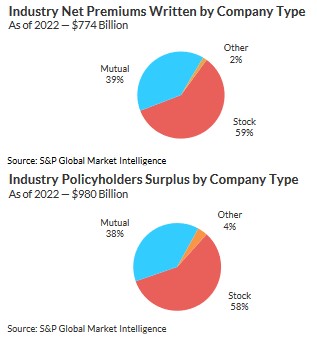

In the U.S. P&C market, about 98 percent of all premiums are written by companies organized by mutual (39 percent) or stock (59 percent) ownership.

Owned by policyholders, mutual insurers require governance structures that encourage management to act in their interest, prioritizing capital conservatism over profitability, the report stated.

Stock company management is challenged to balance policyholder and shareholder interests, the report explained, while earning a sufficient rate of return to raise and retain equity capital.

Placing more emphasis on attracting and retaining capital, stock companies are more focused on better overall profitability.

Mutual companies, on the other hand, “lean toward stronger capital adequacy,” the report stated, protecting it from economic and other risks.

Fitch’s analysis of statutory financial performance measures by each type of company uncovered significantly improved results for stock companies versus mutual companies.

The financial analysis of 240 companies (125 mutual and 115 stock) highlighted measurable differences in capital management, balance sheet risks and financial performance, including:

- Mutual insurers’ median capital adequacy measures are considerably more conservative than stock insurers across all business profile categories.

- Stock insurers report materially better median profitability measures than mutual insurers, including combined ratios and return on surplus.

- Mutual insurers tend to have less loss reserve risk and more favorable reserve experience than stock insurers.

- Stock insurers use greater median asset leverage and generate a modestly higher investment yield than mutual.

- Mutual insurers are more likely to have significant equity asset allocations leading to higher median long run total returns on investments.

There are distinctive differences for mutual and stock insurers in Key Rating Drivers and financial ratios relevant in assigning IFS ratings, the report stated.

According to the rating company, Key Rating Driver guidelines for each factor are the same for stock and mutual insurers.

“Fitch’s Insurance Rating Criteria does not favor either mutual or stock organizations over the other,” the report stated. “The criteria does indicate that only a mutual company is likely to maintain capital adequacy over the long term at a level that would merit an IFS rating of AAA.”

Based on its analysis, “A higher overall rating for the mutual insurer is more likely to derive from better than scoring guidelines and peer company financial performance rather than even more conservative capital levels. Conversely, for the sample stock company, having more conservative capital adequacy and loss reserve measures, relative to rating guidelines and peer companies, may prove more influential in receiving a higher rating rather than more favorable profit measures.”

In assessing performance within the insurance industry, there are two important ratios: the combined ratio (CR) and the return on policyholders’ surplus (ROS). The report found that in the last five years (2018–2022), stock companies generate an average CR close to six points lower than the mutual group (97 versus 103), while ROS is approximately six points better (9 percent versus 3 percent).

The report also revealed that median expense ratios are higher for smaller companies, regardless of whether they were organized as a stock or mutual insurer, highlighting the benefits of a larger scale.

Mutual companies were more conservative when it came to reserves, highlighting lower exposure when it came to reserve risks, the report found. Mutual companies also showed better yields on bond investments, likely due to portfolio composition.

The differences in ownership structure highlight important factors for the insurance sector, the report stated, given the higher inflation seen in the last several months.

P&C insurers are generally well-equipped to navigate recessionary headwinds should one materialize, the reported noted.

“Smaller companies face difficulty in standing out in terms of business profile with ongoing threats in several areas to their competitive position and franchise sustainability,” said Managing Director James Auden.

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages