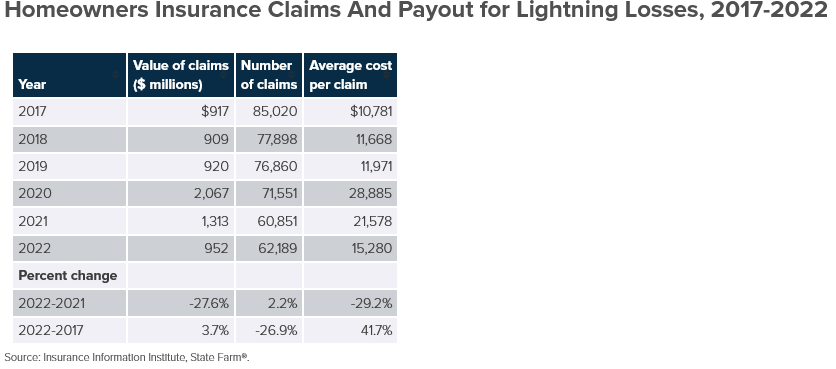

More than $950 million was paid to more than 62,000 U.S. homeowners insurance claims in 2022, according to analysis released last month by the Insurance Information Institute (Triple-I).

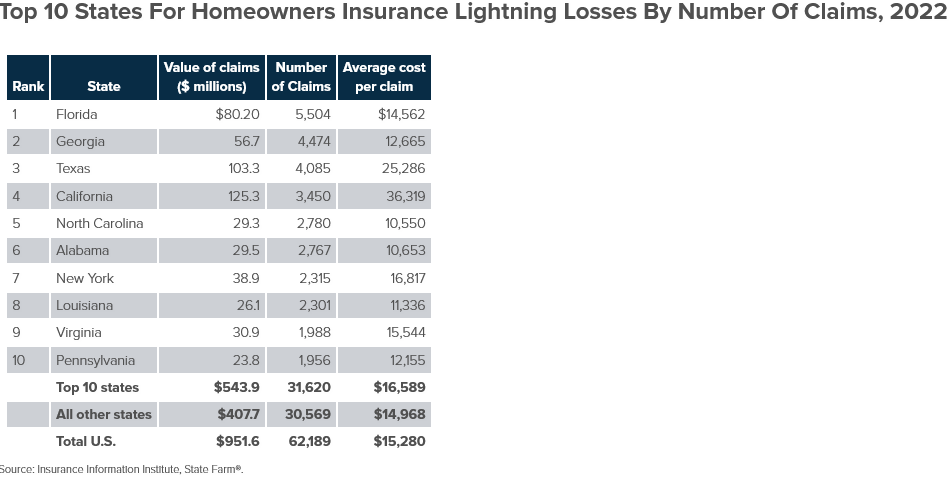

At least $125 million of that total was attributable to the state of California alone.

Based on national insurance claims data, the Triple-I found the total value of lightning-caused U.S. homeowners insurance claims declined more than 27 percent in 2022 ($952 million) from 2021 ($1.3 billion).

The number of lightning-caused homeowners insurance claims increased slightly, by 2.2 percent, between 2021 and 2022 from 60,851 to 62,189, with numbers from the top 10 claims states contributing to about half of the total, the report added.

The average cost per lightning-caused claim decreased 29 percent from $21,578 in 2021 to $15,280 in 2022.

“Insurers are moving toward predicting and preventing losses by advocating for resilience in coordination with the real-time application of technology,” stated Sean Kevelighan, CEO, Triple-I.

State Rankings

Florida—the state experiencing most thunderstorms—reported the greatest number of lightning claims in the U.S. in 2022, with 5,504, the report stated.

California had the highest average cost per claim at $36,319, followed by Texas with $25,286.

Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll