With third-quarter earnings reports for publicly traded companies slowing down to a trickle, and FEMA publishing an estimate of NFIP last Friday, Carrier Management has updated a company-by-company list of Hurricane Ian estimates.

The latest figures tally to $20.2 billion, excluding the Federal Emergency Management Agency’s estimate of $3.5 billion-$5.3 billion for the National Flood Insurance Program. Including a $4 billion estimates for NFIP, the total including NFIP Is just over $24 billion. (The midpoint of FEMA’s range is $4.4 billion, but a media statement indicates that the reinsurance program has a $4 billion trigger.)

With no figures available for large national mutual companies, such as State Farm, the largest estimates on our list are generally associated with reinsurers and Citizens. Excluding NFIP, the largest single estimate is Berkshire Hathaway’s $2.7 billion, which consists of $600 million for GEICO, $600 million for other primary operations, and $1.5 billion for the reinsurance operations.

Although Berkshire’s property/casualty reinsurance operations had the largest share of the total, reinsurance turned in a small profit for the conglomerate, while the GEICO and the rest of he primary operations reported combined ratios of roughly 108.

As of Nov. 18, Carrier Management’s running tally also includes a $2.650 billion figure for Lloyd’s, the average of a $2.3 billion-$3 billion range announced by Lloyd’s earlier in the day.

Hurricane Ian Loss Estimates By Carrier ($ Millions)

| Date |

Company |

Net |

|

Reference article |

| 11/15/2022 |

Citizens Property Insurance Corp. |

2,400.0 |

|

Florida Citizens’ Revises Ian Loss Estimate to $3.8B, Including Litigation Expenses (insurancejournal.com) |

| 10/12/2022 |

United Insurance Holdings Corp. |

36.4 |

|

United Insurance Holdings Corp. Announces Estimated Losses From Hurricane Ian | Business Wire |

| 10/13/2022 |

Heritage Insurance Holdings # |

40.0 |

|

Heritage Provides Estimated Impact of Hurricane Ian – Oct 13, 2022 (heritagepci.com) |

| 10/13/2022 |

Progressive Corp. |

785.0 |

|

Progressive Loses A Bundle: Nearly $2.0B Gross Ian Losses; $760M Net (carriermanagement.com) |

| 10/14/2022 |

RLI Corp.* |

40.0 |

|

RLI Announces Hurricane Ian Loss Estimates | Business Wire |

| 10/18/2022 |

Swiss Re |

1,300.0 |

|

Swiss Re Expects Hurricane Ian Claims to Bring Q3 Loss (carriermanagement.com) |

| 10/19/2022 |

Allstate |

360.0 |

|

Allstate Sees Q3 Net Loss; Auto Reserve Boosts More Damaging Than Ian (carriermanagement.com) |

| 10/19/2022 |

Arch Capital ** |

545.0 |

|

Arch Capital Group Ltd. Announces Catastrophe Loss Estimates | Business Wire |

| 10/19/2022 |

Everest Re |

600.0 |

|

Everest Announces Preliminary Impact of Third Quarter 2022 Catastrophe Events | Business Wire |

| 10/19/2022 |

RenaissanceRe |

540.0 |

|

RenaissanceRe Announces Estimated Net Negative Impact on Third Quarter 2022 Results of Operations | Business Wire |

| 10/19/2022 |

Travelers Corp. |

326.0 |

|

Travelers Q3 Net Income Falls 31% (insurancejournal.com) |

| 10/20/2022 |

AXIS Capital |

160.0 |

|

AXIS Capital Comments on Impact of Catastrophe and Other Weather-Related Losses on Third Quarter 2022 Financial Results | Business Wire |

| 10/20/2022 |

Cincinnati Financial |

220.0 |

|

Cincinnati Financial Corporation Announces Preliminary Estimate for Third-Quarter Storm Losses (prnewswire.com) |

| 10/20/2022 |

The Hanover |

28.0 |

|

The Hanover Estimates Third Quarter Catastrophe Losses and Preliminary Results (prnewswire.com) |

| 10/23/2022 |

Munich Re |

1,600.0 |

|

Munich Re Estimates $1.6B Hit From Hurricane Ian Could Affect 2022 Targets (carriermanagement.com) |

| 10/24/2022 |

W. R. Berkley ** |

94.0 |

|

Berkley Cooling On Professional Lines, Firing Up Property Cat Re Engines (carriermanagement.com) |

| 10/25/2022 |

Chubb |

975.0 |

|

Chubb’s Q3 Numbers: Net Income Falls on Realized Losses; P/C Profits Up 15% (carriermanagement.com) |

| 10/27/2022 |

The Hartford |

214.0 |

|

Q3 Net Income Down 30% at The Hartford; $214M in Ian Losses (carriermanagement.com) |

| 10/27/2022 |

Kinsale+ |

26.0 |

|

Kinsale Capital Group, Inc. | Kinsale Capital Group Reports Third Quarter 2022 Results |

| 10/31/2022 |

CNA |

87.0 |

|

CNA Records 50% Drop in Q3 Net Income (carriermanagement.com) |

| 11/1/2022 |

AIG |

450.0 |

|

AIG Reports Q3 Results With $450M in Losses From Ian (insurancejournal.com) |

| 11/1/2022 |

James River |

5.0 |

|

James River Announces Third Quarter 2022 Results (globenewswire.com) |

| 11/1/2022 |

Markel |

70.0 |

|

Markel Q3 Income Drops on Investments but Insurance ‘Solidly Profitable’ (carriermanagement.com) |

| 11/2/2022 |

American Financial Group |

39.0 |

|

American Financial Group, Inc. Announces Third Quarter Results and Declares Special Dividend | Business Wire |

| 11/2/2022 |

AXA |

414.0 |

|

2022-11-02 – AXA – Press release – 9M22 Activity Indicators (axa-contento-118412.eu) |

| 11/2/2022 |

Greenlight Re |

19.5 |

|

Press Release Earnings 2022 Q3 (greenlightre.com) |

| 11/2/2022 |

Hiscox Ltd |

135.0 |

|

Q3 2022 trading statement | Hiscox Group |

| 11/2/2022 |

Kemper** |

27.0 |

|

Kemper Reports Third Quarter 2022 Operating Results | Business Wire |

| 11/2/2022 |

Selective |

10.0 |

|

Selective Reports Third Quarter 2022 Results, Including Net Income of $0.66 per Diluted Common Share and Non-GAAP Operating Income(1) of $0.99 per Diluted Common Share (prnewswire.com) |

| 11/2/2022 |

SiriusPoint |

80.1 |

|

SiriusPoint Ltd. – SiriusPoint reports year-over-year improvement of underwriting results and simplifies operating platform (siriuspt.com) |

| 11/3/2022 |

Fairfax Financial Holdings |

560.0 |

|

Fairfax – Fairfax Financial Holdings Limited: Financial Results for the Third Quarter |

| 11/3/2022 |

Lancashire Insurance* |

175.0 |

|

Results, Reports & Presentations (lancashiregroup.com) |

| 11/3/2022 |

Liberty Mutual |

835.0 |

|

q3-2022-earnings-release1.pdf (libertymutualgroup.com) |

| 11/5/2022 |

Berkshire Hathaway |

2,700.0 |

|

Berkshire Hathaway Reports $2.7B Loss in Third Quarter (carriermanagement.com) |

| 11/6/2022 |

Hannover Re |

286.0 |

|

Hannover Re Quarterly Statement 09/30/2022 |

| 11/7/2022 |

Argo Group |

4.2 |

|

Argo Group Reports Third Quarter 2022 Results | Business Wire |

| 11/7/2022 |

White Mountains |

51.0 |

|

WHITE MOUNTAINS REPORTS THIRD QUARTER RESULTS (prnewswire.com) |

| 11/8/2022 |

Lemonade |

2.2 |

|

Lemonade 10Q SEC Filing |

| 11/9/2022 |

Kin |

2.5 |

|

Kin Insurance Maintains Steady Year-Over-Year Growth in Third Quarter, Increasing 151% Year-to-Date | Kin Insurance |

| 11/9/2022 |

PartnerRe |

300.0 |

|

PartnerRe Ltd. Reports Third Quarter 2022 Results – PartnerRe |

| 11/9/2022 |

SCOR |

289.0 |

|

First nine months 2022 results | SCOR |

| 11/9/2022 |

Zurich |

550.0 |

|

Zurich Insurance Expects $550M Hit From Hurricane Ian, but On Track to Beat Targets (insurancejournal.com) |

| 11/10/2022 |

Hippo |

4.7 |

|

Hippo-Shareholders-2022-Q3-v8[47].pdf (q4cdn.com) |

| 11/11/2022 |

Beazley plc |

120.0 |

|

REG – Beazley PLC -Trading statement (investis.com) |

|

| 11/18/2022 |

Lloyd’s |

2,650.0 |

|

Lloyd’s Ian Claims More Than $2B (carriermanagement.com) |

| as of 11/13/2022 |

Total Incl NFIP |

20,155.6 |

|

|

| 11/10/2022 |

NFIP* |

4,000.0 |

|

FEMA Projects $3.5-$5.3B NFIP Losses for Hurricane Ian |

| as of 11/13/2022 |

Total Incl NFIP |

24,155.6 |

|

|

* Range of net losses provided by company; CM used the midpoint

** Includes catastrophes other than Ian

+ Approximate: Estimated based on loss ratio points and earned premium

Note: Loss figure of $2.4 billion used for Citizens is net of reinsurance (updated 11/15/2022 based on new $3.8 billion direct loss estimate. Related article Florida Citizens’ Revises Ian Loss Estimate to $3.8B, Including Litigation Expenses (insurancejournal.com)

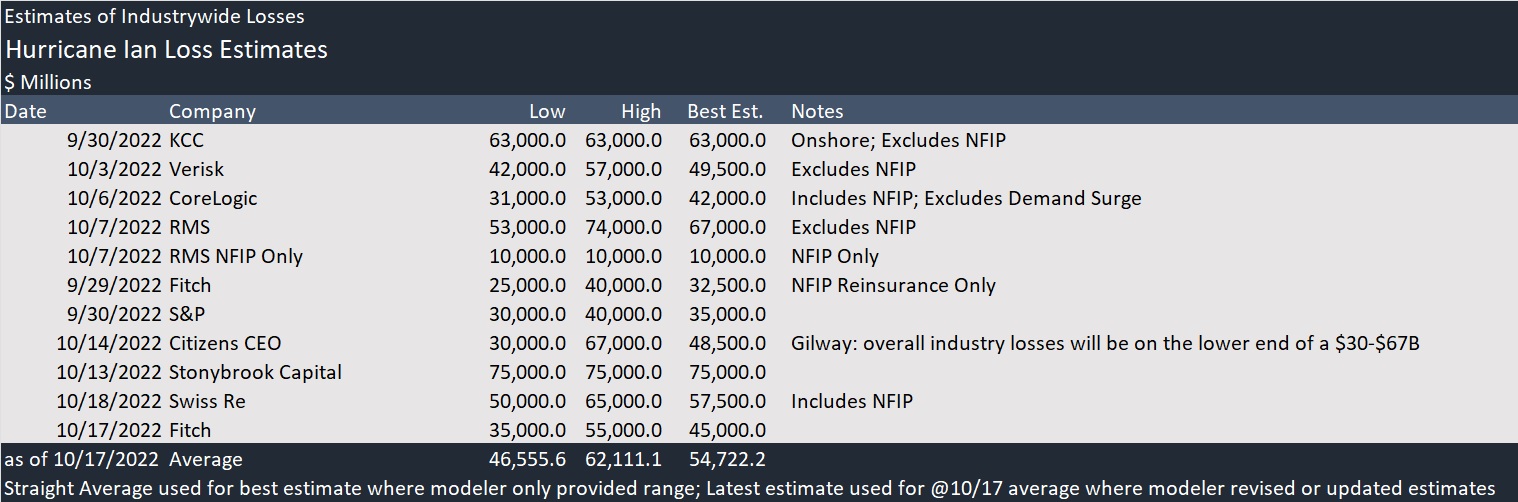

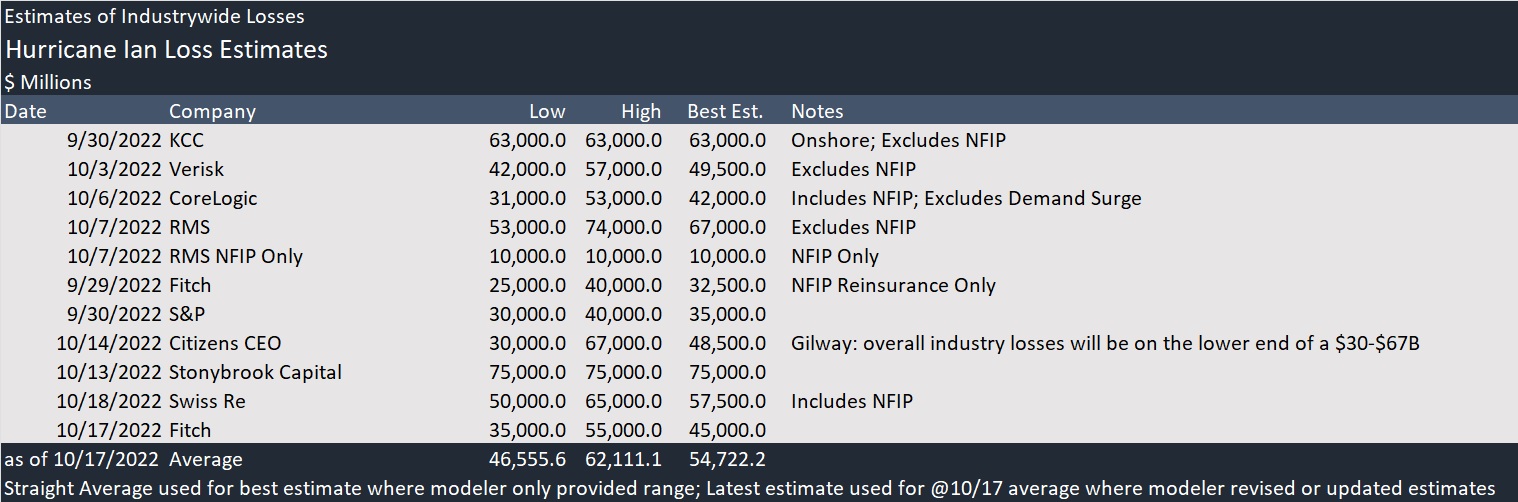

In aggregate, the tally as of mid-November still falls far below industrywide estimates of Hurricane Ian losses put out by modeling firms and rating agencies in the days following Ian’s landfall, which average to around $55 billion.

Hurricane Ian Industrywide Loss Estimates ($ Millions)

| Date |

Company |

Low |

High |

|

Best Est. |

|

Article Link |

|

|

|

|

|

|

Notes |

|

| 9/30/2022 |

KCC |

63,000.0 |

63,000.0 |

|

63,000.0 |

|

KCC Estimates Near $63B in Hurricane Ian Insured Losses (insurancejournal.com) |

Onshore; Excludes NFIP |

|

| 10/3/2022 |

Verisk |

42,000.0 |

57,000.0 |

|

49,500.0 |

|

Verisk: Up to $57B Insured Losses from Hurricane Ian (insurancejournal.com) |

Excludes NFIP |

|

| 10/6/2022 |

CoreLogic |

31,000.0 |

53,000.0 |

|

42,000.0 |

|

Insured Damages From Hurricane Ian $31-$53B: CoreLogic (insurancejournal.com) |

Includes NFIP; Excludes Demand Surge |

|

| 10/7/2022 |

RMS |

53,000.0 |

74,000.0 |

|

67,000.0 |

|

New and Revised Ian Loss Estimates, Images of Property Damage Published (carriermanagement.com) |

Excludes NFIP |

|

| 10/7/2022 |

RMS NFIP Only |

10,000.0 |

10,000.0 |

|

10,000.0 |

|

RMS Range of Insured Losses From Ian $53-$74B, ‘Best Estimate’ of $67B (insurancejournal.com) |

NFIP Only |

|

| 9/29/2022 |

Fitch |

25,000.0 |

40,000.0 |

|

32,500.0 |

|

Unrated Insurers at Risk From Ian; Reinsurers Impacted: Fitch (carriermanagement.com) |

NFIP Reinsurance Only |

|

| 9/30/2022 |

S&P |

30,000.0 |

40,000.0 |

|

35,000.0 |

|

Ian Insured Loss Estimates Rise: New High Over $60B (carriermanagement.com) |

|

|

| 10/14/2022 |

Citizens CEO |

30,000.0 |

67,000.0 |

|

48,500.0 |

|

Information provided via email |

|

|

|

|

Gilway: overall industry losses will be on the lower end of a $30-$67B |

| 10/13/2022 |

Stonybrook Capital |

75,000.0 |

75,000.0 |

|

75,000.0 |

|

Stonybrook Capital Says Hurricane Ian Is Largest-Ever Insured Loss Event at Over $75B (insurancejournal.com) |

|

| 10/18/2022 |

Swiss Re |

50,000.0 |

65,000.0 |

|

57,500.0 |

|

Swiss Re Expects Hurricane Ian Claims to Bring Q3 Loss (carriermanagement.com) |

Includes NFIP |

|

| 10/17/2022 |

Fitch |

35,000.0 |

55,000.0 |

|

45,000.0 |

|

This article |

|

|

|

|

|

|

|

|

| as of 10/17/2022 |

Average |

46,555.6 |

62,111.1 |

|

54,722.2 |

|

|

|

|

|

|

|

|

|

|

|

Chart Notes: Straight Average used for best estimate where modeler only provided a range; Latest estimate used of overall average of all modelers where company revised or updated estimates

CM and IJ staff reports. Aon report summarized by Insurance Journal’s L.S. Howard

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark

Why Claims AI Build vs. Buy Decisions So Often Miss the Mark  Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  From Skill to System: The Next Chapter in Insurance Claims Negotiation

From Skill to System: The Next Chapter in Insurance Claims Negotiation  AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard

AI Got Beat by Traditional Models in Forecasting NYC’s Blizzard