Insurers are getting a larger share of suspicious claim referrals from fraud-detection technology and are increasingly using artificial intelligence to sift through data, according to a new study by the Coalition Against Insurance Fraud and SAS.

The Insurance Fraud Technology Study found that 80 percent of respondents to a survey of Coalition members taken last October and November reported that they use predictive analytics to detect fraud, up from 55 percent in 2018. The use of text mining has doubled, jumping to 65 percent from 33 percent during the three-year period.

“These findings prove that, even as COVID has fueled rampant fraud, insurers are agilely stretching their advanced analytics and AI capabilities to counter rapidly changing threats,” stated David Hartley, director of insurance solutions for SAS, a data analytics provider.

The study found that 96 percent of survey respondents used some kind of fraud-detection technology. Eighty-eight percent used automatic red flags, 64 percent reporting capability, 61 percent case management, 51 percent exception reporting and 51 percent visualization/link analysis.

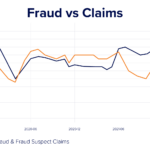

Fraud-detection technology generated more referrals than in past years. According to the study, 39 percent of respondents said that more than 30 percent of their referrals came from an automated system, compared to just 20 percent in 2018.

Two technologies gained use in 2021: identity verification and photo recognition and analysis. The study says 35 percent of respondents were using digital identity solutions, a technology that is expected to see further adoption in coming years.

Photo recognition technology was also used by 35 percent of insurers. The study says a growing number of insurers are looking to save costs by not doing in-person inspections of vehicle property damage claims and even on more minor residential and commercial property claims. The technology allows insurers to know whether a photo of claimed damage is real, has been digitally altered or had been submitted previously on other claims.

Insurers are increasingly measuring their investment in anti-fraud detection against the bottom line. Forty percent of respondents said they analyzed the impact of technology on their loss ratio, up from 15 percent in the 2018 survey.

The study suggests insurers are growing more confident in the results they are getting from fraud-detection technology. About 50 percent of survey respondents identified false negatives and false positives as a major challenge, compared to more than 60 percent in 2020 and 2019.

Funding was also less of an issue. Only 1 percent of respondents said they experienced a decreased budget in 2021, compared to 2 percent in 2020 and 15 percent in 2016. Sixty-eight percent of respondents said there were no significant changes in funding and 19 percent reported additional funding was approved or anticipated.

SAS and the Coalition are hosting a webinar about the survey results at 2 p.m. ET on Feb. 16. Details can be found here.

Large Scale Cargo Ring Busted in LA, $5M Recovered

Large Scale Cargo Ring Busted in LA, $5M Recovered  Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec

Reinsurance Program Could Wipe Out Need for Calif. FAIR Plan: Legal Exec  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  The Future of HR Is AI

The Future of HR Is AI